Last updated: July 27, 2025

Introduction

Valsartan, an angiotensin II receptor blocker (ARB), is widely prescribed for managing hypertension and heart failure. It gained prominence after the expiration of multiple patents, facilitating widespread generic manufacturing. Market dynamics, regulatory developments, and patent litigation significantly influence valsartan's pricing and market share. This report provides a comprehensive market analysis and forecasts future pricing trends driven by industry and regulatory factors.

Market Overview

Global Demand and Market Size

The global valsartan market is valued at approximately USD 3.2 billion in 2022, with an annual growth rate of 4-6%, influenced by the increasing prevalence of cardiovascular diseases (CVD) and evolving healthcare paradigms. The Asia-Pacific region emerges as a critical growth driver, driven by expanding healthcare infrastructure and rising CVD incidence.

Key Market Players

Post-patent expiry, numerous generic manufacturers entered the market, including Teva Pharmaceuticals, Mylan, Sandoz, and local Asian producers. Brand-name incumbents, notably Novartis and Novartis's successor businesses, have retained market share primarily through strategic branding and supply tie-ins, although their influence diminishes amid generic competition.

Regulatory Landscape

The U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regulators have undertaken rigorous post-market surveillance. In 2018, Pfizer’s patent on Diovan (brand-name valsartan) expired, leading to a surge in generic entries. However, concerns over contamination with N-nitrosodimethylamine (NDMA) and N-nitrosodiethylamine (NDEA) impurities, identified in some batches, prompted regulatory actions, affecting supply chains and prices.

Market Dynamics Influencing Price Fluctuations

Patent Expiry and Generic Competition

The primary factor enabling dramatic price reductions post-patent expiry pertains to the entry of generics. Before patent expiration, branded valsartan prices are significantly higher, often 3-5 times the cost of generics. Generic entries, however, lead to intense price competition.

Supply Chain Disruptions and Quality Concerns

In 2018, contamination issues with valsartan sourced from certain manufacturers led to recalls and supply shortages. These disruptions temporarily inflated prices and created opportunities for counterfeit and substandard products, impacting market stability.

Regulatory Measures and Quality Standards

Enhanced quality control measures, including batch testing for impurities, have initially increased production costs, influencing pricing. Moreover, ongoing monitoring may impose additional compliance costs, influencing the price of both branded and generic variants.

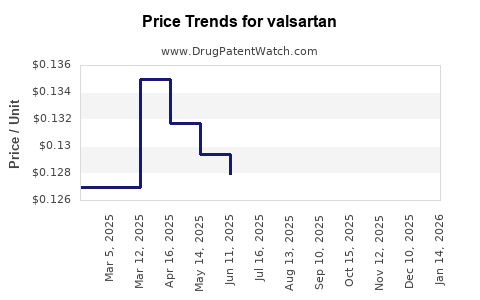

Price Trends and Forecasts (2023-2028)

Historical Pricing Trends

- Pre-2018: Brand-name valsartan (e.g., Diovan) ranged from USD 300–400 per month supply.

- Post-2018: Generic valsartan prices plummeted by up to 70–80%, with monthly costs dropping below USD 50 in many markets.

- Current landscape: Stabilization occurs around USD 30–50 per month, with regional variations.

Projected Price Trajectory

- Near term (2023-2024): Prices may stabilize or slightly decline owing to epidemic-scale adoption and increased manufacturing efficiencies. However, potential regulatory crackdowns on impurities could introduce slight upward pressures temporarily.

- Medium term (2025-2028): As global demand persists and manufacturing scales improve, prices are expected to plateau at USD 20–40 per month supply, with some regional variances. Advanced formulations or fixed-dose combinations could command higher prices, but standard monotherapy is likely to remain low-cost.

Influence of Policy and Innovation

Emerging biosimilar or innovative fixed-dose combinations (e.g., valsartan with hydrochlorothiazide) can significantly alter market dynamics. Market entrants leveraging novel delivery mechanisms or improved formulations could command premium pricing but are unlikely to impact core generic pricing significantly.

Regional Market Outlook

United States

The US remains the largest market due to high hypertension prevalence. Despite intense competition, proprietary formulations or combination products might sustain higher prices. Regulatory vigilance on impurity levels influences supply and price stability.

Europe

The European market faces akin dynamics with strict adherence to quality standards. Regional procurement policies and tender systems influence pricing, often resulting in aggressive negotiations that maintain low prices.

Asia-Pacific

High growth potential with expanding healthcare infrastructure. Local manufacturing, lower regulatory barriers, and increased healthcare access support robust growth and competitive pricing structures.

Key Challenges & Opportunities

- Challenges: Regulatory uncertainties, impurity-related recalls, supply chain disruptions, and pricing pressures due to widespread generics.

- Opportunities: Development of combination therapies, improvements in formulation, emerging markets’ expansion, and regulatory pathways for biosimilars.

Conclusion & Price Projection Summary

Valsartan’s market post-patent expiry typifies the classic generic drug landscape characterized by heightened competition and declining prices. Continued regulatory scrutiny, especially regarding impurity contamination, could temporarily influence market prices but is unlikely to reverse the overall downward trend. By 2028, average monthly costs are projected to remain within USD 20–40, with regional variations depending on market maturity, regulatory policies, and competitive dynamics.

Key Takeaways

- The valsartan market experienced a sharp price decline post-2018 patent expiry, now stabilizing around USD 20–40 per month in developed markets.

- Regulatory actions related to impurities significantly impact supply chains, temporarily influencing pricing patterns.

- Emerging markets present substantial growth opportunities, potentially impacting global pricing trends through increased competition.

- Innovation, such as fixed-dose combinations, could offer premium pricing niches but will not fundamentally alter pricing levels of standard monotherapies.

- Vigilant regulatory oversight remains critical, as impurity issues and quality standards significantly influence supply and pricing stability.

FAQs

1. What factors most significantly influence valsartan pricing in the current market?

Major drivers include patent expirations, the influx of generics, regulatory oversight regarding impurities, manufacturing costs, and regional procurement policies.

2. How have recent regulatory concerns affected valsartan prices?

Impurity-related recalls in 2018 initially caused supply shortages and price increases in certain markets, but the subsequent tightening of safety standards has stabilized prices at lower levels due to increased manufacturing costs and enhanced quality controls.

3. Will the introduction of fixed-dose combination products impact valsartan pricing?

Potentially, premium-priced combination therapies could command higher prices, but they are unlikely to affect the base price trend of standard generic valsartan significantly.

4. What is the expected price trend for valsartan in emerging markets?

Prices are likely to decrease due to local manufacturing, competitive bidding, and increased access, although regional regulatory and import tariffs influence actual costs.

5. Are biosimilar or innovative formulations expected to disrupt the current market?

While biosimilars are not applicable to small molecules like valsartan, innovative formulations or delivery methods may create niche markets, but the core generic landscape will continue to drive low prices for standard products.

References

- IQVIA. Global Cardiovascular Market Report. 2022.

- U.S. FDA. Valsartan Drug Safety Communications. 2018.

- European Medicines Agency. Quality of Valsartan-containing medicines. 2019.

- MarketWatch. Generic drug pricing trends. 2022.

- IMS Health. Pharmaceutical Market Intelligence. 2022.