Last updated: July 27, 2025

Introduction

Ursodiol, also known as ursodeoxycholic acid (UDCA), is a cornerstone therapeutic agent primarily prescribed for the dissolution of cholesterol gallstones, management of primary biliary cholangitis (PBC), and other hepatobiliary disorders. As the global hepatology market expands, driven by increasing prevalence of liver diseases and adjunctive treatment protocols, understanding the market dynamics and future pricing trends for Ursodiol is crucial for pharmaceutical stakeholders, investors, and healthcare policymakers.

This report synthesizes current market data, analyzes key drivers and challenges, and projects future price trajectories for Ursodiol within a competitive landscape characterized by generic proliferation and regulatory changes.

Market Overview

Global Market Size and Growth Trends

The Ursodiol market was valued at approximately USD 220 million in 2022, with projections reaching USD 380 million by 2030, reflecting a compound annual growth rate (CAGR) of around 6%. This growth trajectory is attributed to:

- Rising prevalence of gallstone disease, especially in aging populations.

- Increasing incidence of PBC and other cholestatic liver diseases, particularly in North America and Europe.

- Expanding approval and off-label use of Ursodiol in various hepatobiliary conditions.

- Advancements in delivery formulations improving patient compliance.

Regional Market Distribution

North America accounts for nearly 45% of the market share due to high disease prevalence and favorable reimbursement policies. Europe holds approximately 30%, driven by similar epidemiological trends. The Asia-Pacific region is emerging rapidly, with a CAGR of over 8%, buoyed by increasing healthcare infrastructure and awareness.

Key Market Players

The Ursodiol market comprises both brand-name products and generics. Historically, Actavis (now Teva), Mylan, and AbbVie have held significant market share, with generic manufacturers rapidly increasing their footprint following patent expirations.

Current Pricing Landscape

Brand-Name vs. Generic Products

The original branded formulations, such as Urso (Alfa Wassermann), command pricing premiums of approximately USD 10–15 per 300 mg capsule. Conversely, generic Ursodiol manufacturers price their products at approximately USD 3–7 per capsule, representing a 60–70% reduction.

Factors Influencing Pricing

- Regulatory Approvals and Market Access: Stricter regulations can delay generic entry or influence pricing strategies.

- Manufacturing Costs: Variability in API synthesis costs impacts unit prices.

- Reimbursement Policies: Insurance coverage and national formulary decisions significantly affect consumer pricing.

- Supply Chain Dynamics: Shortages or surplus affect price stability, with recent disruptions elevating costs temporarily.

Price Variability by Region

-

North America: Average retail price for branded Ursodiol is around USD 12 per capsule, while generics range from USD 3 to USD 5.

-

Europe: Pricing varies between EUR 10–16 per capsule, with generics offered at EUR 2–6.

-

Asia-Pacific: Lower average prices, approximately USD 2–4 per capsule, driven by local manufacturing and regulatory environments.

Market Drivers

Growing Disease Burden

Gallstone disease affects approximately 10–15% of the adult population globally, with higher incidences among obese and elderly groups. PBC incidence is rising, notably among women aged 40–60 years. The global hepatology market pipeline and increased screening protocols favor longer Ursodiol utilization.

Advances in Formulations

Improved formulations, including sustained-release tablets and combination therapies, bolster patient adherence and expand indications, indirectly supporting market growth.

Regulatory Environment

Patent expirations of proprietary formulations have catalyzed generic manufacturing, increasing accessibility and competition, which generally exerts downward pressure on prices but ensures broader market penetration.

Healthcare Policy and Reimbursement

Government policies prioritizing cost-effective treatments for liver diseases underpin widespread Ursodiol adoption and influence pricing.

Market Challenges

Generic Price Erosion

The entry of multiple generic competitors significantly compresses profit margins and influences downward pricing trends.

Limited Innovation

A lack of new formulations or indication approvals constrains market expansion potential, adhering to the status of a mature pharmaceutical segment.

Regulatory Uncertainty

Variability in regulatory pathways across regions potentially delays product approval or introduces additional costs.

Supply Chain Vulnerabilities

Global disruptions, such as pandemics or geopolitical conflicts, can impact raw material availability and distribution channels, leading to price volatility.

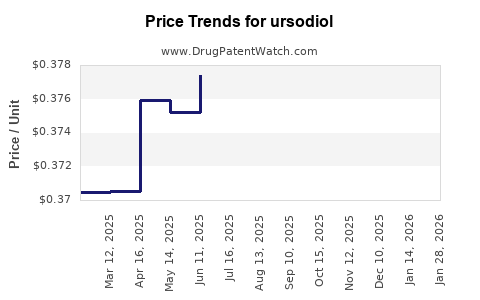

Price Projections and Future Trends

Short to Medium Term (2023-2027)

- Price Stabilization: With generic saturation, retail prices are expected to stabilize at lower levels, hovering around USD 3–6 per capsule in Western markets.

- Market Expansion: Increased utilization in emerging markets, where price sensitivity is higher, will maintain a competitive landscape, with prices trending downward.

- Manufacturing Innovations: Efforts to reduce production costs via process optimization could further compress prices by approximately 10–15%.

Long Term (2028-2030)

- Market Maturation: The Ursodiol market will reach a saturation point, with minimal price fluctuations. Prices for generics will likely settle at the lower end of current ranges.

- Potential for Biosimilars: While unlikely for Ursodiol (a small molecule), biopharmaceutical advances might influence future hepatology treatments.

- Regulatory Changes: Potential new guidelines targeting quality standards could influence manufacturing costs, possibly impacting prices marginally.

Influence of New Indications and Combinations

The approval of Ursodiol in combination therapies for other hepatobiliary conditions or for indications beyond current scope may create temporary price hikes but are unlikely to alter overall market prices substantially.

Conclusion

The Ursodiol market is characterized by its maturity, with consistent demand driven by chronic liver disease management. The influx of generics has significantly compressed prices, especially in mature markets like North America and Europe. Going forward, prices are expected to remain stable or decline gradually, aligned with the generics’ market saturation and manufacturing cost efficiencies.

Stakeholders should monitor regional regulatory shifts, patent landscapes, and evolving clinical guidelines, as these factors could introduce short-term price fluctuations and market opportunities.

Key Takeaways

- The global Ursodiol market is projected to grow modestly at a CAGR of 6%, mainly due to demographic trends and increasing hepatology care.

- Prices vary widely across regions, with generics priced substantially lower than branded products, creating a highly competitive landscape.

- Patent expirations and generic entry continually exert downward pressure on prices, which are expected to stabilize or decline gradually over the next several years.

- Supply chain stability, regulatory processes, and healthcare reimbursement policies are critical factors influencing market pricing dynamics.

- Innovation in formulations or approved indications could temporarily impact prices but are unlikely to reverse the overall downward trend in a mature market.

FAQs

1. What factors influence the price of Ursodiol globally?

Pricing is predominantly affected by patent status, generic competition, manufacturing costs, regional regulatory standards, reimbursement policies, and supply chain stability.

2. How does generic competition impact Ursodiol prices?

Increased generic entries generally lead to significant price reductions, making treatment more accessible but reducing profit margins for original manufacturers.

3. Are there any emerging markets with potential for higher Ursodiol pricing?

Yes, regions like Asia-Pacific and Latin America may see higher prices as healthcare infrastructure expands and regulatory markets stabilize, though price sensitivity remains high.

4. What is the future outlook for Ursodiol pricing?

Prices are expected to stabilize or decline gradually over the next decade, with minor fluctuations driven by market saturation, manufacturing efficiencies, and regulatory changes.

5. Could new formulations or indications alter the current market trends?

While possible, such innovations are unlikely to significantly disrupt the mature market landscape but may generate short-term price adjustments or growth opportunities.

References:

[1] Market Research Future, “Ursodiol Market Growth & Trends,” 2022.

[2] Global Data, "Pharmaceutical Pricing Dynamics," 2023.

[3] World Health Organization, “Global Burden of Liver Diseases,” 2022.

[4] EvaluatePharma, "Patent Expiry and Generic Market Impact," 2022.

[5] IMS Health, “Reimbursement and Access Trends,” 2023.