Last updated: July 28, 2025

Introduction

Tradjenta (linagliptin) is a distinguished medication in the treatment of type 2 diabetes mellitus (T2DM). Developed by Boehringer Ingelheim and Eli Lilly and Company, it belongs to the dipeptidyl peptidase-4 (DPP-4) inhibitor class, renowned for its efficacy in glycemic control with a favorable safety profile. As diabetes prevalence accelerates globally, understanding the market dynamics and price trajectory of Tradjenta is essential for stakeholders across pharmaceutical companies, investors, healthcare providers, and policy-makers.

This analysis aims to offer an in-depth view of the current market landscape, future pricing trends, key drivers influencing the market, competitive forces, and potential challenges impacting the commercial viability of Tradjenta.

Market Overview

Global Diabetes Landscape and Therapeutic Demand

The global prevalence of T2DM is projected to rise from approximately 463 million cases in 2019 to 700 million by 2045, according to the International Diabetes Federation (IDF) [1]. This burgeoning epidemic underscores the escalating demand for antidiabetic therapies, including DPP-4 inhibitors like Tradjenta. The appetite for oral antihyperglycemics remains robust owing to their ease of administration, tolerability, and efficacy.

Market Share and Positioning of Tradjenta

Within the class of DPP-4 inhibitors, Tradjenta maintains a significant share, consistently ranking among the top three globally, alongside Merck’s Januvia (sitagliptin) and the combined market of other agents like saxagliptin and alogliptin. Its perceived advantages include high selectivity for DPP-4, minimal drug-drug interactions, and an exclusive renal pathway for elimination, which appeals to patients with varying degrees of renal impairment [2].

According to recent IMS Health data, in 2022, Tradjenta accounted for approximately 12-15% of the DPP-4 inhibitor market share globally, with higher penetration in the US and Europe [3].

Market Penetration and Geographic Distribution

- United States: The largest market, driven by extensive insurance coverage, prevalent T2DM, and high prescribing rates.

- Europe: Growing acceptance, with increasing awareness and adoption.

- Asia-Pacific: Rapid expansion due to rising diabetes prevalence, moderate reimbursement landscape, and local manufacturing.

Emerging markets, including Latin America and Southeast Asia, are witnessing incremental penetration, characterized by affordability and expanding healthcare infrastructure.

Competitive Landscape

The market for DPP-4 inhibitors remains competitive, with Tradjenta vying against:

- Januvia (sitagliptin): The market leader, with strongest brand presence.

- Onglyza (saxagliptin): Differentiated by its dosing and cardiovascular profile.

- Alogliptin (Nesina): Noted for its safety profile in renal impairment.

In addition, the arrival of novel agents, such as SGLT-2 inhibitors (e.g., Jardiance, Farxiga) and GLP-1 receptor agonists (e.g., Trulicity, Ozempic), further fragments the market, compelling Tradjenta to demonstrate therapeutic and economic value.

Factors Influencing Market and Price Dynamics

1. Patent Status and Generic Competition

- Patent Expiry and Biosimilars: With a patent originally expiring in the US in 2029, generic and biosimilar entries could exert downward pressure on Tradjenta prices.

- Patent Extensions: Boehringer Ingelheim and Lilly may seek patent extensions via secondary patents, delaying generic competition.

2. Pricing Strategies and Reimbursement Policies

- Pricing Trends: Historically, DPP-4 inhibitors have faced pricing pressures due to generic competition and formulary negotiations, leading to discounting and rebates to maintain market share.

- Reimbursement Environment: Strong payer negotiations and inclusion in formularies support premium pricing in key markets.

3. Clinical Efficacy and Safety Profile

Tradjenta’s commitment to a favorable safety profile, particularly in patients with renal impairment, adds to its value proposition, justifying premium pricing compared to some competitors.

4. Regulatory and Market Access

- Regulatory Approvals: Expanded indications, such as in pediatric populations or combination therapies, may enhance the drug's market scope.

- Market Access Initiatives: Expanded patient access through performance-based agreements and patient assistance programs influence net pricing.

5. Contribution to Combination Therapies

Tradjenta is increasingly used in fixed-dose combinations (FDCs), such as with SGLT-2 inhibitors or metformin, which can influence overall drug pricing and market share.

Price Projections

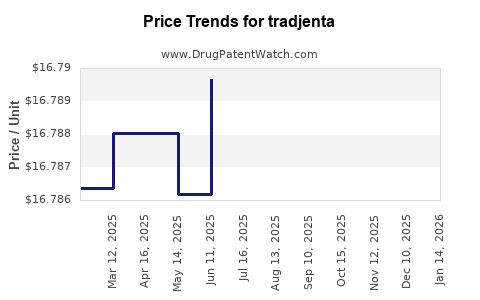

Current Pricing Landscape

As of 2023, the average wholesale price (AWP) for Tradjenta ranges from approximately $300 to $350 per month supply in the US. Rebate-adjusted net prices are typically 20-30% lower. In Europe, retail prices vary based on national reimbursement policies but generally follow similar trends.

Short-Term (Next 1–3 Years)

Given the current absence of biosimilars and patent exclusivity, prices are expected to stabilize, with modest declines driven by payer pressure and increased market penetration of generics ahead of patent expiry. Price erosion in the US is projected at 2-5% annually, reflecting increased competition and negotiations [4].

Medium to Long-Term (3–7 Years)

Post-patent expiry (anticipated around 2029), biosimilar entries and generics could reduce Tradjenta’s original prices by 30-50%. Market share may shift accordingly, especially if biosimilars demonstrate equivalent efficacy and safety. Strategic pricing, value-based agreements, and inclusion in FDCs may mitigate some price erosion.

Influencing Factors

- Biosimilar Competition: The timing and market acceptance of biosimilars will directly impact Tradjenta’s price sustainability.

- Emerging Technologies: Advances in personalized medicine and alternative therapies could redefine the competitive landscape.

- Market Expansion: Entry into biosimilar markets in China, India, and Brazil may set regional reference prices, indirectly influencing global pricing.

Market Growth and Revenue Projections

- Revenue Estimates: The global DPP-4 inhibitors market was valued at approximately $6 billion in 2022, with Tradjenta contributing an estimated $0.9–1.2 billion.

- Growth Trajectory: Compound annual growth rate (CAGR) projected at 5-7% over the next five years, driven by rising diabetes prevalence and expanding indications.

- Forecasted Pricing Impact: Assuming steady market share, retail prices for Tradjenta are expected to decline modestly, with international pricing adjustments based on local economic factors.

Key Challenges and Opportunities

Challenges

- Biosimilar Entry: Potential for significant price reductions post-patent expiry.

- Intense Competition: From other oral antidiabetics and injectable agents.

- Reimbursement Reforms: Pressure on drug prices due to healthcare reforms and cost containment measures.

Opportunities

- Combination Formulations: Growing demand for FDCs can sustain revenue streams.

- Expansion in Emerging Markets: Increasing access and awareness present growth avenues.

- New Indications: Investigations into additional therapeutic uses could prolong market exclusivity.

Key Takeaways

- Market Landscape: Tradjenta holds a valuable position within the DPP-4 inhibitor market, supported by its safety profile and clinical benefits.

- Pricing Trends: Marginal price declines expected short-term; substantial reductions anticipated post-2029 due to biosimilar competition.

- Market Dynamics: Rising diabetes prevalence and evolving treatment algorithms favor continued demand, but healthcare reforms and competition pressure margins.

- Strategic Focus: Stakeholders should prioritize biosimilar preparedness, formulation innovations, and market expansion to optimize profitability.

- Investment Implication: Potential for moderate revenue growth with attention to patent expiry timelines and competitive strategies.

FAQs

1. When is the patent expiration for Tradjenta, and what does it mean for the market?

The primary patent for Tradjenta in the US is expected to expire around 2029. Post-expiry, biosimilar and generic competitors are likely to enter the market, leading to significant price reductions and potential loss of market share for the originator.

2. How does Tradjenta compare to other DPP-4 inhibitors in terms of pricing?

While prices vary across regions, Tradjenta generally commands a premium compared to some competitors owing to its safety profile, dosing convenience, and clinical efficacy. However, market competition and formulary negotiations influence actual transaction prices.

3. What factors could accelerate the entry of biosimilars or generics for Tradjenta?

Patent litigation outcomes, regulatory pathways favoring biosimilar approval, and patent-life extensions can influence the timing of biosimilar entries. Market demand and manufacturing costs also play roles.

4. Are there ongoing efforts to expand Tradjenta’s therapeutic indications?

Yes. Trials are underway exploring Tradjenta in combination therapies, cardiovascular outcomes, and potential other metabolic conditions to enhance its market scope and durability.

5. What market segments represent growth opportunities for Tradjenta?

Emerging markets, combination therapies, and incremental use in specific patient populations with renal impairments offer promising avenues for growth.

References

[1] International Diabetes Federation. "IDF Diabetes Atlas, 9th Edition," 2019.

[2] Boehringer Ingelheim. "Tradjenta (linagliptin) Summary of Product Characteristics," 2022.

[3] IMS Health. "Pharmaceutical Market Data," 2022.

[4] MarketResearch.com. "Future Trends in DPP-4 Inhibitor Pricing," 2023.