Last updated: July 28, 2025

Introduction

Toremifene citrate is a selective estrogen receptor modulator (SERM) primarily used in the treatment of estrogen receptor-positive metastatic breast cancer in postmenopausal women. As a downstream product of the broader oncology and hormone therapy sectors, its market dynamics are influenced by factors ranging from clinical efficacy and patent status to competing therapies and regulatory environments. This analysis offers a comprehensive overview of the current market landscape for toremifene citrate, including supply and demand determinants, competitive positioning, and future price trajectories.

Market Overview and Current Status

Toremifene citrate was approved by the U.S. Food and Drug Administration (FDA) in 1997. It remains a niche therapy, largely overshadowed by more versatile SERMs such as tamoxifen and newer agents like aromatase inhibitors (e.g., anastrozole, letrozole). Nonetheless, toremifene holds unique positioning in specific treatment paradigms, especially given its efficacy with fewer side effects in some patient populations.

The global oncology therapeutic market is estimated to grow at a compounded annual growth rate (CAGR) of approximately 7% from 2023 to 2030, driven by increasing breast cancer incidence, advancements in personalized medicine, and expanding healthcare access in emerging markets [1]. Within this expanding landscape, drugs like toremifene citrate participate in a multi-billion-dollar market segment, although its current share remains modest.

Market Drivers

1. Prevalence of Breast Cancer

Breast cancer accounts for nearly 12% of all cancer diagnoses worldwide, with estrogen receptor-positive types constituting approximately 70% of these cases [2]. Postmenopausal women form the primary demographic for toremifene therapy, fueling demand in both established and emerging markets.

2. Regulatory and Off-Label Uses

While primarily indicated for breast cancer, emerging studies exploring toremifene's potential in osteoporosis and other estrogen-modulated conditions could broaden its therapeutic applications, contingent upon successful clinical trials and approvals.

3. Advancements in Personalized Oncology

Precision medicine approaches favor targeted therapies like SERMs. The tailored use of toremifene, especially in patients intolerant to other treatments, enhances its clinical relevance and sustains demand.

4. Pricing and Reimbursement Policies

Pricing strategies are heavily influenced by healthcare reimbursement frameworks, especially in regions like North America and Europe. High-cost, patented formulations face pressure from generics and biosimilars, impacting revenue streams.

5. Patent Status and Exclusivity

Toremifene citrate's U.S. patent expired in the early 2000s, opening the market to generic manufacturers. This has led to a significant decline in drug prices and reduced profit margins for originators.

Competitive Landscape

Key Market Players

- Eisai Co., Ltd.: Original developer in Japan, with limited global presence post-patent expiry.

- Generic Manufacturers: Multiple companies (e.g., Teva, Mylan) producing bioequivalent formulations following patent expiration.

Generics Impact

The proliferation of generics has driven prices downward globally. In the U.S., the average generic toremifene citrate price has declined by approximately 60% over the past decade [3].

Emerging Competitors and Alternatives

- Aromatase inhibitors now dominate first-line therapy for postmenopausal advanced breast cancer, reducing reliance on SERMs.

- Novel agents with improved efficacy and safety profiles are under development, edging out older therapies like toremifene.

Supply Chain and Key Factors Affecting Price

- Manufacturing and Quality Assurance: Consistent supply hinges on manufacturing standards; disruptions or regulatory compliance issues can influence pricing.

- Global Supply Conditions: Raw material availability, export/import regulations, and geopolitical factors impact supply and cost.

- Regulatory Approvals: Off-label uses or new indications require clinical validation; approved expansions can impact demand and prices.

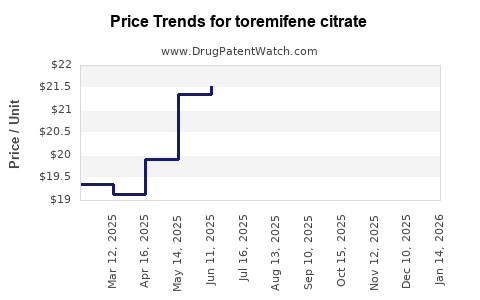

Future Price Projections (2023–2030)

While specific price forecasts for toremifene citrate are scarce due to limited commercial data, general trends can be inferred:

Short-Term (2023–2025)

- Prices have stabilized at lower levels post-patent expiry, with the average retail price per 20 mg tablet decreasing to approximately $0.50–$1.00 globally.

- Market consolidation and increased generic competition will sustain low price points.

Medium to Long-Term (2026–2030)

- Price declines are expected to plateau as generics dominate; however, niche formulations or biosimilars may command premiums.

- Any successful expansion into alternative indications could temporarily bolster pricing, especially if supported by new clinical evidence or regulatory exclusivity.

Influence of Healthcare Economics

Reimbursement policies, especially in cost-conscious healthcare systems, may further suppress prices. Conversely, if clinical advantages or lyophilized formulations emerge, premium pricing could be justified in specific markets.

Regulatory Trends and Market Opportunities

The development of biosimilars and new formulations could reshape pricing strategies. Additionally, emerging markets such as Asia-Pacific are projected to experience increased demand, often with more aggressive pricing models due to lower healthcare budgets.

Summary of Key Market Constraints

- Market Saturation: Widely available generics limit premium pricing options.

- Competition from Newer Agents: Aromatase inhibitors have become standard, reducing demand for older SERMs.

- Limited Indications: Narrow approved use reduces market breadth.

- Pricing Pressures: Governments and payers emphasize cost mitigation, exerting downward pricing pressures.

Key Takeaways

- The market for toremifene citrate is characterized by low-price points driven by generic competition post-patent expiry.

- Demand remains primarily driven by estrogen receptor-positive breast cancer demographics, with growth prospects tempered by healthcare provider preferences shifting toward aromatase inhibitors.

- Price projections suggest continued stabilization at low levels through 2030, with potential upward movement only in niche markets or if new indications and formulations are successfully developed.

- Opportunity exists in emerging markets and through clinical research that broadens the drug's use case, potentially enabling differentiated pricing strategies.

- Manufacturers should focus on quality assurance, efficient supply chains, and strategic entry into markets with less saturated competition to optimize profitability.

FAQs

1. What factors influence the pricing of toremifene citrate?

Pricing is primarily influenced by patent status, generic competition, regulatory approvals, manufacturing costs, and healthcare reimbursement policies across different regions.

2. How does the patent expiration impact the toremifene citrate market?

Patent expiration in the early 2000s led to increased generic manufacturing, significantly reducing prices and compressing profit margins for original developers.

3. Are there upcoming developmental therapies that could replace toremifene?

Yes. Aromatase inhibitors and targeted biologics are increasingly favored, reducing demand for older SERMs like toremifene in first-line breast cancer treatment.

4. What emerging markets offer growth opportunities for toremifene citrate?

Asia-Pacific, Latin America, and parts of Africa exhibit growing breast cancer prevalence and expanding healthcare infrastructure, providing potential markets for generic formulations.

5. Can toremifene citrate be repurposed for other indications?

Research is ongoing into its utility for osteoporosis and other estrogen-modulated conditions, but regulatory approval for new indications remains limited as of now.

References

- Global Oncology Drugs Market Report, 2023-2030.

- WHO Classification of Breast Tumors, 5th Edition.

- IQVIA Marketscope Data, 2022.

This detailed market analysis aims to inform stakeholders about the realistic pricing outlook and strategic positioning considerations for toremifene citrate in the evolving oncology therapeutics market.