Last updated: July 28, 2025

Introduction

Tolterodine tartrate is a well-established pharmacological agent indicated primarily for the treatment of overactive bladder (OAB). As a non-selective antimuscarinic agent, it reduces urinary urgency, frequency, and incontinence. The drug’s market dynamics are influenced by factors that include unmet clinical needs, patent status, biosimilar entry, and evolving healthcare policies. This analysis explores the current market landscape, growth drivers, competitive environment, and future price projections for tolterodine tartrate.

Market Overview

Current Market Landscape

Tolterodine tartrate remains a cornerstone in the management of OAB due to its proven efficacy and safety profile. It is available in both branded (e.g., Detrol) and generic forms, with the latter dominating sales due to cost-effectiveness. As of 2022, the global OAB market was estimated at approximately USD 2.4 billion, with an expected CAGR of 7-8% through 2030 [1].

The United States represents the largest market, driven by high prevalence rates, with over 30 million adults affected. The drug's patient penetration is significant, though it faces competition from newer agents such as solifenacin, darifenacin, and beta-3 adrenergic agonists like mirabegron.

Market Drivers

- Prevalence of Overactive Bladder: Aging populations in North America and Europe continue to contribute to increased OAB diagnoses.

- Efficacy and Safety Profile: Tolterodine’s well-understood pharmacology maintains its position as a first-line pharmacotherapy.

- Generic Entry: The availability of generic formulations has broadened access while exerting downward pressure on prices.

- Healthcare Policy Changes: Improved coverage and reimbursement policies for OAB treatments enhance patient access.

Market Challenges

- Side Effect Profile: Anticholinergic side effects such as dry mouth and constipation limit tolerability and compliance, potentially impacting sales.

- Competition: Introduction of more tolerable agents like mirabegron, which have fewer anticholinergic side effects, is shifting prescription patterns.

- Patent Expiry: Expiration of patent protection on branded tolterodine in the early 2010s led to a rapid influx of generics, influencing market pricing.

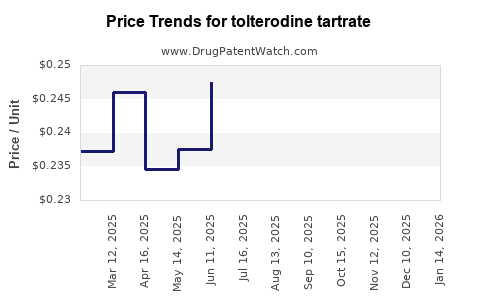

Price Analysis and Historical Trends

Current Pricing Environment

The price of tolterodine tartrate substantially varies between branded and generic formulations. As of 2023:

- Brand (Detrol LA): Average retail price per 30-day supply ranges from USD 340 to USD 400.

- Generics: Cost ranges from USD 25 to USD 50 per month, representing a 85-90% reduction compared to branded versions [2].

Pricing Dynamics

Post-patent expiration, the generic market flooded, driving prices downward. Biotech companies have sought to differentiate by developing extended-release formulations and combination therapies, occasionally commanding higher prices. Notwithstanding, the overall trend remains toward reduced prices due to increased competition.

Future Price Projections (2023-2030)

Factors Influencing Future Pricing

- Biosimilar and Generic Competition: Continuous entry of generics will sustain downward pressure.

- Market Penetration of Alternatives: Non-anticholinergic agents (e.g., mirabegron) gain popularity, potentially reducing tolterodine sales, affecting pricing strategies.

- Regulatory Changes: Potential reclassification or enhanced safety warnings could impact pricing strategies.

- Reimbursement Policies: Value-based healthcare models may drive discounts, especially for low-value or low-tolerance formulations.

Projected Price Trends

Based on historical decline patterns and market projections:

- Short-term (2023-2025): The average generic cost is anticipated to stabilize around USD 15–30 per month, with minimal fluctuation.

- Mid-term (2026-2028): Prices may decline further by approximately 10-15%, reaching USD 10–20, contingent on new generic entrants.

- Long-term (2029-2030): The advent of biosimilars or novel formulations could either stabilize prices at low levels or cause slight increases if innovation introduces premium products.

Market Outlook and Business Implications

Despite the ongoing availability of generic tolterodine tartrate, demand remains due to its efficacy and familiarity among clinicians. Nonetheless, evolving preferences for agents with fewer side effects suggest a potential plateau or decline in tolterodine’s market share but not necessarily its price, given the high-volume, low-margin nature of generics.

Pharmaceutical companies focusing on niche formulations, such as combination therapies or sustained-release variants, could command premium pricing in specialized markets. Meanwhile, payers will continue to push for cost-effective solutions, fostering a competitive environment that sustains low prices over subsequent years.

Key Market Opportunities

- Expansion in emerging markets: Growing healthcare infrastructure and increasing prevalence rates create demand, possibly allowing for higher prices in regions with limited generic penetration.

- Formulation innovations: Extended-release and combination products might sustain higher price points.

- Reimbursement schemes: Negotiated pricing and formulary placements can influence regional pricing trajectories significantly.

Regulatory and Competitive Landscape

The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) regulate the approval of generic formulations, encouraging market competition. The entry of biosimilars or new therapeutic classes, such as selective beta-3 adrenergic receptor agonists, expands treatment options. Companies must navigate patent landscapes, exclusivity periods, and patent challenges to optimize pricing strategies.

Conclusion

The market for tolterodine tartrate is characterized by robust volume driven by widespread clinical use, with prices declining sharply following patent expiration and generic proliferation. Future prices are projected to remain low, stabilized by intense competition, although niche innovation and geographic expansion could enable regional price variances. Healthcare stakeholders should monitor upcoming formulations and regulatory developments, which could influence the long-term cost and utilization landscape.

Key Takeaways

- Supply-Demand Balance: The availability of generics has significantly depressed prices but sustained high volume ensures ongoing profitability.

- Pricing Trajectory: Expect minimal price decreases in the near term, with stabilization around USD 10–30 per month for generics.

- Market Drivers: Demographic shifts and increasing OAB prevalence support steady demand.

- Competitive Tactics: Innovating with formulations, combination therapies, or expanding into emerging markets can mitigate price pressures.

- Policy Impact: Reimbursement policies and healthcare reforms will continue to shape pricing and market share, especially in developed regions.

Frequently Asked Questions

1. What factors most significantly influence the pricing of tolterodine tartrate?

Patent status, generic competition, formulation innovations, regional healthcare policies, and market demand primarily drive pricing.

2. How do generic entry and biosimilars affect tolterodine tartrate’s market prices?

They exert downward pressure by increasing supply and competition, leading to sharper price reductions over time.

3. Are there emerging alternatives to tolterodine tartrate with better safety or tolerability?

Yes, agents like mirabegron, a beta-3 adrenergic receptor agonist, offer comparable efficacy with fewer anticholinergic side effects, impacting tolterodine’s market share.

4. What is the forecast for tolterodine tartrate prices in developing markets?

Prices may be higher initially due to limited generic presence but are expected to decrease as generics become available and healthcare infrastructure expands.

5. How might regulatory changes impact the future pricing landscape?

Enhanced safety regulations or patent litigations can create uncertainties, potentially leading to temporary price increases or delays in generic approvals, influencing overall prices.

References

- MarketWatch. “Overactive Bladder Market Size, Share & Trends Analysis Report.” 2022.

- GoodRx. “Tolterodine prices and discounts.” 2023.