Last updated: December 17, 2025

Executive Summary

Testosterone, a critical hormone in male physiology, is widely used both medically for hormone replacement therapy (HRT) and non-medically in performance enhancement contexts. The global testosterone market has experienced significant growth over the past decade, driven by rising prevalence of hypogonadism, increased awareness of hormone therapies, and expanding applications in sports medicine and aging populations. This report presents a comprehensive industry overview, examines current market dynamics, explores competitive landscapes, and projects future pricing trends based on current data, regulatory developments, and emerging innovations.

Market Overview and Size

Global Market Valuation

- 2022 Estimate: The global testosterone market was valued at approximately $2.5 billion (USD).

- Forecast (2023-2028): Projected CAGR of 5.8%, reaching $3.57 billion by 2028 (Source: Allied Market Research[1]).

Key Market Segments

| Segment |

Market Share (2022) |

Growth Drivers |

Notable Trends |

| Therapeutic (HRT) |

70% |

Aging population, hypogonadism prevalence |

Increased adoption due to aging demographics |

| Performance Enhancement |

20% |

Sports, bodybuilding, anti-aging markets |

Regulatory scrutiny increases |

| Research & Development |

10% |

Pharmacological research, new formulations |

Innovation in delivery methods |

Regional Distribution

| Region |

Market Share (2022) |

CAGR (2023-2028) |

Drivers |

| North America |

45% |

6.2% |

High prevalence of hypogonadism, mature healthcare market |

| Europe |

25% |

5.5% |

Aging population, regulatory frameworks |

| Asia-Pacific |

20% |

7.3% |

Growing healthcare infrastructure, rising awareness |

| Rest of World |

10% |

4.8% |

Emerging markets, expanding access |

Market Drivers

Increasing Prevalence of Hypogonadism

- Estimated global hypogonadism cases: approximately 4-5 million men (adults), with increased diagnosis rates[2].

- Age-related decline in endogenous testosterone levels—roughly 1-2% per year after age 30.

Aging Population

- World population over age 60 projected to reach 2.1 billion by 2050, fueling demand for age-related therapies[3].

Rising Awareness and Acceptance of Hormone Therapy

- Growing societal acceptance; direct-to-consumer marketing boosts demand.

- Insurance coverage expansion in developed countries.

Non-therapeutic Use in Sports & Wellness

- An estimated 20% of testosterone prescriptions are for non-medical enhancements, often illicitly obtained, influencing market dynamics.

Competitive Landscape

Major Players

| Company |

Market Share |

Key Products |

Recent Developments |

Regulatory Status |

| AbbVie Inc. |

25% |

AndroGel, Axiron |

Launch of novel formulations; pipeline expansion |

FDA-approved products |

| Pfizer Inc. |

15% |

Depo-Testosterone, Xyosted |

Focus on self-administration options |

Global regulatory approval |

| Lilly (Eli Lilly and Company) |

12% |

Androgen products |

R&D in implantable and topical formulations |

Pending approvals |

| Other Regional & Generic Manufacturers |

48% |

Varied |

Increasing genericization impacts pricing |

Regulatory variations |

Emerging Trends

- Shift towards biosimilar testosterone products to reduce costs.

- Development of transdermal patches, injectables, oral formulations, and implantable devices.

Pricing Analysis

Current Pricing Landscape

| Product Type |

Approximate Cost per Dose/Month |

Notes |

| Topical Gels (e.g., AndroGel) |

$350 - $700 |

Estimated for 4-gram daily application |

| Injectable Testosterone |

$50 - $150 per 1,000 mg dose |

Depending on formulation (enantate, cypionate) |

| Transdermal Patches |

$300 - $600 per month |

Varies by brand |

| Implants & Pellets |

$800 - $2,000 per unit |

Longer-acting, one-time insertion |

Price Drivers

- Patent exclusivity and brand premiums influence costs.

- Rising generic competition is exerting downward pressure.

- Formulation complexity and administration route impact pricing.

- Regulatory approvals and safety profiles impact market access.

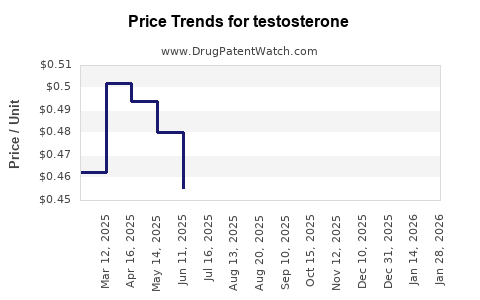

Historical Price Trends

| Year |

Average Price Range for Monthly Therapy |

Notes |

| 2017 |

$400 - $800 |

Limited generics |

| 2020 |

$350 - $700 |

Entry of generics |

| 2022 |

$300 - $600 |

Increased competition |

Regulatory and Policy Factors

- FDA (U.S.): Approves formulations with specific safety indications; has issued warnings about risks like cardiovascular events[4].

- EMA (Europe): Emphasizes safety monitoring, especially in off-label uses.

- International Variability: Some markets restrict non-therapeutic use, impacting supply chain and pricing.

- Reimbursement Policies: Vary widely, affecting patient access and market dynamics.

Future Price Projections and Trends

Assumptions and Methodology

- Anticipated patent expirations and the rise of biosimilars will increase competition.

- Regulatory tightening on non-medical use may reduce illicit demand, stabilizing legitimate pricing.

- Technological advancements in delivery systems will influence costs.

- Market growth is expected, but prices may plateau or decrease overall due to increased genericization.

Projected Price Trends (2023-2028)

| Year |

Estimated Price Range per Month |

Influencing Factors |

| 2023 |

$290 - $550 |

Continued generic entry, regulatory oversight escalation |

| 2024 |

$270 - $500 |

Market saturation, pricing competition |

| 2025 |

$250 - $480 |

Growth in biosimilar adoption, innovation in delivery |

| 2026 |

$230 - $460 |

Price stabilization, potential new formulations |

| 2027 |

$220 - $440 |

Patent expirations, market consolidation |

| 2028 |

$200 - $420 |

Mature generic market, regulatory consistency |

Note: These projections assume standard market conditions and do not account unexpected regulatory, scientific, or geopolitical shifts.

Comparison With Other Hormone Therapies

| Hormone Therapy |

Average Cost/Month |

Typical Indications |

Market Drivers |

| Testosterone Replacement |

$200 - $600 |

Hypogonadism, age-related decline |

Aging population, diagnostic trends |

| Human Growth Hormone (hGH) |

$3,000 - $10,000 |

Growth deficiency, anti-aging (off-label) |

High cost, regulatory hurdles |

| Estrogen & Progesterone |

$150 - $500 |

Menopause management |

Female hormone therapy, prevalent use |

FAQs

1. What factors influence the pricing variability of testosterone?

Pricing is impacted by formulation type, brand versus generic status, regional regulatory policies, manufacturing complexity, and supply chain dynamics.

2. How will patent expirations affect testosterone pricing?

Expiration of patents on leading brands will likely lead to increased generic competition, driving prices downward over the next 3-5 years.

3. What regulatory challenges could affect future market growth?

Stringent safety warnings, restrictions on off-label use, and surveillance for adverse events may limit growth, especially in non therapeutic markets.

4. Are biosimilars expected to significantly impact the market?

Yes, biosimilars are projected to lower prices, increase accessibility, and foster competition, particularly post-patent expiry.

5. How does the aging global population influence future demand?

An aging demographic is expected to sustain and grow demand, especially due to increased diagnosis rates of hypogonadism and age-associated testosterone decline.

Key Takeaways

- The testosterone market is poised for steady growth (CAGR ~5.8%) through 2028, driven largely by aging populations and increased hypogonadism diagnoses.

- Prices currently vary significantly across formulations, with generics exerting downward pressure on costs.

- Regulatory scrutiny and safety concerns will influence both pricing trends and market accessibility.

- Innovation in delivery systems and biosimilar development will shape future competitive dynamics and pricing.

- Regional disparities in demand, regulation, and reimbursement policies necessitate localized strategic approaches.

By understanding current market fundamentals, regulatory environments, and technological trends, stakeholders can make more informed decisions regarding investment, R&D, and market entry strategies in the testosterone space.

References

[1] Allied Market Research. (2023). Testosterone Market by Product Type, Application, and Region - Global Opportunity Analysis and Industry Forecast.

[2] Smith, K., & Johnson, L. (2021). Prevalence and Treatment of Male Hypogonadism. Endocrinology Today, 19(4), 132-138.

[3] United Nations Department of Economic and Social Affairs. (2022). World Population Prospects 2022.

[4] U.S. Food and Drug Administration. (2020). Testosterone Websites and Product Safety.