Last updated: July 27, 2025

Introduction

Telmisartan, a potent angiotensin II receptor blocker (ARB), is widely prescribed for managing hypertension and reducing cardiovascular risks. As a flagship drug of the ARB class, Telmisartan's market dynamics are influenced by evolving healthcare policies, patent statuses, competing therapies, and regional prescribing patterns. This analysis explores the current market landscape, evaluates key drivers, and offers price projection insights, equipping stakeholders with data-driven decision-making support.

Market Overview

Global Pharmaceutical Market for Telmisartan

The global antihypertensive market exceeds USD 30 billion, with ARBs accounting for a significant share—estimated at approximately 35% of hypertension medications in 2022. Telmisartan ranks among the leading ARBs, attributed to its once-daily dosing, favorable lipid metabolism profile, and patent exclusivity until recent expiration in some jurisdictions.

Key Players and Market Share

Major pharmaceutical companies such as Boehringer Ingelheim, Mylan, Teva Pharmaceuticals, and Sun Pharma hold substantial market shares for Telmisartan. Boehringer Ingelheim pioneered Telmisartan with its Micardis brand, maintaining a strong position through brand loyalty and clinical advantages documented in numerous trials (e.g., ONTARGET, TRANSCEND).

Regulatory and Patent Landscape

Boehringer Ingelheim's patent for Micardis expired in the U.S. in 2018 and in the European Union in 2019, opening markets to generics. Patent expirations facilitate increased generic entry, intensifying price competition but expanding accessibility. Pending patent litigations and secondary patents may temporarily obscure market entry for competitors in specific regions.

Market Drivers and Constraints

Drivers

- Economic and Clinical Efficacy: Telmisartan’s established efficacy, tolerability, and cardiovascular benefits position it favorably among antihypertensives.

- Patent Expiry and Generics: Expiration of key patents increases manufacturing of generic versions, lowering prices and broadening access.

- Regulatory Approvals: Continued approvals across emerging markets expand potential user bases.

Constraints

- Competitive ARBs and Alternatives: The presence of other ARBs (e.g., losartan, valsartan) and ACE inhibitors exert competitive pressure.

- Price Sensitivity in Emerging Markets: Lower income levels compel aggressive pricing strategies, impacting profit margins.

- Reimbursement Policies: Variability in insurance reimbursement influences prescribing behaviors and affordability.

Regional Market Projections

United States

Since patent expiration in 2018, the consumer shift towards generics has been notable. Despite increased competition, Telmisartan retains a niche due to its clinical profile. The market growth is tempered by the popularity of other ARBs and combination therapies. Price erosion is anticipated, with average retail prices declining by 10–15% annually over the next five years.

Europe

Patent expirations and stringent health authority guidelines lead to robust generic penetration. Expect prices to decrease by approximately 12–18% annually. Regional variations, particularly in Germany and the UK, will influence local market dynamics.

Emerging Markets (e.g., India, China, Brazil)

Growing hypertension prevalence combined with cost-sensitive healthcare systems favor generic formulations. Price reductions could surpass 20% annually, with sales volume expanding significantly. Local manufacturing and regulatory frameworks will influence actual price points.

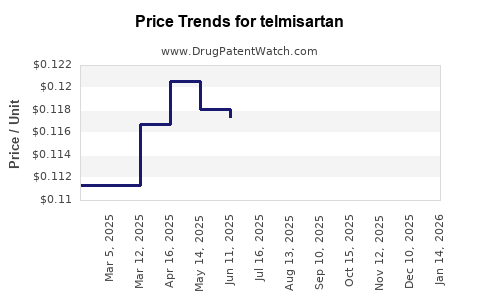

Price Projection Analysis (Next 5 Years)

Base Case Scenario

- United States: The current average wholesale price (AWP) for branded Telmisartan (~USD 2.50 per tablet) may decline to around USD 2.00 within five years, reflecting generic competition.

- Generics: Entry of multiple generics will drive prices down to an estimated USD 0.50–USD 1.00 per tablet, representing a 50–80% reduction.

Optimistic Scenario

If patent litigations delay generics’ market entry in key regions, branded prices may stabilize or decline marginally, maintaining premium margins temporarily.

Pessimistic Scenario

Accelerated generic proliferation and price erosion could push unit prices below USD 0.50, severely impacting revenues for innovator companies and reducing margins for generic providers.

Implications for Stakeholders

- Pharmaceutical Manufacturers: To sustain profitability post-patent expiry, investing in cost-efficient manufacturing and exploring combination therapies is essential.

- Investors: Price declines necessitate reassessment of profit forecasts; diversification within the antihypertensive segment becomes vital.

- Healthcare Providers: The influx of lower-cost generics enhances adherence but raises concerns over quality and bioequivalence assurance.

- Regulators and Policymakers: Encouraging competition while safeguarding quality can enhance healthcare affordability.

Conclusion

The Telmisartan market is approaching a pivotal phase marked by increased generic competition, leading to significant price reductions over the next five years. Despite the downward pressure on prices, the drug's clinical profile ensures sustained demand, especially in regions prioritizing hypertension management. Stakeholders must adapt strategies to evolving market conditions, emphasizing cost efficiency, regulatory navigation, and positioning within combination therapies.

Key Takeaways

- The patent expiration of Telmisartan has catalyzed a transition toward generic-dominant markets, with prices projected to decline between 50–80% over five years.

- Regional differences significantly influence price trajectories, with emerging markets experiencing more substantial reductions.

- Competitive pressures from other ARBs and combination therapies necessitate strategic diversification for manufacturers.

- Price erosion could impact profit margins; innovation and cost optimization are essential for sustaining growth.

- Policymakers should balance affordability with quality to foster equitable access to Telmisartan and similar therapies.

Frequently Asked Questions (FAQs)

-

What factors influence the pricing trajectory of Telmisartan globally?

Patent status, competitive generic entry, regional healthcare policies, and prescribing patterns are primary determinants affecting Telmisartan’s pricing. Patent expiry facilitates generics, leading to substantial declines, while regional regulations and reimbursement policies modulate pricing and accessibility.

-

How will generic competition impact pharmaceutical profits for Telmisartan?

The entry of multiple generics will likely lead to sharp price reductions, squeezing profit margins for branded manufacturers. Companies must innovate, optimize costs, and explore value-added formulations to maintain profitability.

-

In which markets will Telmisartan experience the fastest price declines?

Emerging markets such as India, China, and Brazil will see rapid price declines due to high generic penetration and cost-sensitive healthcare systems, often exceeding 20% annual reductions.

-

Are there any ongoing patent litigations that could delay generic entry?

Yes. Secondary patents, patent litigations, or exclusivity rights may temporarily prevent market entry of generics in certain regions. Stakeholders should monitor jurisdiction-specific legal developments.

-

What strategic steps can manufacturers take to remain competitive in the Telmisartan market?

Investing in manufacturing efficiencies, developing combination therapies, expanding into new markets, and engaging in clinical research to demonstrate superior profiles are vital strategies to preserve market share.

References

- [1] Market research reports on antihypertensive drugs and ARBs, 2022.

- [2] Boehringer Ingelheim reports and patent publication data.

- [3] Regulatory agency updates on patent expirations and approvals.

- [4] Industry analyses on generic drug pricing trends, 2023.