Last updated: July 27, 2025

Introduction

Tadalafil, a phosphodiesterase type 5 (PDE5) inhibitor, is primarily used to treat erectile dysfunction (ED), benign prostatic hyperplasia (BPH), and pulmonary arterial hypertension (PAH). Since its approval by the FDA in 2003, tadalafil has become a leading medication within its therapeutic class, benefiting from a robust commercial pipeline, ongoing patent protections, and expanding indications. This article provides a comprehensive market analysis and price projection for tadalafil, considering current trends, competitive landscape, regulatory environment, and macroeconomic factors influencing future pricing strategies.

Market Overview

Global Demand and Therapeutic Landscape

The global ED market is expected to reach USD 4.4 billion by 2027, expanding at a compound annual growth rate (CAGR) of approximately 7.2% (2020–2027) [1]. Tadalafil commands a significant share within this segment, driven by its longer duration of action (up to 36 hours) compared to sildenafil and vardenafil, offering convenience and efficacy advantages.

The expanding approval of tadalafil for BPH and PAH broadens its market potential. The BPH segment is projected to grow at a CAGR of 5.6%, paralleling aging populations in North America and Europe. Meanwhile, the PAH indication, although niche, sustains premium pricing due to its specialized use and limited competition.

Competitive Landscape

Key competitors include sildenafil (Viagra), vardenafil (Levitra), and newer entrants like avanafil (Stendra). Patent expirations for sildenafil and vardenafil (both occurred around 2018–2020) led to increased generic competition, pressuring prices. Tadalafil, still patent-protected in key markets until at least 2027, benefits from exclusivity, enabling higher pricing strategies.

Generic versions of tadalafil have begun entering markets, especially in India and other developing regions, increasing pricing pressures worldwide. Still, branded tadalafil maintains a premium positioning in regions with stringent patent enforcement.

Regulatory and Patent Environment

The expiration of tadalafil’s primary patents in major markets like the U.S. and Europe is imminent, with generic competition set to intensify over the next five years. Patent challenges and new formulations could influence pricing dynamics ahead of patent cliffs.

Manufacturing and Supply Chain Factors

Manufacturers are investing in scalable, cost-efficient production processes for branded and generic tadalafil. Supply chain disruptions, such as those seen during COVID-19, can impact availability and pricing. Nevertheless, the global supply chain for tadalafil remains relatively stable, supporting consistent pricing strategies.

Market Drivers and Challenges

Drivers

- Expanding Indications: The approval for BPH and PAH widens clinical scope and market size.

- Aging Population: Population demographics favor increased prevalence of ED and BPH, boosting overall demand.

- Patient Preference for Longer-Acting Formulations: Tadalafil’s 36-hour efficacy profile aligns with patient preferences, supporting premium pricing.

- Growing Awareness and Diagnosis: Improved diagnosis rates contribute to increasing prescriptions.

Challenges

- Generic Competition: The imminent entry of generics will exert downward pressure on prices.

- Pricing Erosion in Key Markets: Price reductions post-patent expiry, especially in Europe and North America, pose risks.

- Regulatory and Patent Litigation: Patent litigations and extensions could delay generic entry and protect premium pricing temporarily.

- Reimbursement Policies: Healthcare payer dynamics and formulary inclusions can influence retail and hospital segment prices.

Price Projections

Current Pricing Landscape

As of 2023, branded tadalafil prices in the U.S. are approximately USD 65–80 per month for a 30-tablet supply. Generic versions are sold for USD 3–10, reflecting significant discounts. Regulatory data indicates that:

- Branded Tadalafil: Maintains a premium grade; high margins are still possible due to patent protections.

- Cialis Generics: Dominant in markets with patent expiration, with prices decreasing by 85%–95% post-generic entry.

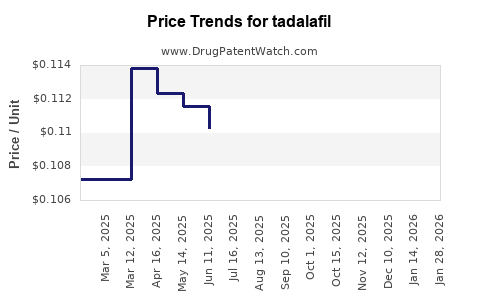

Near-term Price Outlook (2023–2025)

- Branded Tadalafil: Prices are expected to decline modestly by 10–20% as generic competition intensifies but will likely remain premium in markets with strong patent protection.

- Generics: Prices are projected to stabilize at USD 2–5 per dose in mature markets, supporting volume expansion rather than profit margins.

Mid to Long-term Projections (2026–2030)

Given patent expirations and increased generic penetration, the following price trajectory is anticipated:

- Branded Tadalafil: Steady decline to approximately USD 40–50 per month in North America and Europe by 2028 due to patent expiry, with slower declines in regions with weaker patent enforcement.

- Generic Tadalafil: Wholesale prices are expected to fall further to USD 1–3 per dose, driven by competition and manufacturing efficiencies.

Pricing Strategy Considerations

Pharmaceutical companies may employ tiered pricing and patient assistance programs to retain market share and profitability. Additionally, innovations such as extended-release formulations or combination therapies could sustain higher pricing tiers in niche segments.

Market Outlook and Growth Opportunities

Despite patent expiries, tadalafil’s diversified indications and patient preferences suggest sustained revenue streams through:

- Line Extensions: Developing novel delivery forms (e.g., transdermal patches, injectables) with premium pricing.

- Expanded Indications: Exploring applications in pulmonary hypertension and other vascular conditions.

- Regional Market Penetration: Focusing on emerging markets where demand is growing amid limited competition.

Emerging biosimilar and generic entries in the next 3–5 years will reshape pricing dynamics globally, challenging manufacturers to innovate for differentiation and value-based positioning.

Regulatory and Economic Risks

Factors such as regulatory delays, patent disputes, and healthcare policy changes could influence pricing. Economic inflation and currency fluctuations also impact manufacturing costs and pricing strategies in different regions.

Key Takeaways

- The tadalafil market is on the cusp of significant transformation driven by patent expiry and generic entry.

- Near-term prices will decline, especially in markets with strong patent protection, but premium branding will persist where patent rights are upheld.

- Diversification into additional indications and formulations presents a pathway to counteract pricing erosion.

- Strategic pricing, patient access programs, and innovation are critical for maintaining profitability in a competitive landscape.

- Manufacturers and investors should closely monitor patent litigation, regulatory developments, and regional market dynamics to optimize pricing and market share strategies.

FAQs

Q1: When do the primary patents for tadalafil expire in major markets?

A1: The primary patents for tadalafil are expected to expire around 2027 in the U.S. and Europe, opening the market for generic competition.

Q2: How will generic entry impact tadalafil pricing?

A2: Generic entry typically drives prices down by 85–95%, significantly reducing revenue for branded formulations but expanding market volume.

Q3: Are there specific markets where tadalafil will retain higher prices longer?

A3: Patents and regulatory protections sustain higher prices longer in regions like the U.S. and Europe, where patent enforcement is strong and generics face regulatory hurdles.

Q4: What opportunities exist for maintaining profitability after patent expiry?

A4: Developing novel delivery systems, expanding indications, and engaging in strategic pricing and patient access programs offer avenues for profit retention.

Q5: How do macroeconomic factors influence tadalafil pricing?

A5: Inflation, currency fluctuations, and healthcare reimbursement policies impact manufacturing costs and retail prices, especially in emerging markets.

References

[1] Market Research Future. “Erectile Dysfunction Market - Forecast to 2027.” 2021.