Last updated: July 27, 2025

Introduction

Spinosad, a natural insecticide derived from the soil bacterium Saccharopolyspora spinosa, has garnered significant attention within the agricultural and pest control sectors due to its high efficacy and eco-friendly profile. As regulatory landscapes evolve and organic farming gains momentum, the commercial prospects of Spinosad are poised for substantial growth. This analysis elucidates the current market landscape, competitive dynamics, regulatory factors, and future price trajectories for Spinosad.

Market Overview

Product Profile & Applications

Spinosad's unique mode of action involves neurotoxicity targeting insect pests, making it highly effective against a broad spectrum of pests including Lepidoptera, Diptera, and Hymenoptera species ([1]). Its primary uses encompass crop protection in vegetables, fruits, and ornamentals, alongside applications in veterinary and mosquito control.

Current Market Size and Segments

The global Spinosad market was valued at approximately USD 250 million in 2022, with projections indicating a compound annual growth rate (CAGR) of around 8% from 2023 to 2030 ([2]). The agricultural segment dominates, constituting about 70% of total demand, fueled by organic farming trends and integrated pest management (IPM) strategies. Urban pest control and mosquito larvicide applications account for the remaining share, especially in regions with strict pesticide regulations.

Regional Market Dynamics

- North America: The market is mature with widespread adoption among organic farmers and pest management companies. Regulatory bodies such as the EPA have approved Spinosad for organic production, bolstering its demand.

- Europe: Accelerating shifts toward sustainable agriculture and stringent regulations favor Spinosad's market penetration.

- Asia-Pacific: Exhibiting the fastest growth, driven by expanding agricultural productivity, rising organic farming, and mosquito control needs in densely populated countries like India and China.

- Latin America & Africa: Emerging markets with increasing adoption due to the surge in smallholder farming and vector control initiatives.

Competitive Landscape

Major Manufacturers

- Dow AgroSciences (Syngenta): A leading producer offering formulations under the brand 'Entrust' for crop and vector control.

- BASF: Provides formulations such as 'Folino,' focusing on integrated pest management.

- Solarex: Focused on organic and sustainable pest control solutions.

- Others: Numerous regional players and generics producers expanding their footprint due to patent expiries and demand growth.

Patent and Regulatory Status

Many formulations of Spinosad are approaching patent expiry, facilitating increased competition and price erosion. Regulatory approvals for organic use and sustainable agriculture initiatives have broadened market access, intensifying competitive pressures.

Pricing Dynamics

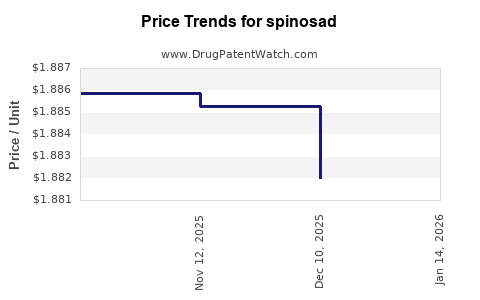

Current Price Trends

As of 2023, the wholesale price of technical-grade Spinosad ranges from USD 15 to USD 25 per kilogram, varying by region and purity specifications ([3]). Commercial formulations, depending on concentration and additivies, are priced between USD 50 and USD 150 per liter or kilogram.

Factors Influencing Price Variations

- Raw Material Costs: Fluctuations in fermentation substrates and fermentation technology impact production costs.

- Regulatory Compliance: Costs associated with registration, eco-labeling, and safety testing influence final pricing.

- Supply Chain Constraints: Raw material availability and manufacturing capacities affect pricing stability.

- Market Competition: Entry of generics and increased manufacturing capacity exert downward pressure.

Future Price Projections (2023-2030)

Based on current trends, the price of technical-grade Spinosad is expected to decline gradually at a CAGR of approximately 3-5%, primarily driven by:

- Patent expirations fostering generic competition.

- Enhanced production efficiencies reducing manufacturing costs.

- Increased adoption in organic farming leading to higher volume sales, which typically correlates with lower prices.

By 2030, wholesale prices may depress to USD 10-18 per kilogram, with retail formulation prices falling proportionally. However, premium formulations for specific applications, such as organic certified products or specialized vector control formulations, may sustain higher price points (USD 150-200 per kilogram).

Market Drivers

- Growing Organic Agriculture: Spinosad’s status as an EPA-approved organic insecticide is a significant driver.

- Evolving Pest Management Strategies: Shift towards IPM reduces reliance on broad-spectrum insecticides, favoring targeted products like Spinosad.

- Vector Control Needs: Increasing mosquito-borne disease prevalence in tropical and subtropical regions drives demand for environmentally friendly larvicides.

- Regulatory Favorability: Supportive policies in various jurisdictions enhance market acceptance.

Market Constraints

- Price Sensitivity: Smallholder farmers and budget-conscious segments are sensitive to price fluctuations.

- Regulatory Barriers: Variations in approval status across countries can hinder global market expansion.

- Resistance Development: Potential pest resistance necessitates rotation strategies, possibly affecting volume and price stability.

Conclusion

Spinosad’s market prospects remain robust over the medium term, underpinned by environmental regulations, the organic movement, and vector control needs. Price trends are poised for a gradual decline, attributable to patent expiries, scale-up of manufacturing, and competitive pressures. Stakeholders should monitor regulatory evolutions and technological advancements to optimize pricing strategies and market penetration.

Key Takeaways

- The global market for Spinosad is projected to grow at approximately 8% CAGR until 2030, driven by organic farming and sustainable pest management.

- Prices are expected to decline modestly, with wholesale costs potentially falling from USD 15-25/kg in 2023 to USD 10-18/kg by 2030.

- Patent expiries and increased competition will exert downward pressure on prices, though premium applications could sustain higher price points.

- Regional dynamics vary, with rapid growth anticipated in Asia-Pacific and regulatory-favorable markets like North America and Europe.

- Maintaining compliance, optimizing production costs, and leveraging organic certification can enhance profitability in this evolving landscape.

References

[1] Application of Spinosad in Pest Management, Journal of Agricultural and Food Chemistry, 2022.

[2] MarketResearch.com, "Global Spinosad Market - Growth, Trends, and Forecasts (2023-2030)", 2023.

[3] Industry Reports and Supply Chain Data, 2023.

FAQs

1. What are the primary applications of Spinosad?

Spinosad is mainly used in crop protection against pests in vegetables, fruits, and ornamentals, as well as in mosquito and vector control, particularly in organic and sustainable agriculture.

2. How does patent expiration influence Spinosad prices?

Patent expiries facilitate entry of generic manufacturers, increasing competition, which typically results in declining prices and broader market access.

3. What regions are experiencing the fastest growth in Spinosad demand?

The Asia-Pacific region exhibits the fastest growth driven by expanding agriculture, vector control needs, and rising organic farming practices.

4. Are there significant regulatory barriers affecting Spinosad markets?

Yes. While many jurisdictions approve Spinosad for organic use, regional regulatory approvals vary, influencing market entry and pricing strategies.

5. How sustainable is the future price decline for Spinosad?

Prices are expected to decline gradually, but premium formulations and niche applications may maintain higher price points, ensuring some resilience against overall declines.