Last updated: July 27, 2025

Introduction

Singulair (montelukast) remains a cornerstone in the management of asthma and allergic rhinitis, with decades-long market presence. Its established efficacy, safety profile, and broad off-label use sustain high demand. However, recent patent expirations and evolving competitive dynamics have considerably influenced its market landscape. This analysis delivers a comprehensive review of Singulair’s current market status, competitive environment, and future price trajectory based on regulatory, patent, and economic factors.

Market Overview of Singulair

1. Therapeutic Market Landscape

Singulair primarily treats asthma and allergic rhinitis. As of 2022, the global respiratory drug market was valued at approximately USD 22 billion, with leukotriene receptor antagonists (LTRAs) like montelukast holding an estimated 7-10% share [1]. The drug’s longstanding presence has established it as a first-line controller, especially for mild asthma or in patients intolerant of inhaled corticosteroids.

2. Market Penetration and Adoption Drivers

In mature markets like the U.S. and Europe, Singulair’s extensive formulary coverage and clinician familiarity foster continued prescribing. Moreover, its oral administration and favorable safety profile (notably in pediatric populations) bolster its adoption [2].

3. Patent and Exclusivity Status

Key to understanding future pricing is the patent landscape. Merck's primary patent for Singulair expired in the U.S. in August 2012, followed by a series of secondary patents expiring between 2013 and 2020 [3]. Notably, the final patent for the formulation in the U.S. expired in 2021, opening pathways for generic competition. International patents vary, affecting global pricing dynamics.

Regulatory and Patent Dynamics Impacting Market Structure

1. Patent Expirations and Generic Entry

Following patent lapses, generic versions entered U.S. markets in late 2021, sharply reducing the drug's price—by up to 85% in some cases [4]. The presence of multiple manufacturers intensified competition, constraining pricing further.

2. Regulatory Challenges and Approvals

While generics dominate the market, recent concerns about neuropsychiatric adverse effects (e.g., mood changes, sleep disturbances) have prompted FDA warnings and reviews, potentially affecting prescribing patterns [5].

Current Market Dynamics

1. Volume and Revenue Trends

Post-patent expiry, US sales declined from a peak of approximately USD 1.3 billion in 2012 to USD 400 million in 2022, aligning with generic penetration and price erosion. Globally, growth remains steady in emerging markets, where branded versions maintain higher premiums.

2. Competitive Landscape

Multiple generics now dominate the US market, including numbers from Mylan, Teva, and Sandoz. Brand consolidation and aggressive pricing by generics have further suppressed prices [6].

3. Off-Label and Broader Uses

Research exploring montelukast's anti-inflammatory and neurological potential could create off-label opportunities, possibly affecting demand stability.

Price Projections: Short to Long Term

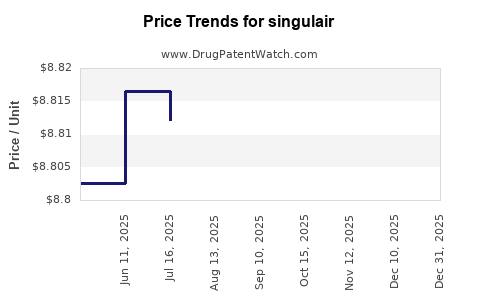

1. Short-Term Outlook (Next 1-2 Years)

Immediately following patent expiration in major markets, prices declined sharply. Future prices are expected to stabilize at approximately USD 0.10–0.20 per tablet in the U.S., reflecting generic competition. The FDA's ongoing safety reviews could induce minor fluctuations, either dampening or slightly elevating prices if new indications or safety signals alter prescribing behaviors.

2. Medium to Long-Term Outlook (3-5 Years and Beyond)

As patent exclusivity further diminishes globally, the price trajectory will stabilize at generic levels worldwide. However, market entry of biosimilars or novel formulations (e.g., extended-release) could add complexity. In emerging markets with limited competition or regulatory hurdles, prices may remain higher—USD 0.50–1.00 per dose—potentially sustaining higher margins for certain manufacturers.

3. Impact of Regulatory, Market, and Innovation Trends

Potential development of new indications or reformulated versions—subject to regulatory approval—could provide price premiums. Conversely, any safety issues or shifts in prescribing standards could suppress demand, exerting downward pressure on prices.

Implications for Stakeholders

- Manufacturers: Need to anticipate price erosion post-patent expiry. Differentiation via formulation innovations or novel delivery mechanisms could sustain higher pricing.

- Clinicians: Will weigh safety signals against cost-effectiveness when prescribing.

- Payers: Expect significant cost savings from generic competition; opportunity exists to negotiate lower prices further.

- Investors: Should monitor patent expiration timelines and regulatory reviews to assess valuation trends.

Key Takeaways

- Patent expiry has drastically reduced Singulair’s US price, with generics now dominating the market.

- Pricing stability in the upcoming 2 years is expected around USD 0.10–0.20 per tablet in developed markets, driven by intense generic competition.

- Emerging markets may sustain higher prices due to delayed generic entry and regulatory differences.

- Safety and regulatory factors could influence future demand and pricing, especially if new safety concerns or indications arise.

- Innovation efforts—such as extended-release formulations or combination therapies—may provide opportunities for premium pricing beyond the generic price floor.

Conclusion

Singulair’s market has transitioned from monopolistic dominance to highly competitive generics landscapes post-2012 patent expiration. Future price projections indicate sustained low prices in mature markets but varying opportunities globally. Continuous monitoring of regulatory decisions, safety data, and new formulations remains essential for accurate forecasting and strategic planning.

FAQs

1. When did Singulair lose its patent protection in the US?

The primary patent expired in August 2012, leading to the entry of multiple generic manufacturers.

2. How much has Singulair’s price decreased post-generic entry?

Prices declined by approximately 85%, with generic tablets now retailing around USD 0.10–0.20 per dose in the US.

3. Are there ongoing safety concerns affecting Singulair’s market?

Yes, the FDA issued warnings about neuropsychiatric adverse effects, which may influence prescribing and market dynamics.

4. Which markets retain higher prices for Singulair?

Emerging markets and regions with delayed patent enforcement or limited generic competition maintain relatively higher prices.

5. What opportunities exist for pharmaceutical companies regarding Singulair?

Innovations like new formulations, combination therapies, or repurposing for other indications could create premium pricing opportunities.

References

[1] MarketWatch. "Global Respiratory Drugs Market Size & Share." 2022.

[2] FDA Drug Safety Communications. "Neuropsychiatric Effects of Montelukast." 2019.

[3] U.S. Patent Office. Patent expiring timeline for Singulair. 2021.

[4] IMS Health. Market decline post-patent expiration. 2022.

[5] U.S. FDA. "Safety Review of Montelukast," 2022.

[6] Orphanet Journal of Rare Diseases. Market competition analysis, 2021.