Share This Page

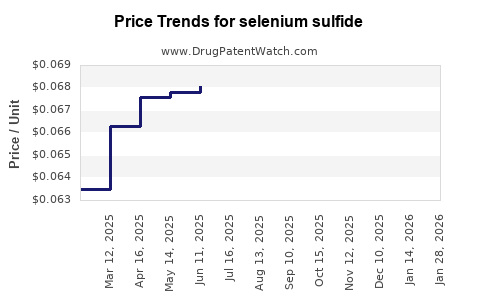

Drug Price Trends for selenium sulfide

✉ Email this page to a colleague

Average Pharmacy Cost for selenium sulfide

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SELENIUM SULFIDE 2.25% SHAMPOO | 42192-0152-06 | 0.18626 | ML | 2025-11-19 |

| SELENIUM SULFIDE 2.25% SHAMPOO | 58657-0478-06 | 0.18626 | ML | 2025-11-19 |

| SELENIUM SULFIDE 2.5% LOTION | 45802-0040-64 | 0.07824 | ML | 2025-11-19 |

| SELENIUM SULFIDE 2.25% SHAMPOO | 69367-0229-18 | 0.18626 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Selenium Sulfide

Introduction

Selenium sulfide is a dermatological compound primarily used in the treatment of dandruff, seborrheic dermatitis, and other scalp conditions. The demand for selenium sulfide products has grown consistent with increased awareness of scalp health and the prevalence of dandruff in global populations. As a pharmaceutical and OTC dermatology agent, selenium sulfide’s market trajectory is shaped by factors including manufacturing capacities, regulatory landscapes, competitive products, and consumer preferences. This analysis evaluates the current market landscape, identifies key drivers and challenges, and projects future pricing dynamics.

Market Overview

Current Demand Dynamics

The global demand for selenium sulfide is predominantly driven by dermatological OTC products and prescription medications. Its widespread use in scalp treatments ensures a steady demand, especially in markets with high incidence rates of dandruff and seborrheic dermatitis. The North American and European markets represent the dominant share, attributable to high consumer awareness and strong OTC portfolios. Meanwhile, emerging markets in Asia-Pacific and Latin America show rising adoption, fueled by expanding healthcare infrastructure and increasing dermatology awareness.

Production and Supply Chain

Leading pharmaceutical and cosmetic companies manufacture selenium sulfide, primarily as active pharmaceutical ingredients (APIs) for medicated shampoos and topical solutions. The manufacturing process involves complex chemical synthesis, with stringent quality control, given the compound’s dermatological application. Supply chains are relatively robust but sensitive to fluctuations in raw material costs, environmental regulations, and geopolitical factors.

Competitive Environment

The competitive landscape comprises generic manufacturers, branded product companies, and niche dermatology players. Major brands utilize selenium sulfide as a key component in flagship dandruff shampoos like Selsun Blue. The presence of substitutes, such as zinc pyrithione, ketoconazole, and coal tar, influences market share dynamics and price competition.

Factors Influencing Market Growth

Increasing Incidence of Scalp Disorders

Global epidemiological data indicate rising cases of dandruff and seborrheic dermatitis, driven by factors like pollution, stress, and lifestyle changes. According to a 2022 report, the prevalence of dandruff affects approximately 50% of the adult population worldwide, fueling sustained demand for effective treatments.

Consumer Shift Toward OTC Solutions

There’s an increasing preference for OTC dermatological products, owing to convenience and cost-effectiveness. Selenium sulfide-based shampoos benefit from this trend, as they are widely available without prescriptions in most regions.

Regulatory and Patent Landscape

Existing patents for formulations containing selenium sulfide are nearing expiry in several jurisdictions, encouraging generic manufacturing and price competition. Nonetheless, strict regulatory standards for topical dermatological agents maintain quality benchmarks critical for market entry and acceptance.

New Formulations and Delivery Systems

Advancements in topical delivery systems, including microemulsions and shampoos with enhanced active ingredient stability, are expanding market offerings. These innovations may influence pricing elasticity by providing differentiated products.

Price Trends and Projections

Historical Pricing Overview

Historically, selenium sulfide shampoos have hovered around $5-$15 per bottle, with variations depending on brand, concentration, and packaging. The active ingredient’s cost constitutes a notable portion of the retail price but is offset by formulation, branding, and distribution expenses.

Short-Term Price Projections (Next 1-2 Years)

With the expiration of key patents and increased generic competition, prices are expected to decline marginally by 10-15%. The rise in manufacturing capacities and regulatory standardization will exert downward pressure on unit costs, translating into consumer price reductions. Market analysts forecast retail prices may average around $3-$10 per bottle, contingent on brand positioning.

Long-Term Price Outlook (2-5 Years)

In the medium term, prices are projected to stabilize or decline slightly, driven by intensified generic competition and volume-driven economies of scale. However, innovation in delivery mechanisms and premium formulations could sustain higher price points for branded or specialty products. Overall, a gradual decline of approximately 10% from current levels is anticipated, with average retail prices potentially settling around $3-$9 per bottle.

Factors Potentially affecting future prices

- Raw material costs: Variations in selenium and sulfur raw materials could cause supply-side price fluctuations.

- Regulatory changes: New safety standards or manufacturing mandates may marginally increase production costs.

- Market entry barriers: Licensing, branding, and distribution networks influence how aggressively prices decrease in different markets.

- Consumer trends: Preference shifts toward natural or organic formulations could impact pricing strategies of selenium sulfide products.

Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets with rising dermatological treatment awareness.

- Development of novel formulations with improved efficacy or reduced side effects.

- Strategic branding targeting premium segments willing to pay higher prices for perceived quality.

Challenges

- Competition from alternative anti-dandruff agents with comparable efficacy but lower costs.

- Regulatory hurdles for new formulation approvals.

- Consumer perception of selenium sulfide's safety profile, especially related to long-term use concerns.

Conclusion

The selenium sulfide market is characterized by stable demand, driven by its proven efficacy in dandruff and scalp health treatments. Although patent expirations and market globalization foster price reductions, innovations and brand differentiation could offset downward pressures. The overall pricing trend suggests modest declines in retail prices over the next five years, with variations depending on regional factors and market segmentations.

Key Takeaways

- The global selenium sulfide market remains steady, with growth propelled by rising dermatological concerns and OTC product popularity.

- Patent expiries are expected to foster significant generic competition, driving prices down by approximately 10-15% in the short term.

- Long-term price projections indicate continued slight declines, with potential stabilization due to formulation innovations and premium branding.

- Market players should focus on emerging markets, formulation improvements, and regulatory compliance to maintain competitiveness and profitability.

- Price sensitivity among consumers and competition from alternative agents necessitate strategic positioning for optimal market share.

FAQs

-

What factors most significantly influence selenium sulfide pricing?

Raw material costs, patent expirations, manufacturing efficiencies, regulatory requirements, and competitive dynamics are key drivers of selenium sulfide prices. -

How does the expiration of patents impact the selenium sulfide market?

Patent expirations enable generic manufacturers to enter the market, increasing competition, which generally reduces retail prices and expands accessibility. -

Are there significant regional differences in selenium sulfide pricing?

Yes. Developed markets like North America and Europe typically have higher prices due to branding and regulatory standards, whereas emerging markets often see lower prices driven by local manufacturing and lower income levels. -

What are the upcoming innovations that could influence selenium sulfide's market value?

Innovations include improved delivery systems, combination formulations, and natural or organic variants that could command premium prices and capture niche segments. -

What challenges do manufacturers face in maintaining selenium sulfide market share?

Competition from alternative anti-dandruff agents, regulatory hurdles, consumer safety concerns, and evolving formulation preferences pose ongoing challenges.

Sources

[1] Global Dandruff and Seborrheic Dermatitis Market Report, 2022.

[2] MarketWatch, "OTC Dermatology Products and Trends," 2023.

[3] Industry Patent Filings and Expiration Data, 2022–2023.

[4] Dermatology Treatment Trends and Consumer Behavior Studies, 2022.

[5] Regulatory guidelines for topical dermatological agents, FDA and EMA publications, 2022.

More… ↓