Last updated: July 27, 2025

Introduction

Scopolamine, a tropane alkaloid derived primarily from plants in the Solanaceae family, notably Hyoscyamus niger and Atropa belladonna, serves a pivotal role in medical therapeutics. Its primary indications encompass motion sickness, postoperative nausea, vomiting, and certain neurological conditions. As a pharmacological agent with established efficacy, recent innovations, patent landscapes, and evolving market dynamics merit comprehensive analysis to inform investment, manufacturing, and strategic positioning decisions.

Market Overview

Current Global Market Size

The global scopolamine market is estimated to be valued at approximately USD 400-500 million as of 2023, with consistent growth driven by the expanding prevalence of nausea-related conditions and increasing adoption in anesthesia and postoperative care. The Asia-Pacific region accounts for nearly 40% of market revenue, leveraging the high prevalence of motion sickness and the widespread use of traditional medicines containing plant-derived scopolamine.

Key Segments and Therapeutic Applications

- Nausea and Motion Sickness Management: The majority share, driven by OTC transdermal patches (e.g., transdermal scopolamine patches) and injectable formulations.

- Perioperative and Anesthesia Uses: Utilized as an adjunct to anesthesia to mitigate motion sickness and maintain patient stability.

- Neurological Conditions: Emerging off-label applications include treating certain types of tremors and spasticity, although these remain experimental.

Market Drivers

- Rising Adoption of Transdermal Delivery Systems: The convenience and reduced side-effect profile of patches bolster market expansion.

- Increasing Patient Demographics: Growing aging populations worldwide elevate demand for antiemetic therapies.

- Regulatory Approvals and New Formulations: Innovations enhancing bioavailability or reducing adverse effects expand therapeutic options.

- Emerging Markets: Developing countries are witnessing increased usage due to healthcare infrastructure development and rising health awareness.

Market Challenges

- Toxicity and Side Effects: Cognitive impairment, dry mouth, visual disturbances, and potential anticholinergic toxicity pose limitations.

- Regulatory and Patent Landscape: Patent expirations in certain regions have led to generic proliferation, intensifying price competition.

- Supply Chain Constraints: Dependence on botanical sources and complex synthesis routes introduce variability and risks.

Competitive Landscape

Major pharmaceutical companies with established presence in the antiemetic segment include Mylan (now part of Viatris), Sandoz (Novartis), and Hikma Pharmaceuticals. Generic manufacturers dominate in price-sensitive markets, often selling scopolamine patches and formulations at significantly reduced costs once patents expire.

Emerging biotech firms are exploring novel delivery systems, such as nanoparticle carriers, to improve efficacy and safety profiles, potentially transforming market dynamics in the coming years.

Patent and Regulatory Environment

The patent landscape has seen significant shifts:

- Patent Expirations: Several patents related to transdermal delivery methods and formulations expired between 2018 and 2022, facilitating generic competition.

- Regulatory Approvals: Agencies like the FDA and EMA have approved multiple formulations, ensuring market access but also intensifying competition among manufacturers.

- Upcoming Patent Filings: Innovation-driven companies seek to protect novel delivery mechanisms and combination therapies, creating potential premium segments.

Price Projections and Future Trends

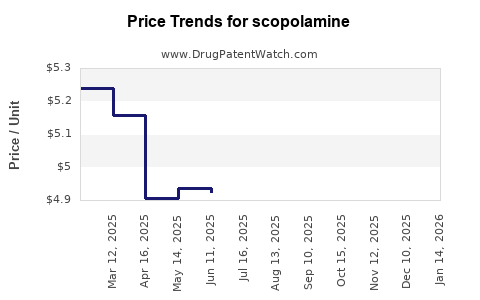

Historical Pricing Trends

Analyses indicate that prices for branded scopolamine patches ranged from USD 30 to USD 50 per patch, whereas generics often sell for USD 5 to USD 15 per patch, reflective of high market saturation and competitive pressures [1]. Injectable formulations are priced higher due to manufacturing complexities, often exceeding USD 100 per dose.

Forecasted Price Dynamics (2023-2030)

- Price Stabilization Post-Patent Expiration: With patent losses, generic prices are forecast to decline by approximately 15-25% annually, reaching as low as USD 2-5 per patch in price-sensitive markets by 2028.

- Premium Formulations: Innovations such as multi-layer patches with sustained-release mechanisms could maintaining higher price points (~USD 20-30 per patch), capturing niche markets seeking improved efficacy and tolerability.

- Impact of Biosimilars and Novel Delivery Systems: Adoption of innovative delivery platforms might sustain or elevate price points, especially if clinical benefits over existing formulations are demonstrated.

Market Penetration and Pricing Strategies

- Emerging Markets: Price-sensitive models predominate, with manufacturers leveraging local production and lower-cost raw materials.

- Developed Markets: Focus on safety, convenience, and usability allows for premium pricing, notably with patented delivery systems or combination formulations.

Strategic Considerations

- Manufacturing Localization: In-house botanical extraction versus synthetic production offers differing cost structures and scalability.

- Regulatory Compliance: Ensuring fast-track approval processes, especially for novel delivery systems, can provide competitive edge.

- Intellectual Property Strategies: Patents on delivery mechanisms or proprietary formulations can protect market share amid generics proliferation.

Conclusion

The scopolamine market exhibits moderate but steady growth, bolstered by innovation and diversified therapeutic uses. Price projections suggest significant downward trends for core products due to patent cliffs and increased generic competition, but opportunities for premium formulations and novel delivery methods present avenues for sustained profitability. Strategic focus on innovation, cost optimization, and regional market adaptation will be critical for stakeholders aiming to capitalize on future market shifts.

Key Takeaways

- The global scopolamine market is primarily driven by motion sickness treatments and perioperative applications, with a valuation around USD 400-500 million in 2023.

- Patent expirations have catalyzed a surge in generic products, leading to substantial price reductions, especially in price-sensitive regions.

- Price projections indicate a decline of approximately 15-25% annually for generic patches over the next five years, with branded and innovative formulations maintaining higher price points.

- The rise of novel delivery technologies and combination therapies offers potential for premium pricing, especially in developed markets.

- Strategic manufacturing, regulatory expertise, and intellectual property management are vital for navigating competitive pressures and maximizing profitability.

FAQs

-

What are the primary therapeutic uses of scopolamine?

Scopolamine is chiefly used to prevent motion sickness, manage postoperative nausea and vomiting, and as an adjunct in anesthesia. Emerging off-label uses include neurological disorder management, though these remain investigational.

-

How has patent expiration impacted scopolamine pricing?

Patent expirations have led to a proliferation of generic products, significantly reducing prices—by up to 50% or more in some markets—due to increased competition.

-

What are the prospects for innovative delivery systems in the scopolamine market?

Innovations such as bioengineered patches with sustained-release properties or combination formulations could command premium pricing and offer competitive advantages, particularly in sophisticated markets.

-

Which regions are expected to exhibit the fastest growth?

Asia-Pacific remains the fastest-growing segment, driven by rising healthcare access and prevalent motion sickness, with the Middle East and Latin America also on accelerated growth trajectories.

-

What are the main challenges influencing market growth?

Side effect profiles, regulatory hurdles, botanical sourcing variability, and price competition from generics are primary challenges constraining optimal market expansion.

References

- MarketWatch. "Scopolamine Transdermal Patches Market Size and Forecast." 2023.