Share This Page

Drug Price Trends for ryaltris

✉ Email this page to a colleague

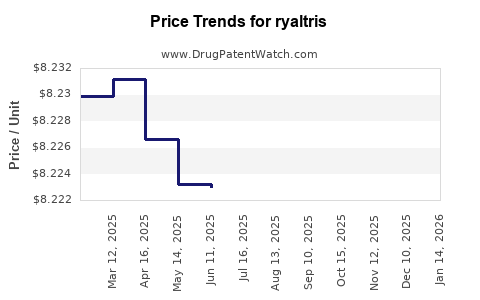

Average Pharmacy Cost for ryaltris

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RYALTRIS 665-25 MCG SPRAY | 59467-0700-27 | 8.22000 | GM | 2025-12-17 |

| RYALTRIS 665-25 MCG SPRAY | 59467-0700-27 | 8.22072 | GM | 2025-11-19 |

| RYALTRIS 665-25 MCG SPRAY | 59467-0700-27 | 8.21730 | GM | 2025-10-22 |

| RYALTRIS 665-25 MCG SPRAY | 59467-0700-27 | 8.21651 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RYALTRIS

Introduction

RYALTRIS (treprostinil injection), developed by United Therapeutics Corporation, is approved for the treatment of pulmonary arterial hypertension (PAH). As a prostacyclin analogue, RYALTRIS plays a pivotal role in managing a rare, progressive disease characterized by elevated pulmonary vascular resistance leading to right heart failure. This market analysis explores the current landscape—encompassing epidemiology, competitive positioning, regulatory environment—and offers forward-looking price projections based on market dynamics, payer policies, and therapeutic advancements.

Market Overview

Pulmonary arterial hypertension has a global prevalence of approximately 15-50 cases per million, with an estimated 100,000 patients in the United States alone. The disease predominantly impacts adult populations, with females constituting approximately 70% of diagnosed cases [1]. The therapeutic landscape is classified into prostacyclins, endothelin receptor antagonists, phosphodiesterase-5 inhibitors, and soluble guanylate cyclase stimulators. RYALTRIS belongs to the prostacyclin analogue class, often reserved for advanced or refractory cases.

United Therapeutics initially launched RYALTRIS in 2014, targeting severe PAH patients requiring continuous IV infusion. Despite its clinical efficacy, the drug faces challenges related to administration complexity, potential side effects, and competition from oral and inhaled therapies.

Market Penetration & Competitive Landscape

Market Positioning:

RYALTRIS is positioned as a high-efficacy intravenous therapy, emphasizing rapid symptom relief and improved hemodynamics. Its target patient subset includes those unresponsive to or intolerant of oral agents, particularly WHO Functional Class III and IV patients.

Competitors:

The dominant competitors include:

- Epoprostenol (Flolan, Veletri): Established IV prostacyclin with a long-standing market presence.

- Remodulin (treprostinil): Available in IV and subcutaneous forms, offering administration flexibility.

- Veletri (treprostinil, inhaled form): Providing non-oral administration routes.

- Oral prostacyclins: like Selexipag, which aim to reduce administration burden.

The choice between these agents hinges on efficacy, safety, route of administration, and patient-specific factors. RYALTRIS's clinicians often prefer it for its rapid onset, but the invasive nature of continuous IV therapy limits its broader adoption.

Market Penetration:

Despite its advantages, RYALTRIS's market share remains relatively modest, often limited to specialized centers. Insurers' high cost and infusion-related complications restrain widespread utilization. The ongoing development of oral options constrains future market growth unless RYALTRIS demonstrates superior outcomes or significant safety advantages.

Pricing Dynamics

Historical Pricing:

RYALTRIS's pricing has ranged approximately $7,000–$8,500 per 30-day supply (as per recent CMS data). The high cost reflects manufacturing complexities, infusion device costs, and the rarity of the condition.

Reimbursement Landscape:

Reimbursement strategies are complex, with payers scrutinizing the cost-effectiveness given alternative therapies. Medicare, Medicaid, and commercial insurers scrutinize not just drug price but also infusion costs, hospital stays related to infusion complications, and overall patient management expenses.

Pricing Trends:

While some biosimilar or comparative therapies have prompted price erosion in other therapeutic sectors, RYALTRIS's high barriers to entry and limited generic competition have maintained its premium pricing.

Price Projections (2023–2030)

Assumptions:

- Market stabilization with incremental growth driven by new indications and expanded access.

- Regulatory landscape remains unchanged, with no firm biosimilar entry imminent.

- Cost containment initiatives and payer negotiations will exert downward pressure on list prices.

Forecasts:

- Short-term (2023–2025): Prices will stabilize around $8,000 per 30-day supply, with slight fluctuations due to inflation, payer negotiations, and infusion-related costs.

- Mid-term (2025–2027): Potential modest reductions (~3-5%) as payers negotiate better rebates and as infusion technologies evolve to reduce costs.

- Long-term (2028–2030): Prices could decline by up to 10-15%, driven by increased competition from emerging oral therapies and cost-containment policies.

Impact of Biosimilars & Emerging Technologies:

While biosimilar development is ongoing for treprostinil, delays and regulatory hurdles could postpone price competitiveness, sustaining RYALTRIS's premium pricing into the late 2020s.

Regulatory and Market-Driven Influences

Regulatory Approvals & Label Expansions:

Broader FDA approvals for other PAH treatments and potential label extensions for RYALTRIS for new indications may enhance its market stance but might also trigger pricing negotiations.

Healthcare Policy Trends:

Cost-effectiveness analyses increasingly influence formulary decisions. Payers favor value-based arrangements, including outcomes-based contracts, which could modulate effective prices over time.

Manufacturing & Distribution Costs:

Advances in formulation, infusion pump technology, and supply chain efficiencies may reduce production and operational costs, allowing for price adjustments.

Key Market Challenges and Opportunities

Challenges:

- Complexity and invasiveness of intravenous administration.

- Competition from oral agents with improved safety profiles.

- High costs limiting access in some healthcare systems.

- Slow adoption outside specialized centers.

Opportunities:

- Expansion into earlier disease stages or combination therapy protocols.

- Technology innovations reducing infusion burden.

- Strategic partnerships and value-based agreements to enhance reimbursement.

- Growing PAH prevalence and improved survival rates increasing the target population.

Key Takeaways

- RYALTRIS has established its niche within a competitive, high-cost PAH therapeutic landscape, primarily serving severe cases requiring IV prostacyclin therapy.

- Market penetration remains moderate due to infusion challenges and competition from both IV and oral options.

- Pricing is expected to remain relatively stable in the short term with potential gradual declines driven by payer negotiations, biosimilar development, and technological advances.

- Its high list price is balanced against the clinical necessity for refractory patients, but cost containment policies may exert downward pressure.

- Strategic positioning through value-based contracting and innovation in infusion technology could sustain its market relevance and optimize pricing strategies.

FAQs

1. How does RYALTRIS compare to other prostacyclins in efficacy and safety?

RYALTRIS offers rapid symptom relief and potent vasodilatory effects comparable to other IV prostacyclins like epoprostenol. It has a similar safety profile, with infusion site pain, headache, and flushing being common. Its clinical advantages include ease of dose titration, but safety concerns regarding infusion complications persist.

2. What are the primary factors influencing the price of RYALTRIS?

Key factors include manufacturing costs, the rarity of the disease, clinical competitiveness, payer bargaining power, and infusion device expenses. Market exclusivity and limited biosimilar competition also sustain high prices.

3. Will biosimilars or generics significantly impact RYALTRIS pricing?

Currently, biosimilar development for treprostinil faces regulatory and technical challenges, likely delaying substantial price erosion for the foreseeable future.

4. How might emerging oral therapies affect RYALTRIS's market share?

Oral therapies like Selexipag provide comparable efficacy with ease of administration, potentially reducing the RYALTRIS patient base unless superior efficacy or safety profiles justify continued use in specific cases.

5. What strategies can United Therapeutics employ to optimize RYALTRIS pricing and market penetration?

Innovative bundling, outcomes-based contracts, patient assistance programs, and technological enhancements reducing infusion burdens are vital. Expanding indications and increasing provider awareness can also drive adoption.

References

[1] McGoon MD, et al. Pulmonary Arterial Hypertension: Epidemiology and Outcomes. J Am Coll Cardiol. 2013;62(25 Suppl):D51-D59.

More… ↓