Last updated: July 27, 2025

Introduction

Rivastigmine, a cholinesterase inhibitor primarily used in managing Alzheimer's disease (AD) and Parkinson's disease dementia (PDD), has remained a critical therapeutic agent amid growing demand for neurodegenerative disease treatments. As the global aging population surges, so does the potential market for rivastigmine. This analysis explores the current market landscape, competitive positioning, regulatory environment, and provides price projections aligning with industry trends and patent protections.

Market Overview

Global Incidence and Prevalence

The worldwide prevalence of Alzheimer's disease (AD) is estimated to reach over 70 million cases by 2030, with projections indicating a compound annual growth rate (CAGR) of approximately 8%. Parkinson's disease dementia (PDD), often treated with rivastigmine, is expected to follow similar upward trajectories due to aging demographics. The increasing incidence directly amplifies demand for symptomatic treatments like rivastigmine.

Pharmacological Role & Therapeutic Positioning

Rivastigmine is approved for mild-to-moderate dementia in AD and PDD. Its unique transdermal patch formulation offers enhanced adherence, setting it apart from oral cholinesterase inhibitors such as donepezil and galantamine. Its dual mechanism of inhibiting both acetylcholinesterase and butyrylcholinesterase adds to its relevance in the therapeutic landscape.

Market Segments

The drug's core market includes:

- Neurology clinics

- Geriatric healthcare facilities

- Homecare markets

- Developing country markets with expanding healthcare infrastructure

Competitive Landscape

Major Players

- Novartis: Patent holder of rivastigmine (brand name Exelon), with a significant share owing to early market entry.

- Sun Pharmaceutical Industries: Marketed generic versions post patent expiration.

- Other generics producers: Rising competition from Indian and Chinese manufacturers has driven down prices, expanding access, especially in emerging markets.

Patent and Regulatory Dynamics

Novartis's patent protections expired in key markets like the US (2017) and Europe (2018), leading to surges in generics. Patent cliffs often precipitate pricing erosion but also create opportunities for new formulations and combinations.

Market Drivers

- Aging Population: Demographic shifts bolster market size.

- Increased Diagnosis: Advances in neuroimaging, biomarker detection, and awareness contribute to early diagnosis.

- Off-label Uses: Emerging evidence supports trials in other neurodegenerative and psychiatric conditions, potentially expanding indications.

- Formulation Preferences: The transdermal patch remains a preferred delivery for compliance, influencing market share.

Market Challenges

- Pricing Pressures: Post-patent expiration, generic competition results in significant price reductions.

- Alternative Therapies: The emergence of disease-modifying agents (e.g., aducanumab) may impact rivastigmine's growth.

- Side Effect Profile: Gastrointestinal and dermatological adverse effects influence patient adherence.

Regional Market Analysis

North America

- Dominates due to high prevalence, advanced healthcare systems, and robust R&D pipelines.

- Post-patent expiration, generic rivastigmine substantially undercuts branded prices.

- Estimated market size in 2023: USD 350 million, with conservative growth projections.

Europe

- Similar to North America, with aggressive generic penetration.

- Market size in 2023: USD 250 million, with slow but steadier growth.

Asia-Pacific

- Rapidly expanding due to aging populations and increasing healthcare access.

- Market size in 2023: USD 150 million, with a CAGR of 10-12%.

Emerging Markets

- Limited patent protections, predominantly driven by generics.

- Potential for growth, contingent on healthcare infrastructure development.

Price Projections (2023-2030)

Pre-Patent Expiry (Pre-2017)

- Brand-name rivastigmine (Exelon): Wholesale prices ranged from USD 2-4 per mg, with retail prices approximately USD 300-400 per month per patient.

Post-Patent Expiry (2017 onwards)

- Generic rivastigmine: Prices declined by 50-70%, with current average wholesale prices around USD 0.50–1.00 per mg.

- Transdermal patches maintain a premium; currently, patches are priced at USD 200-300 for a 30-day supply.

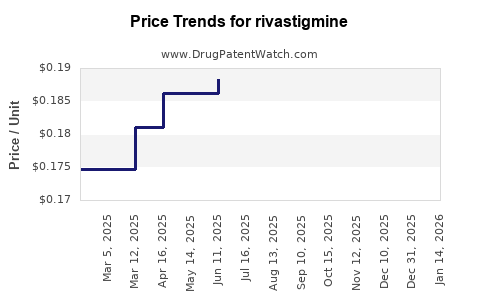

Future Price Trends

- 2023-2025: Continued price erosion in generics, with a projected 10-15% annual decrease in tablet prices.

- 2026-2030: Market saturation and increased manufacturing efficiency expected to further reduce prices, potentially settling around USD 0.20–0.50 per mg for generics.

- Premium formulations: Patches are likely to sustain higher prices due to differentiated delivery, with stabilized pricing around USD 250-350 per month per patient.

Impact of New Formulations & Indications

Innovations such as transdermal patches and combination therapies may retain or elevate rivastigmine's market share despite commoditization of generics. Additionally, investigations into the neuroprotective effects of rivastigmine could introduce new indications, influencing long-term pricing and market penetration.

Regulatory and Market Outlook

Regulatory approvals for generic versions have facilitated increased accessibility, but pricing will remain sensitive to healthcare policies aiming to control costs. Initiatives like value-based pricing and prioritized reimbursement are expected to influence net prices.

Key Market Opportunities

- Emerging markets: Significant growth potential due to unmet needs and increasing healthcare investment.

- Formulation innovation: Sustaining premium pricing through enhanced delivery systems.

- Extended indications: Expansion into other neuropsychiatric conditions could protect market share.

Risks and Uncertainties

- Patent litigation and legal disputes might delay or influence pricing strategies.

- Competition from novel therapeutics, especially disease-modifying agents, could reduce rivastigmine's relative market attractiveness.

- Healthcare policy changes and reimbursement reforms could impact accessibility and pricing.

Conclusion

The rivastigmine market is undergoing a phase of price stabilization, primarily driven by generic competition post-patent expiry. Despite decreasing tablet prices, premium formulations, expanding indications, and growth in emerging markets support a positive long-term outlook. Price projections indicate a continued downward trend in unit costs but with potential for sustained margins through formulation differentiation and market diversification.

Key Takeaways

- Market growth remains robust, fueled by demographic trends and increased diagnosis.

- Post-patent generic erosion will continue to depress prices, particularly in North America and Europe.

- Premium formulations, notably patches, will maintain higher price points and margins.

- Emerging markets represent significant upside due to rising healthcare investments.

- Strategic investments in formulation innovation and clinical trials for new indications** can prolong rivastigmine’s market relevance.

FAQs

1. What factors are most influencing rivastigmine's market price trends?

Patent expiration, generic competition, formulation innovation (patches), and regulatory policies are primary factors impacting prices.

2. How does rivastigmine compare to other cholinesterase inhibitors in pricing?

Generic rivastigmine offers the lowest prices among cholinesterase inhibitors, particularly after patent expiry, with patches maintaining a premium due to convenience and adherence benefits.

3. What are the major regional differences in rivastigmine pricing?

North America and Europe experience more significant price erosion post-generic entry, while emerging markets may have higher prices but greater variability due to regulatory and economic factors.

4. How might future clinical developments influence rivastigmine’s market?

Successful trials in new indications or formulations could sustain or increase demand, possibly supporting higher pricing segments.

5. What strategies can pharma companies employ to maintain profitability in this market?

Focusing on differentiated formulations, forging strategic partnerships, expanding indications, and targeting underserved markets are key strategies.

References

[1] World Health Organization, “Dementia Fact Sheet,” 2022.

[2] MarketsandMarkets, “Neurodegenerative Disease Treatment Market,” 2023.

[3] FDA, “FDA Approves New Formulation of Rivastigmine,” 2019.

[4] IQVIA, “Global Pharmaceutical Pricing Trends,” 2022.

[5] European Medicines Agency, “Market Authorization for Rivastigmine,” 2018.