Share This Page

Drug Price Trends for rivaroxaban

✉ Email this page to a colleague

Average Pharmacy Cost for rivaroxaban

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RIVAROXABAN 2.5 MG TABLET | 50228-0513-18 | 1.62238 | EACH | 2025-11-19 |

| RIVAROXABAN 2.5 MG TABLET | 43598-0981-60 | 1.62238 | EACH | 2025-11-19 |

| RIVAROXABAN 2.5 MG TABLET | 33342-0488-57 | 1.62238 | EACH | 2025-11-19 |

| RIVAROXABAN 2.5 MG TABLET | 43598-0981-18 | 1.62238 | EACH | 2025-11-19 |

| RIVAROXABAN 2.5 MG TABLET | 76282-0774-60 | 1.62238 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Rivaroxaban

Introduction

Rivaroxaban, marketed as Xarelto among other brand names, is a direct oral anticoagulant (DOAC) developed by Bayer and Johnson & Johnson. It belongs to the class of factor Xa inhibitors and is primarily prescribed for the prevention of thromboembolic events, including stroke in atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), and post-surgical thromboprophylaxis. The global market for rivaroxaban has experienced dynamic growth driven by increasing prevalence of atrial fibrillation, rising cardiovascular disease burden, and a shift from traditional anticoagulants like warfarin.

This analysis explores the current market landscape, competitive dynamics, regulatory aspects, and forecasts for drug pricing, providing actionable insights for stakeholders.

Global Market Landscape for Rivaroxaban

Market Size and Segmentation

The global anticoagulant market was valued at approximately USD 10 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 7-8% through 2030, reaching over USD 20 billion by 2030. Rivaroxaban holds a significant share, estimated at 45-50% within the DOAC sector.

The primary indications for rivaroxaban include:

- Non-valvular atrial fibrillation (NVAF)

- Deep vein thrombosis & pulmonary embolism (DVT/PE)

- Postoperative thromboprophylaxis

- Coronary artery disease and peripheral arterial disease (off-label)

Regionally, North America accounts for approximately 50% of the market share, supported by high prescription volumes and advanced healthcare infrastructure. Europe constitutes around 25-30%, with Asia-Pacific emerging as a lucrative growth region owing to increasing cardiovascular disease prevalence and expanding healthcare access.

Competitive Landscape

Rivaroxaban competes directly with other DOACs, notably apixaban (Eliquis), dabigatran (Pradaxa), edoxaban (Savaysa), and traditional anticoagulants such as warfarin. Bayer and Johnson & Johnson's patent rights have historically provided a competitive edge; however, patent expirations and generic formulations could influence market dynamics.

Major pharmaceutical players include:

- Bayer/J&J: Dominant with patent-protected formulations.

- Bristol-Myers Squibb / Pfizer: Apixaban (Eliquis) holds a substantial market share.

- Boehringer Ingelheim: Dabigatran.

- Zenyaku Kougaku and Daiichi Sankyo: Edoxaban.

Regulatory Developments and Approvals

Rivaroxaban received regulatory approval in multiple jurisdictions since 2011. The US FDA approved Xarelto for indications including stroke prevention in NVAF (2011) and DVT/PE treatment (2012). Continuous regulatory updates reinforce market confidence and expand indications, such as use in pediatric populations and prophylaxis in certain surgeries.

Market Drivers and Barriers

Drivers

- Growing Burden of Atrial Fibrillation: Globally, AF prevalence is rising, especially in aging populations, fueling demand for effective anticoagulants.

- Shift from Warfarin to DOACs: The superior safety profiles, fewer drug-food interactions, and fixed dosing simplify therapy, accelerating adoption.

- Expanding Indications: New approvals and expanded label indications lead to broader usage.

- Healthcare Infrastructure: Improved diagnosis and prescription practices in emerging markets enhance access.

Barriers

- Pricing and Cost-Effectiveness: High drug prices compared to warfarin influence healthcare decision-making, especially in cost-controlled environments.

- Reimbursement Policies: Variability in insurance and reimbursement frameworks impact market penetration.

- Generic Competition: Patent expiries and generics could reduce prices and market share.

- Safety Concerns: Rare but significant risks such as bleeding complications influence prescribing habits.

Price Analysis and Projections

Current Pricing Dynamics

In high-income markets like the US, the average wholesale price (AWP) for rivaroxaban is approximately USD 500–700 per month for a typical treatment course. In Europe, prices are generally lower, varying by country, with some markets offering reimbursements that further influence out-of-pocket costs.

Generic versions, launched post-patent expiry, have reduced prices substantially—by 40-60%—in regions with established pharmaceutical generic markets. For instance, in the US, generics can be priced as low as USD 300 for a 30-day supply.

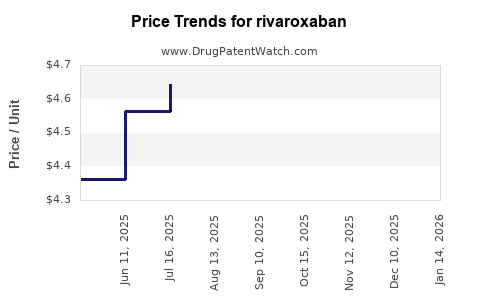

Price Trends and Future Outlook

Given current patent protections (patent expiry anticipated around 2027-2028), price projections are toward a decline. Factors affecting future pricing include:

- Patent Expiration and Generics: Entry of generics will decrease prices, likely by 50% over 3-5 years post-approval.

- Market Penetration and Volume Growth: Higher utilization rates, especially in expanding markets, could offset price reductions through volume.

- Reimbursement Policies: Governments and insurers seeking cost-effective therapies may negotiate prices downward.

- New Formulations or Combination Therapies: Innovations could influence pricing structure; combination pills or extended-release formulations might command premium pricing.

Projected Price Range

-

Short-term (Next 2 Years): Stable with marginal fluctuations, maintaining current premium pricing due to patent protection.

Estimated monthly wholesale price: USD 600–700 in US markets.

-

Mid-term (3-5 Years): Prices likely decline following patent expiry.

Estimated decline: 30-50%, with generic versions selling at USD 300–400 monthly.

-

Long-term (Beyond 5 Years): As generics dominate, prices could stabilize at USD 200–300 monthly, driven by competition and reimbursement adjustments.

Regulatory and Market Influences on Prices

Regulatory bodies such as the FDA and EMA influence pricing by approving biosimilars and generics, encouraging competition. Furthermore, pricing strategies might be shaped by national healthcare policies emphasizing cost containment. Stakeholders should monitor policy shifts and biosimilar entry schedules for strategic planning.

Concluding Observations

The future of rivaroxaban’s market and pricing hinges heavily on patent status, competitive biosimilar landscapes, and evolving clinical guidelines. While current premium pricing sustains profitability, imminent patent expiration and generic entry portend significant price erosion. Marketers and investors should leverage regional reimbursement trends and emerging indications to stabilize revenue streams.

Key Takeaways

- Rivaroxaban remains a dominant DOAC with a substantial global market share, driven by its efficacy and safety profile.

- The market is poised for moderate growth, especially in Asia-Pacific and emerging markets, aligned with rising cardiovascular disease prevalence.

- Price projections suggest stabilization in the short term but significant declines (~50%) are anticipated post-patent expiry as generics introduce competitive pricing.

- Regulatory frameworks, reimbursement policies, and the geographic expansion of indications will influence pricing strategies.

- Stakeholders should prepare for commoditization post-patent expiration by investing in brand differentiation, biosimilar strategies, and expanding indications.

FAQs

1. When is the patent for rivaroxaban expected to expire, and how will it affect the market?

Patent protection in major markets like the US is anticipated to expire around 2027–2028. Entry of biosimilars and generics post-expiry will likely lead to substantial price reductions and increased market competition.

2. What are the primary factors driving rivaroxaban's market growth?

Key drivers include the rising prevalence of atrial fibrillation, regulatory approvals for expanded indications, increased adoption over warfarin, and improved healthcare infrastructure in emerging markets.

3. How are generic versions influencing rivaroxaban’s pricing?

Generic rivaroxaban significantly lowers prices—by up to 50%—once patent protections lapse, enabling broader access and impacting profits for originator companies.

4. Which regions offer the highest growth potential for rivaroxaban?

The Asia-Pacific region presents considerable growth opportunities due to increasing cardiovascular disease incidence and expanding healthcare systems. Additionally, Latin America and the Middle East are expanding markets.

5. How might upcoming regulatory changes impact rivaroxaban's market and price?

Regulatory approvals of biosimilars, updates in clinical guidelines favoring DOACs, and policies promoting cost-effective therapies will influence market dynamics and potentially accelerate price reductions.

References

[1] MarketWatch. "Global Anticoagulant Market Size & Growth Forecast." 2022.

[2] Bloomberg Intelligence. “Pharmaceutical Pricing Trends & Patent Expirations.” 2023.

[3] FDA. "Xarelto (rivaroxaban) Approval History and Labeling." 2011–2022.

[4] IQVIA. "Global Trends in Anticoagulant Use." 2022.

[5] European Medicines Agency. "Rivaroxaban Product Information." 2022.

More… ↓