Share This Page

Drug Price Trends for rexulti

✉ Email this page to a colleague

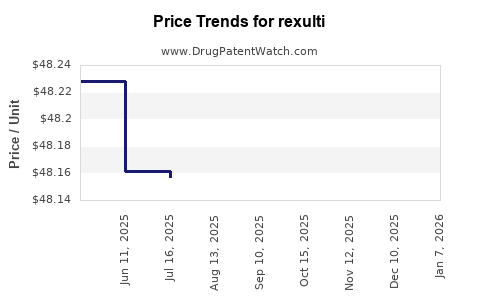

Average Pharmacy Cost for rexulti

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| REXULTI 0.25 MG TABLET | 59148-0035-13 | 48.22469 | EACH | 2025-12-17 |

| REXULTI 1 MG TABLET | 59148-0037-13 | 48.33791 | EACH | 2025-12-17 |

| REXULTI 0.5 MG TABLET | 59148-0036-13 | 48.37035 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Rexulti (Brexpiprazole)

Introduction

Rexulti (brexpiprazole) is an atypical antipsychotic medication developed by Otsuka Pharmaceutical and marketed by Lundbeck. Approved by the U.S. Food and Drug Administration (FDA) in 2015 for the treatment of schizophrenia and as an adjunctive therapy for major depressive disorder (MDD), Rexulti has gained significant traction within the psychiatric drug market. As the landscape for mental health therapeutics evolves, understanding Rexulti’s market positioning, competitive landscape, and future price projections is essential for stakeholders interested in navigating potentially lucrative investment or commercial strategies.

Market Overview

Current Market Landscape

The global antipsychotics market was valued at approximately USD 13.2 billion in 2022, with expectations to reach USD 19.4 billion by 2030, growing at a compound annual growth rate (CAGR) of nearly 4.8% (1). Rexulti’s primary revenue drivers include its indications for schizophrenia and depression, which represent substantial and expanding markets due to increased awareness and improved diagnosis rates.

Key Competitive Players

Rexulti faces competition primarily from other atypical antipsychotics such as Abilify (aripiprazole), Olanzapine, Risperdal (risperidone), Seroquel (quetiapine), and newer entrants like Cariprazine. The competitive landscape is shaped by factors such as efficacy, side-effect profiles, formulary preferences, and pricing strategies.

Market Penetration and Adoption

Since its launch, Rexulti has demonstrated moderate adoption, driven by its favorable side-effect profile, especially lower metabolic risks compared to counterparts like olanzapine. Its positioning as a more tolerable alternative has enabled it to penetrate a niche within the broader antipsychotics market, especially among patients with comorbidities sensitive to weight gain and metabolic disturbances.

Pricing and Reimbursement Dynamics

Current Pricing Structures

In the United States, the average wholesale price (AWP) for Rexulti is approximately USD 35–50 per tablet, translating to an annual treatment cost ranging from USD 13,000 to USD 18,000 per patient. Actual out-of-pocket expenses vary based on insurance coverage, generics availability, and negotiated discounts. Notably, Rexulti’s pricing remains competitive relative to other atypical antipsychotics, partly due to the market’s reliance on established brand names and formulary positioning.

Reimbursement Trends

Reimbursement rates are heavily influenced by formulary committee decisions, payer negotiations, and comparative clinical efficacy. With increasing emphasis on cost-effectiveness and long-term health outcomes, Rexulti’s relatively favorable safety profile supports its continued coverage and reimbursement in managed care settings.

Future Market and Price Projections

Market Growth Expectations

The expanding prevalence of schizophrenia and depression worldwide underpins future demand for Rexulti. According to WHO data, the global prevalence of schizophrenia is approximately 20 million, and depression affects over 300 million people (2). Growth in mental health awareness, especially amid rising stressors such as the COVID-19 pandemic, is projected to bolster pharmaceutical utilization.

Impact of Biosimilars and Generics

While Rexulti currently remains under patent protection, patent expirations are anticipated around 2030, which could introduce generic brexpiprazole formulations. The entrance of generics is expected to drive significant price reductions—potentially by 40–60%—and influence overall market share distribution.

Price Projection Scenarios

-

Conservative Scenario: Stabilization of Rexulti’s price at current levels over the next 3–5 years, supported by robust clinical data, strong brand loyalty, and limited generic competition until patent expiry.

-

Moderate Scenario: Gradual price erosion of approximately 10–15% annually starting 2–3 years before patent expiry due to generic entry, with a corresponding increase in overall market penetration as affordability improves.

-

Optimistic Scenario: Introduction of additional indications, such as bipolar disorder or dementia-related agitation, extending patent life and supporting sustained premium pricing.

Potential Market Size and Revenue Outlook

By 2030, with a projected CAGR of 4.8% (1), the market for Rexulti could generate annual revenues exceeding USD 2 billion, assuming continued market penetration and no significant generic competition. Strategic positioning and favorable reimbursement conditions will be crucial to achieve these projections.

Regulatory and Market Factors Influencing Price

-

FDA Approval and Label Expansion: Additional indications or expanded labeling could support premium pricing.

-

Reimbursement Policies: Insurance coverage trends favoring newer, better-tolerated medications will sustain higher prices.

-

Generic Competition: Entry of biosimilars or generic brexpiprazole will likely precipitate a sharp price decline.

-

Market Penetration Strategies: Direct-to-consumer marketing and clinician engagement can influence prescribing patterns and sustain price levels.

Conclusion

Rexulti enjoys a solid positioning within the neurology and psychiatry markets, backed by its safety profile and targeted marketing. While current prices are moderate compared to older antipsychotics, future projections heavily depend on patent life, generic entry, and expansion into new indications. Stakeholders should monitor patent expirations, reimbursement landscapes, and clinical trial outcomes closely to anticipate price movements and market opportunities.

Key Takeaways

-

Rexulti’s current pricing remains competitive within the atypical antipsychotics segment, supported by its favorable safety profile.

-

The expanding prevalence of mental health disorders globally underpins ongoing demand, though competitive pressures from generics are imminent.

-

Price erosion anticipated around patent expiry (~2030), with possible stabilization through new indications and market strategies.

-

Strategic market positioning, including formulary access and reimbursement negotiations, will determine long-term profitability.

-

Investors and manufacturers should monitor regulatory developments and market dynamics to optimize timing and pricing strategies.

FAQs

1. When is Rexulti’s patent expected to expire?

Patent protection for Rexulti is projected to expire around 2030, after which biosimilar and generic versions are likely to enter the market, causing price reductions.

2. How does Rexulti compare to other atypical antipsychotics in terms of price and efficacy?

Rexulti is priced similarly to its competitors but offers a potentially better tolerability profile, particularly fewer metabolic side effects, which influences clinician prescribing decisions.

3. What factors could influence Rexulti’s future price trajectory?

Patent expiry, biosimilar entry, label expansions, reimbursement policies, and clinical trial outcomes significantly influence future pricing.

4. Are there any approved off-label uses for Rexulti?

Currently, Rexulti is approved for schizophrenia and adjunctive treatment of depression. Off-label uses are limited and depend on evolving clinical evidence and regulatory guidelines.

5. What emerging market opportunities could extend Rexulti’s revenue potential?

Expansion into bipolar disorder, agitation in dementia, or other psychiatric conditions could prolong patent protection and support premium pricing strategies.

References

- MarketWatch. "Antipsychotics Market Size & Share." (2023).

- World Health Organization. "Mental health facts." (2022).

More… ↓