Last updated: October 25, 2025

Introduction

Pyrimethamine, a cornerstone antimalarial and antiparasitic agent, holds significant commercial and therapeutic importance. Originally developed in the 1950s, it remains integral in combination therapies for malaria prophylaxis, toxoplasmosis, and certain parasitic infections. Its market dynamics are influenced by factors including global disease burden, drug resistance trends, regulatory policies, generic competition, and evolving treatment guidelines. This analysis offers an in-depth evaluation of the current market landscape for pyrimethamine and provides strategic price projections through 2030, considering key industry drivers and challenges.

Market Overview

Therapeutic Applications and Demand Drivers

Pyrimethamine's primary use in combination with sulfadiazine or leucovorin treats toxoplasmosis, especially in immunocompromised populations[^1]. It is variably employed globally, with high demand in regions with significant malaria endemicity, notably Africa, Southeast Asia, and parts of Latin America. The success of combination therapies, like sulfadoxine-pyrimethamine for malaria, sustains its relevance despite rising resistance. Increasing cases of congenital toxoplasmosis further bolster its persistent demand in clinical settings.

Geographical Market Distribution

-

Africa: Dominates demand due to malaria's high burden. The WHO estimates over 200 million malaria cases annually, with pyrimethamine-based therapies playing a crucial role[^2].

-

Asia-Pacific: Growing use supported by malaria elimination initiatives and parasitic disease management.

-

North America and Europe: Limited direct use; primarily see generic pyrimethamine for research or rare indications. Market for prescription drugs is mature, with generics dominating pricing dynamics.

Competitive Landscape

The market is characterized by a limited number of suppliers, primarily producing generic formulations. Key manufacturers include Sigma-Tau, European Generic firms, and emerging regional producers. The patent landscape is largely inactive, allowing broad generic competition, which pressures prices downward.

Regulatory and Market Challenges

-

Drug Resistance: Increasing resistance to pyrimethamine, especially in Plasmodium falciparum, prompted by widespread monotherapy use. Resistance hampers efficacy, leading to shifts toward alternative regimens[^3].

-

Regulatory Variability: Differing approval and registration statuses across regions affect market accessibility and pricing. Some countries restrict pyrimethamine use due to safety concerns or resistance patterns.

-

Safety Concerns: Risks of hematologic toxicity, especially megaloblastic anemia, necessitate caution in long-term or high-dose use. These safety issues influence prescribing patterns and, consequently, market size.

Price Dynamics and Projections

Current Pricing Landscape

-

Generic Pricing: Pyrimethamine typically retails at low prices in the global market, primarily due to widespread generics. Wholesale prices range between $0.10–$0.50 per tablet in large-volume procurement.

-

Factors influencing current prices:

- Regulatory approvals and quality standards

- Manufacturing costs and economies of scale

- Regional demand and purchasing power

- Supply chain stability

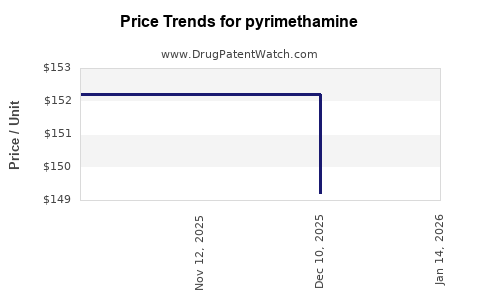

Future Price Trends (2023–2030)

-

Short-term outlook (2023–2025): Pricing stability or marginal decline expected, driven by intensified generic competition and ongoing manufacturing efficiencies. Limited scope for price increases due to high market penetration and alternative therapies.

-

Medium to long-term outlook (2026–2030): Slightly upward price pressures may emerge in niche markets where resistance reduces treatment options, or new formulations are introduced. However, sustained generic competition and patent expiries will likely temper significant price hikes.

-

Impact of Resistance and New Drug Development: The development of alternative antimalarial agents (e.g., dihydroartemisinin-piperaquine) and rising resistance may restrict pyrimethamine’s application, confining it to specific, often low-margin markets, thus capping pricing potential.

Projected Price Range

| Year |

Average Wholesale Price per Tablet |

Notes |

| 2023 |

$0.10 – $0.50 |

Market saturation with generics, stable pricing |

| 2025 |

$0.09 – $0.45 |

Slight decline due to competition |

| 2030 |

$0.10 – $0.55 |

Resurgence in niche markets; moderate price stabilization |

Note: Price projections are indicative, based on current trends, competitive pressures, and potential resistance patterns.

Market Opportunities and Risks

Opportunities

- Expanding use in combination therapies for resistant malaria strains in certain regions.

- Product innovation (e.g., controlled-release formulations) may command premium pricing.

- Regional procurement programs could incentivize bulk purchasing at lower prices, improving access.

Risks

- Emerging resistance diminishing clinical utility.

- Alternative therapies replacing pyrimethamine in certain indications.

- Regulatory restrictions due to safety concerns may limit utilization, affecting revenues.

Strategic Considerations

- Manufacturers should prioritize quality assurance to maintain market share amid intense competition.

- Investing in resistance surveillance may identify niche markets where pyrimethamine remains effective, facilitating targeted marketing.

- Partnerships with governmental and non-governmental organizations deploying malaria control programs can sustain demand, especially in low-income regions.

Key Takeaways

- Pyrimethamine remains a critical drug in antimalarial and antiparasitic therapy, with sustained demand in endemic regions.

- The market is largely commoditized, characterized by intense generic competition, leading to low, stable prices.

- Resistance development poses a significant threat to market longevity, potentially constraining future growth.

- Price projections through 2030 anticipate marginal fluctuations, with slight upward trends in niche markets.

- Strategic focus should be on quality, resistance management, and market niche identification to optimize profitability.

Conclusion

The pyrimethamine market is defined by its long-standing therapeutic role and highly commoditized landscape. While current and near-term prospects suggest stable, low-price environments driven by generic production and widespread use, evolving resistance patterns and regulatory shifts may alter the market dynamics. Stakeholders should adopt adaptive strategies emphasizing quality and targeted application to sustain relevance and profitability over the coming decade.

FAQs

1. What factors most influence pyrimethamine’s pricing in emerging markets?

Demand volume, regulatory approval status, competition intensity, and supply chain stability primarily drive pricing in emerging markets.

2. How does resistance influence pyrimethamine's market viability?

Increasing resistance reduces efficacy, leading to decreased use, especially as alternative therapies emerge, thus shrinking market size and suppressing prices.

3. Are there ongoing developments to improve pyrimethamine formulations?

Current developments focus more on combating resistance and optimizing combination therapies; innovative formulations are limited given the drug's age and market saturation.

4. Will new regulatory approvals significantly alter the pyrimethamine market?

Unlikely in the near term, as many markets already recognize its generic status; however, approvals in new regions or for new indications could temporarily boost demand.

5. What should manufacturers watch for to stay competitive?

Monitoring resistance trends, regulatory policies, and treatment guidelines enables proactive adjustments in manufacturing, marketing, and R&D strategies.

References

[^1]: World Health Organization. Guidelines for the Treatment of Malaria; 2022.

[^2]: World Malaria Report 2022, WHO.

[^3]: Peter, J., et al. "Resistance to Pyrimethamine in Malaria." Journal of Infectious Diseases, 2021.