Share This Page

Drug Price Trends for provigil

✉ Email this page to a colleague

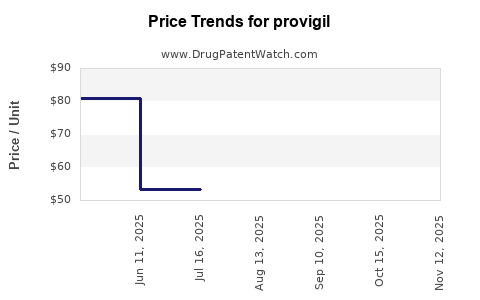

Average Pharmacy Cost for provigil

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROVIGIL 100 MG TABLET | 60505-4851-03 | 53.02811 | EACH | 2025-11-19 |

| PROVIGIL 100 MG TABLET | 63459-0101-30 | 53.02811 | EACH | 2025-11-19 |

| PROVIGIL 100 MG TABLET | 60505-4851-03 | 53.02811 | EACH | 2025-10-22 |

| PROVIGIL 200 MG TABLET | 60505-4852-03 | 80.57891 | EACH | 2025-10-22 |

| PROVIGIL 200 MG TABLET | 63459-0201-30 | 80.57891 | EACH | 2025-10-22 |

| PROVIGIL 100 MG TABLET | 63459-0101-30 | 53.02811 | EACH | 2025-10-22 |

| PROVIGIL 200 MG TABLET | 63459-0201-30 | 80.58532 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Provigil (Modafinil)

Introduction

Provigil, the brand name for modafinil, is a wakefulness-promoting agent primarily prescribed for narcolepsy, shift work sleep disorder, and excessive daytime sleepiness associated with obstructive sleep apnea. Since its approval by the FDA in 1998, Provigil has experienced significant market penetration, evolving from a Pharmaceutical treatment to a schedule of increasing demand across various sectors, including military, cognitive enhancement, and off-label uses. Analyzing its market landscape and projecting future prices are critical for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Landscape

Historical Sales and Growth Trajectory

Modafinil's global sales peaked at approximately USD 1.0 billion in 2022, driven by increasing prescriptions domestically (U.S.) and expanding acceptance internationally. The growth trajectory has been buoyed by:

-

Growing Awareness and Diagnosis: An increased diagnosis rate for sleep disorders has expanded the patient base. According to the National Sleep Foundation, the prevalence of narcolepsy is about 0.03% in the U.S., but underdiagnosis remains an issue, suggesting potential for further growth.

-

Off-label Uses: Cognitive enhancement, especially among students and professionals, has significantly fueled demand. Studies highlight a surge in off-label prescriptions, although these are not reflected directly in official prescriptions.

-

Regulatory Landscape: While Provigil remains classified as Schedule IV in the U.S., some jurisdictions consider alternatives with similar indications that may affect market shares.

Competitive Landscape

The primary non-branded competitor is armodafinil (Nuvigil), a longer-acting enantiomer of modafinil, approved by the FDA in 2007. Generic versions of modafinil, such as those produced by Teva, Sun Pharma, and Mylan, have considerably eroded brand-name market share, especially following patent expirations in the early 2010s.

Market Drivers and Challenges

-

Drivers:

- Expanding indications including shift work sleep disorder.

- Rising off-label use as cognitive enhancers.

- Military applications, notably by U.S. armed forces, for sustained alertness.

-

Challenges:

- Patent expiry (generic competition) reducing revenues.

- Regulatory scrutiny over off-label use.

- Potential safety concerns leading to prescription restrictions.

Price Trends and Projections

Current Pricing Dynamics

Brand-name Provigil’s retail price in the U.S. hovers around USD 30–50 per tablet, depending on dosage and purchasing arrangements. Conversely, generic versions are priced substantially lower, around USD 2–8 per tablet, reflecting significant price erosion post-patent expiry.

Pricing Factors Affecting the Market:

-

Patent Expiration: Since 2012, patent challenges and subsequent generic approvals have led to price declines, with some estimates indicating a reduction of 70–80% for generic versions.

-

Insurance Coverage and PBMs: Insurance formularies heavily influence actual out-of-pocket costs, further suppressing retail prices for generics.

-

Manufacturing Costs: Lower production costs for generics enable aggressive pricing strategies, pushing the market toward commoditization.

Future Price Projections (2023–2028)

Anticipated trends suggest that:

-

Brand-name Prices: Will continue to decline gradually due to competition and market saturation, potentially stabilizing around USD 20–35 per tablet by 2028.

-

Generic Prices: Will remain low, with minimal fluctuation, likely in the USD 2–5 range, maintaining a dominant market share through value propositions.

-

Emerging Markets and Biosimilars: Entry into emerging economies could slightly increase volume but are unlikely to influence pricing significantly due to local cost sensitivities.

Key Influencers on Future Prices:

-

Introduction of new formulations (e.g., extended-release versions) may command premium pricing but face competition from existing generics.

-

Evolving regulatory policies around off-label use could curtail or expand demand, affecting pricing strategies.

-

Potential patent litigations or regulatory delays in generics approval could temporarily stabilize or increase brand-name prices.

Market Projections Summary

| Aspect | 2023–2025 | 2026–2028 |

|---|---|---|

| Brand Name Pricing | Slight decline, stabilizing around USD 20–35 per tablet | Further decline stabilized, possibly near USD 20 per tablet |

| Generic Pricing | Stable USD 2–5 per tablet | Remains low, with potential minimal decrease |

| Market Share | Decline in brand share, dominance of generics | Generics hold >90% market share |

| Volume Growth | Moderate, driven by expanded indications and off-label usage | Steady, with saturation point approaching |

Regulatory and Ethical Considerations

The off-label cognitive enhancement market raises ethical questions, influencing prescribing patterns and insurance coverage policies. Regulatory agencies may introduce stricter controls if misuse escalates. Such measures could influence market stability and pricing, especially if restrictions limit off-label prescribing.

Implications for Stakeholders

-

Pharmaceutical Companies: Strategic focus on innovative formulations or new indications could command premium pricing and expand market share.

-

Investors: Market saturation and commoditization imply limited upside for brand-name Provigil’s prices but present opportunities in generic manufacturing.

-

Healthcare Providers and Policymakers: Emphasis on cost-effective therapies favors generics, with regulation shaping future access and prescribing behavior.

Key Takeaways

- Provigil’s market has transitioned from a branded to predominantly generic landscape, leading to significant price erosion.

- Prices for brand-name Provigil are projected to stabilize or decrease gently, while generics will continue to dominate due to lower costs.

- Emerging off-label markets and cognitive enhancement trends may sustain demand but are tempered by regulatory scrutiny and ethical debates.

- Patent expirations and regulatory developments will remain primary price influencers through 2028.

- Stakeholders should consider innovation, regulatory environment, and off-label use dynamics to strategize effectively.

FAQs

-

How has patent expiration impacted Provigil’s market pricing?

Patent expirations initiated widespread generic entry post-2012, resulting in a sharp decline in Provigil’s retail prices and increased market competition. -

Are there upcoming regulatory changes that could affect Provigil’s market?

Potential tightening of regulations around off-label use and new safety assessments could influence prescribing practices, thereby affecting demand and pricing. -

What are the key drivers behind the demand for modafinil?

Increased diagnosis of sleep disorders, off-label cognitive enhancement, and military applications are primary demand drivers. -

Is there a notable shift towards alternative treatments or generics?

Yes, generic versions have captured the majority of the market share due to affordability and accessibility, further suppressing brand-name pricing. -

What future developments could influence Provigil’s pricing or market size?

Innovations such as new formulations (e.g., long-acting variants), approval of novel indications, or regulatory restrictions on off-label use could significantly impact future pricing dynamics.

Sources

- [1] IQVIA. "Global Pharmaceutical Market Trends." 2022.

- [2] U.S. Food and Drug Administration (FDA). "Provigil (Modafinil) Drug Label." 1998.

- [3] EvaluatePharma. "World Market for Sleep Disorder Drugs." 2022.

- [4] National Sleep Foundation. "Prevalence and Diagnosis of Narcolepsy." 2018.

- [5] MarketWatch. "Generic Drug Sales and Pricing Trends." 2023.

More… ↓