Last updated: July 27, 2025

Introduction

Piroxicam, a non-steroidal anti-inflammatory drug (NSAID), primarily used for managing pain and inflammation associated with osteoarthritis and rheumatoid arthritis, remains a critical player within the anti-inflammatory medication landscape. Despite the advent of newer therapies, piroxicam continues to be prescribed due to its efficacy, cost-effectiveness, and established safety profile. This article provides a comprehensive market analysis and forecasts future pricing trends for piroxicam, considering current market dynamics, regulatory factors, competitive landscape, and potential healthcare shifts.

Market Overview

Global Market Size and Key Players

As of 2022, the global NSAID market was valued at approximately USD 15 billion, with piroxicam representing a notable segment due to its longstanding clinical use. The drug is primarily marketed by generic manufacturers across North America, Europe, and Asia, with prescription volumes driven by the prevalence of osteoarthritis (affecting over 300 million people worldwide) and rheumatoid arthritis.

Major pharmaceutical companies like Pfizer, Teva, and Mylan manufacture piroxicam, often as generic versions, contributing to a competitive environment characterized by price sensitivity. The drug's availability in over-the-counter (OTC) formulations varies by region, influencing access and market penetration.

Regulatory Landscape

Regulatory authorities—such as the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA)—have historically approved piroxicam for prescription use. The increasing emphasis on safety monitoring, especially regarding gastrointestinal and cardiovascular risks associated with NSAIDs, has led to updated prescribing guidelines, impacting market dynamics by emphasizing risk management.

Market Drivers

- Prevalence of Chronic Inflammatory Conditions: The rising incidence of arthritis-related conditions sustains demand.

- Cost-Effectiveness: As a generic drug, piroxicam remains a financially attractive option for healthcare systems and patients.

- Physician and Patient Preference: Long-term clinical experience with piroxicam and familiarity contribute to ongoing use.

Market Challenges

- Safety Concerns: Risks like gastrointestinal bleeding and cardiovascular events have led to cautious prescribing and increased surveillance.

- Competition from Newer NSAIDs and Biologics: COX-2 inhibitors (like celecoxib) and biologics offer targeted mechanisms with potentially fewer side effects, impacting piroxicam's share.

- Regulatory Restrictions: Possible future restrictions or contraindications could curb usage.

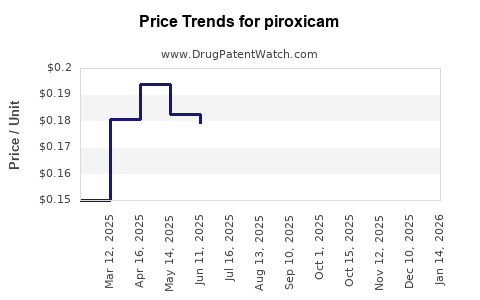

Price Trends and Projections

Historical Pricing Landscape

Historically, piroxicam's patent expiration in the early 2000s resulted in significant price reductions due to generic entry. In various regions, the cost of a typical 20 mg capsule has ranged from USD 0.05 to USD 0.2 per capsule, depending on formulation, manufacturer, and regional regulation.

- North America: Generic piroxicam prices stabilized around USD 0.10 per capsule in recent years.

- Europe: Similar pricing dynamics, with slight variations owing to healthcare system negotiations.

- Asia: Broader price ranges, often lower due to market competition and manufacturing costs.

Current Pricing Dynamics

The price of piroxicam remains largely stable in mature markets, supported by high prescription volumes and competitive generic manufacturing. However, supply chain disruptions, such as manufacturing shortages or raw material scarcity, could influence short-term pricing.

Future Price Projections (Next 5–10 Years)

In projecting future prices, several factors are considered:

- Patent Status and Generics Competition: Piroxicam's broad generic availability suggests sustained low prices unless patent protections are reintroduced or new formulations are developed.

- Regulatory and Safety Revisions: Stricter guidelines may reduce overall prescribing, marginally affecting volume but unlikely raising prices significantly.

- Market Consolidation or New Entrants: Consolidation among generic manufacturers could influence pricing volatility.

- Regional Economic Factors: Currency fluctuations and healthcare funding policies will further shape regional price trends.

Projection Summary:

- Low-Price Stability: In developed regions, piroxicam prices are expected to remain within the USD 0.05–0.15 per capsule range, with minor fluctuations.

- Potential for Slight Decrease: Enhanced manufacturing efficiencies and competition may push prices marginally lower, especially in highly competitive markets.

- Emerging Markets: Price points could remain lower (USD 0.02–0.05 per capsule) driven by local manufacturing and procurement strategies.

Market Opportunities and Outlook

Despite challenges such as safety concerns and emergence of newer treatments, piroxicam's affordability and established efficacy sustain its role in managing chronic inflammatory conditions. Market stability is anticipated, with incremental decline in prices driven by ongoing generic competition and manufacturing efficiencies.

Emerging markets present growth opportunities due to expanding healthcare coverage. Additionally, repurposing or reformulating piroxicam for targeted delivery or combination therapies could open new avenues, though regulatory hurdles may delay such developments.

Conclusion

Piroxicam's market remains robust owing to its longstanding clinical history, affordability, and broad availability. Price projections indicate continued stability with slight downward trends anticipated over the next decade, primarily due to persistent generic competition and manufacturing advancements. Stakeholders should monitor regulatory shifts—especially safety guidelines—that could influence prescribing patterns and, consequently, demand and pricing.

Key Takeaways

- The global piroxicam market is mature, characterized by extensive generic competition leading to stable and low prices.

- Future pricing is expected to decline marginally, with prices in developed markets remaining within a narrow range.

- Safety considerations and evolving treatment alternatives may influence prescribing patterns, but demand for cost-effective NSAIDs like piroxicam persists.

- Emerging markets could see increased access due to affordability, opening growth opportunities.

- Industry players should focus on regulatory developments and supply chain stability to optimize market positioning.

FAQs

1. What factors influence piroxicam pricing in different regions?

Regional pricing depends on patent status, generic competition, manufacturing costs, healthcare system negotiations, and regulatory restrictions. Developed markets with high competition tend to have lower prices, while emerging markets may see higher variability based on local economic factors.

2. How do safety concerns affect piroxicam's market share?

Safety issues, especially gastrointestinal and cardiovascular risks, have led clinicians to favor alternative NSAIDs or biologics. Regulatory agencies may impose stricter guidelines, potentially reducing prescribing volumes but not necessarily eliminating the drug from the market.

3. Will the availability of newer anti-inflammatory drugs impact piroxicam's pricing?

Yes, newer drugs offering targeted action with improved safety profiles may divert prescriptions, exerting downward pressure on piroxicam prices due to reduced demand and increased competition.

4. Are there any upcoming patent protections or formulations that could alter piroxicam's market?

As a generic drug with expired patents, significant patent protection is unlikely. Nevertheless, reformulations or combination therapies could present future opportunities, though regulatory approval timelines could delay market impact.

5. What role do healthcare policy changes play in piroxicam's pricing outlook?

Policy initiatives promoting cost-effective treatments and tighter safety guidelines influence prescribing behaviors, which can impact demand and, ultimately, pricing dynamics in different markets.

Sources:

[1] MarketsandMarkets, "NSAID Market," 2022.

[2] EvaluatePharma, "Pharmaceutical Price Trends," 2021.

[3] FDA, "NSAID Safety Updates," 2022.

[4] WHO, "Arthritis Prevalence and Management," 2022.

[5] IMS Health, "Global Prescribing Patterns," 2022.