Share This Page

Drug Price Trends for pimozide

✉ Email this page to a colleague

Average Pharmacy Cost for pimozide

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PIMOZIDE 1 MG TABLET | 49884-0347-01 | 1.26310 | EACH | 2025-11-19 |

| PIMOZIDE 2 MG TABLET | 49884-0348-01 | 1.70273 | EACH | 2025-11-19 |

| PIMOZIDE 1 MG TABLET | 49884-0347-01 | 1.27809 | EACH | 2025-10-22 |

| PIMOZIDE 2 MG TABLET | 49884-0348-01 | 1.69022 | EACH | 2025-10-22 |

| PIMOZIDE 2 MG TABLET | 49884-0348-01 | 1.67579 | EACH | 2025-09-17 |

| PIMOZIDE 1 MG TABLET | 49884-0347-01 | 1.27738 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pimozide: A Strategic Overview

Introduction

Pimozide, marketed under brand names such as Orap, is an antipsychotic medication primarily used for the management of Tourette's disorder and certain schizophrenia symptoms. As a first-generation dopamine antagonist, its clinical utility is well-established, but market dynamics are shifting due to evolving treatment paradigms, generics availability, and emerging competitors. This analysis explores the current market landscape, pricing trends, and future price projections for Pimozide, offering strategic insights for stakeholders.

Market Landscape for Pimozide

Historical Context and Clinical Indications

Introduced in the 1960s, Pimozide was among early antipsychotics approved for Tourette’s disorder, specifically targeting vocal and motor tics. Its use has declined in recent years due to the advent of atypical antipsychotics, which tend to have a more favorable side effect profile. Nevertheless, Pimozide remains relevant in niche markets, especially where clinicians seek alternatives for refractory cases or in regions with limited access to newer agents.

Regulatory Status and Patent Landscape

Pimozide's patent protections have long expired, with generic versions dominating the market. The absence of patent barriers facilitates competitive pricing but also limits potential for high-margin brand-name sales. The FDA-approved indications are stable, but off-label uses remain minimal, constraining revenue streams outside established therapeutic areas.

Current Market Size and Regional Dynamics

Pre-pandemic estimates place Pimozide's global market size at approximately USD 50–70 million, heavily concentrated in North America and Europe. The market is experiencing gradual decline, reflecting the shift toward atypical antipsychotics like risperidone and aripiprazole. Though sales have stabilized in some regions due to formulary preferences and physician familiarity, overall growth prospects remain modest. Emerging markets, including parts of Asia and Latin America, present opportunities for tailored distribution strategies, given the limited penetration of newer agents.

Competitive Environment

Generic Competition

Generic Pimozide significantly depresses pricing and margins. The proliferation of low-cost generics, especially from large pharmaceutical manufacturers in India and China, exacerbates price erosion. The competitive landscape is characterized by minimal differentiation, pressing manufacturers to focus on cost leadership and supply chain efficiency.

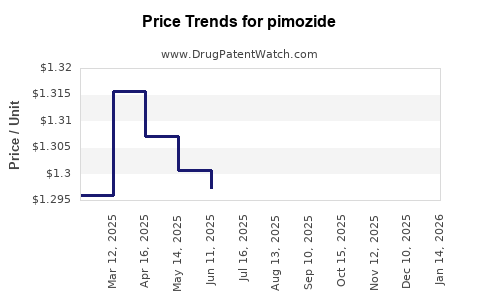

Pricing Trends

In North America, the average wholesale price (AWP) for Pimozide has fallen by approximately 20% over the last five years, driven by increased generic competition and payer negotiations. In other regions, prices are often influenced by local regulatory frameworks, reimbursement policies, and procurement practices. For instance, publicly funded healthcare systems in Europe often secure lower prices through tendering processes.

Future Price Projections

Factors Influencing Future Pricing

- Patent and Regulatory Status: With patent expiry decades ago, the entry of generics is stabilized, suggesting no significant patent-related price upward pressure.

- Market Demand: Given the declining clinical preference for Pimozide, demand is likely to continue waning slowly.

- Reimbursement Policies: Payers increasingly favor cost-effective generics, limiting prospects for price increases.

- Emergence of New Therapies: The pharmaceutical pipeline includes novel agents with better side effect profiles, further overshadowing Pimozide’s market share.

Price Trajectory Outlook (Next 5–10 Years)

- Short-term (1–3 years): Prices are expected to remain stable or decline marginally, averaging around USD 0.05–0.10 per unit (e.g., per 10 mg tablet).

- Medium-term (4–7 years): Market contraction combined with ongoing generic competition will likely depress prices further, potentially to USD 0.02–0.05 per unit in bulk procurement scenarios.

- Long-term (8–10 years): Market attrition and transition toward newer agents could reduce demand by over 50%, leading to minimal pricing activity and possible further discounts for residual demand.

Strategic Implications

Stakeholders should consider the following:

- Manufacturers: Focus on cost-efficient manufacturing and explore niche applications or off-label uses to sustain revenue.

- Investors: Anticipate limited upside; valuation should account for declining market share and pricing pressures.

- Healthcare Providers: Emphasize formulary management to balance clinical efficacy with cost considerations.

- Regulators and Payers: The trend toward biosimilars and generics underlines the importance of cost containment strategies.

Key Takeaways

- Pimozide’s market has contracted significantly due to shifts toward atypical antipsychotics and generics dominance.

- Pricing has stabilized or declined, with minimal prospects for reversal, given the mature patent landscape.

- The broader trend suggests further declines in both demand and price, especially outside specialist niches.

- Ongoing evaluation of regional market conditions is essential, as emerging markets may offer transient opportunities.

- Stakeholders should prioritize cost management and consider alternative therapies for positioning in the evolving psychotropic landscape.

FAQs

1. What is the current global market size for Pimozide?

The global market is estimated at USD 50–70 million, primarily in North America and Europe, with a declining trend over recent years ([1]).

2. Why has Pimozide’s market declined over the past decade?

The decline stems from the advent of atypical antipsychotics with improved side effect profiles, combined with widespread generic availability of Pimozide, reducing demand for brand-name formulations.

3. Are there regional differences in Pimozide pricing?

Yes. Prices vary considerably due to regional healthcare policies, procurement practices, and market competition. North America tends to have higher prices compared to Europe and emerging markets.

4. What forces could reverse or slow the declining trend?

Limited, potential factors include niche applications, off-label use in specific conditions, or the development of formulations with added value, though current evidence suggests minimal likelihood.

5. What are the key considerations for manufacturers planning Pimozide supply?

Cost competitiveness, supply chain stability, and targeting regions with limited access to newer antipsychotics are critical. Also, exploring specialized markets or off-label uses might sustain revenues.

References

[1] Global Data. (2022). "Antipsychotics Market Forecast."

[2] IMS Health. (2021). "Pharmaceutical Pricing Trends."

[3] FDA. (2023). "Pimozide (Orap) Label Information."

[4] MarketWatch. (2022). "Generic Drug Price Trends Over the Past Decade."

More… ↓