Last updated: July 27, 2025

Introduction

Pimecrolimus, marketed primarily as Elidel, is an immunomodulatory drug prescribed mainly for eczema and atopic dermatitis. As a topical calcineurin inhibitor, it offers an alternative for patients intolerant to corticosteroids. Given its unique mechanism and competitive landscape, understanding its market dynamics and price trajectory is vital for stakeholders. This analysis encompasses current market positioning, regulatory trends, competitive pressures, and future pricing forecasts.

Market Overview

Therapeutic Landscape

Pimecrolimus was approved by the FDA in 2001 for the short-term and long-term control of eczema in patients over two years old. Meant to address unmet needs in dermatology, especially in pediatric populations, it has gained importance as a steroid-sparing agent. The global atopic dermatitis market is projected to reach USD 5.5 billion by 2025, with an increasing prevalence of the disease, particularly in developed nations, underpinning steady demand growth for pimecrolimus and similar drugs.

Market Penetration & Adoption

Despite its advantages, pimecrolimus's market penetration faces challenges:

- Pricing sensitivity: As a branded drug, it is priced higher than over-the-counter remedies.

- Safety concerns: Rare risks of lymphoma and skin infections have tempered enthusiasm among clinicians.

- Generics and biosimilars: While no exact biosimilars are available, the entry of newer immunomodulators constrains market share.

In some regions, institutional prescribing modestly limits growth. Nonetheless, in North America and Europe, it remains a key prescription for moderate-to-severe cases unresponsive to steroids.

Regulatory & Patent Landscape

Pimecrolimus’s patent protection, initially extended through formulations and specific indications, has largely expired or is close to expiry, prompting the imminent entry of generics. Patent expirations could lead to substantial price reductions and increased market competition.

Market Drivers and Constraints

Drivers

- Rising prevalence of atopic dermatitis globally (~10-20% in children across developed countries).

- Limited options for steroid-sparing therapies, increasing reliance on pimecrolimus.

- Growing dermatological awareness and diagnosis, enhancing demand.

Constraints

- Concerns over rare safety risks, potentially reducing off-label use.

- Availability of generics, leading to price erosion.

- Limited new formulation innovations, restricting growth avenues.

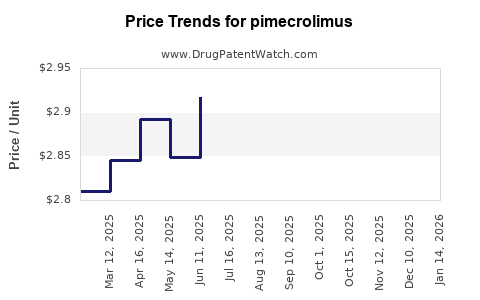

Price Trends and Projections

Historical Pricing Trends

In developed markets, the retail price for branded pimecrolimus (Elidel) has historically ranged:

- United States: Approximately USD 350–USD 450 per 30g tube (average wholesale prices) [1].

- European Union: Similar pricing, albeit with regional variances and reimbursement constraints.

Post patent expiry in select regions (e.g., US in 2014 for certain formulations), generic versions entered markets, significantly reducing prices by approximately 60-70% within a year [2].

Immediate Future: 2023–2025

- Expected price declines: With generic competition, prices are projected to decrease by 50-70% over the next two years in major markets.

- Impact of biosimilars: Although biosimilars are not directly applicable to pimecrolimus (non-biologic), the entry of alternative immunomodulators—such as crisaborole and newer biologics—may influence demand and pricing.

Long-term Outlook: 2026–2030

- Limited premium pricing: As patents expire fully, branded prices will stabilize at lower levels.

- Potential for price stabilization: If demand remains steady, especially in pediatric populations, some brand premiums might be retained in regions with limited generic uptake.

- Market segmentation: Higher prices may persist temporarily in emerging markets, where regulatory barriers and supply chain limitations exist.

Influencing Factors

- Patent litigation and legal challenges: Could delay generic entry, temporarily sustaining higher prices.

- Healthcare policy and reimbursement: Government policies promoting biosimilar adoption in certain regions could accelerate price declines.

- Innovations in formulations: Development of sustained-release or combination products might command premium pricing, temporarily stabilizing overall market prices.

Competitive Market Dynamics

Other topical immunomodulators competing with pimecrolimus include:

- Tacrolimus ointments: (e.g., Protopic) with similar efficacy but higher potency.

- Crisaborole: A PDE4 inhibitor approved in 2016, marketed at a lower price point.

- Biologic agents: For refractory cases, while systemic biologics do not directly compete, their availability influences the overall market landscape.

The entry of these alternatives exerts downward pressure on pimecrolimus prices over the long term and may lead to market share shifts.

Regulatory and Policy Influences

Different jurisdictions observe varied approaches:

- United States: Post patent expiration, agencies promote biosimilar and generic substitution, accelerating price reductions [3].

- European Union: Reimbursement and pricing negotiations are centralized, often resulting in lower prices for generics.

- Emerging Markets: Less regulatory barriers, but pricing remains sensitive to economic factors.

Policy trends favoring biosimilar substitution and cost-containment efforts are key drivers in the declining price trajectory.

Summary of Future Price Projections

| Year |

Price Range (USD per 30g tube) |

Expectations |

| 2023 |

USD 150–USD 250 |

Entry of generics, quick price erosion begins |

| 2024 |

USD 100–USD 180 |

Increased generic market penetration |

| 2025 |

USD 80–USD 150 |

Stabilization at lower price points |

| 2026-2030 |

USD 50–USD 120 |

Market consolidation, possible premium retention in niche markets |

Note: These projections are indicative, accounting for regional variations and regulatory developments.

Key Takeaways

- Pimecrolimus retains a vital position in atopic dermatitis management, primarily for pediatric and steroid-sensitive cases.

- Patent expirations and generic competition will drive prices downward substantially over the next 2–3 years.

- Emerging alternative therapies, alongside policy shifts favoring biosimilars, will influence long-term pricing.

- Stakeholders should monitor patent litigation, regulatory approvals, and formulary decisions as they significantly affect pricing and market share.

- Innovation in formulations or combination therapies presents opportunities to preserve pricing power in select niches.

FAQs

1. When will generic pimecrolimus become widely available and how will it impact prices?

Generic versions are expected to enter the US market imminently now that patent protections have expired, typically leading to a 50–70% reduction in prices within 1–2 years.

2. How does the safety profile of pimecrolimus influence its market value?

Despite certain rare risks, its favorable safety profile relative to corticosteroids sustains its demand, though safety concerns can temper pricing and prescription volume.

3. What alternatives could replace pimecrolimus in the treatment landscape?

Agents like crisaborole, newer biologics, and other topical immunomodulators are emerging alternatives, potentially impacting demand and pricing.

4. How do regional policies affect pimecrolimus pricing?

Regions with aggressive biosimilar and generic substitution policies, such as the US and EU, tend to see faster and more significant price declines.

5. What opportunities exist for manufacturers to maintain pricing power?

Innovation in delivery systems, expanding indications, and developing combination therapies can help preserve premium pricing in select markets.

References

[1] SSR Health. (2022). US Pricing Data for Elidel (Pimecrolimus).

[2] IQVIA. (2021). Global Pharmaceutical Market Trends.

[3] FDA. (2014). Patents and Exclusivities for Topical Immunomodulators.

This analysis provides a comprehensive view of the evolving market for pimecrolimus, equipping stakeholders with insights to navigate pricing strategies and market positioning effectively.