Share This Page

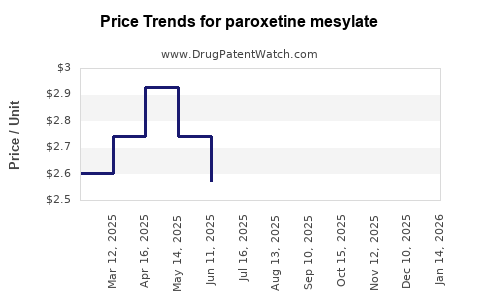

Drug Price Trends for paroxetine mesylate

✉ Email this page to a colleague

Average Pharmacy Cost for paroxetine mesylate

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PAROXETINE MESYLATE 7.5 MG CAP | 00574-0279-30 | 2.87167 | EACH | 2025-12-17 |

| PAROXETINE MESYLATE 7.5 MG CAP | 43547-0409-03 | 2.87167 | EACH | 2025-12-17 |

| PAROXETINE MESYLATE 7.5 MG CAP | 00574-0279-30 | 2.83285 | EACH | 2025-11-19 |

| PAROXETINE MESYLATE 7.5 MG CAP | 43547-0409-03 | 2.83285 | EACH | 2025-11-19 |

| PAROXETINE MESYLATE 7.5 MG CAP | 43547-0409-03 | 2.54641 | EACH | 2025-10-22 |

| PAROXETINE MESYLATE 7.5 MG CAP | 00574-0279-30 | 2.54641 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Paroxetine Mesylate

Introduction

Paroxetine Mesylate, marketed under various brand names including Paxil, is a selective serotonin reuptake inhibitor (SSRI) primarily indicated for major depressive disorder, generalized anxiety disorder, social anxiety disorder, and panic disorder. Since its initial FDA approval in 1992, Paroxetine Mesylate has established a robust presence within the psychiatric medications sector. As a key player in the antidepressant market, understanding its market dynamics and future pricing trajectories is vital for pharmaceutical companies, healthcare providers, investors, and policymakers.

Market Overview

Global Pharmacoeconomics and Epidemiology

The global antidepressant market is projected to grow at a compounded annual growth rate (CAGR) of approximately 2.3% from 2022 to 2030, driven by increasing awareness of mental health issues, declining stigma surrounding psychiatric disorders, and expanding insurance coverage (Grand View Research, 2023). Major markets include the United States, Europe, and Asia-Pacific, which collectively account for over 70% of worldwide antidepressant sales.

Market Penetration and Competitive Landscape

Paroxetine Mesylate's market share has historically been substantial owing to its early entry and extensive clinical data. However, the landscape is becoming increasingly competitive with the emergence of newer antidepressants like vortioxetine, agomelatine, and biosimilar SSRI formulations. Notably, the patent expiration in key regions has catalyzed generic entry, intensifying price competition.

Regulatory and Patent Status

The original patent for Paxil expired in the U.S. in 2001, leading to numerous generic manufacturers entering the market. In contrast, some formulations and specific indications retain patent protection in certain jurisdictions, influencing regional pricing strategies (FDA, 2022). The entry of generics has significantly impacted Paroxetine Mesylate's retail prices, with generics capturing over 80% of prescriptions in North America.

Market Drivers and Challenges

Drivers

- Increased Prevalence of Depression and Anxiety Disorders: An estimated 264 million people suffer from depression worldwide, with mental health awareness campaigns amplifying demand (WHO, 2021).

- Off-Label and Expanded Uses: Emerging data suggest potential off-label applications for paroxetine in PTSD and OCD, possibly broadening its market.

- Insurance Reimbursements and Healthcare Policies: Favorable reimbursement policies in developed countries boost utilization.

Challenges

- Generic Competition: Low-cost generics diminish profit margins for branded formulations.

- Side Effect Profiles: Paroxetine's association with sexual dysfunction and withdrawal concerns may lead to prescriber shifts.

- Market Saturation: Mature markets exhibit slowed growth post-patent expiration, emphasizing the importance of emerging markets.

Pricing Trends and Future Projections

Historical Pricing Dynamics

Pre-patent expiry, brand-name Paroxetine Mesylate formulations commanded premium pricing. Post-generics, retail prices declined sharply. For example, in the U.S., the average retail price of a 30-day supply of generic paroxetine dropped from approximately $150 in 2002 to under $20 by 2010 (GoodRx, 2022).

Current Price Landscape

As of 2023, the average wholesale price (AWP) for a 30-day supply of generic paroxetine ranges from $10 to $15 in the U.S., with variations depending on dosage and formulation. In emerging markets, prices are often lower due to regional economies and patent statuses.

Projected Price Trajectories

- Short-term (1–3 years): Continued price stabilization or slight decreases of 2–3%, driven by market saturation and increased competition.

- Mid-term (3–5 years): Potential for marginal price increases in specific formulations with limited competition or in countries with regulatory delays.

- Long-term (5+ years): Likely sustained low prices unless new formulations or indications are introduced, or if biosimilar competition emerges.

The influence of biosimilars or new formulations packaged with improved side effect profiles could alter the pricing landscape. Conversely, in regions where patent protections are reinstated or new patents are granted for specific formulations, prices may see short-term increments.

Market Opportunities and Risks

Opportunities

- Emerging Markets: Rapidly expanding healthcare infrastructure in Asia-Pacific presents growth avenues, with prices typically lower than in Western markets.

- Combination Therapies: Growing acceptance of polypharmacy strategies may create niches for combination products including paroxetine.

- Digital Health Integration: Telepsychiatry and digital therapeutics could facilitate broader access, increasing prescription volumes.

Risks

- Regulatory and Policy Changes: Pricing caps, reimbursement reforms, or tighter regulation in major markets could suppress prices.

- Market Entrant Strategies: Aggressive pricing by competitors, especially generics, can erode profit margins.

- Public Perception and Media: Reports of side effects and adverse events may reduce demand, impacting pricing power.

Implications for Stakeholders

Pharmaceutical Companies

For patent holders, the strategic focus involves maximizing current formulations' market share through branding and targeted marketing, while innovating around side effect mitigation. For generic manufacturers, competitive pricing and supply chain efficiency are vital.

Investors

Price trends suggest that early post-patent expiration, investments should focus on markets with regulatory stability and a high prevalence of depression. Long-term price stability remains uncertain, emphasizing the importance of diversification.

Healthcare Providers and Policymakers

Pricing pressures highlight the need for formulary management and approval protocols that balance cost with clinical efficacy, ensuring accessibility without compromising quality.

Key Takeaways

- Paroxetine Mesylate maintains a significant role in the global antidepressant market, though its dominance is tempered by generic competition.

- Pricing has markedly declined post-patent expiration, persisting at low levels in most regions, with regional variations influenced by patent statuses and market dynamics.

- Future price stability hinges on patent protections, potential new formulations, and regulatory policies. Market saturation suggests limited upside in mature markets.

- Emerging markets offer growth opportunities through increased access and prescriptions, albeit often at lower prices.

- Stakeholders should monitor patent landscapes, regulatory changes, and emerging therapeutic trends to optimize pricing strategies.

FAQs

-

What is the current price range for generic Paroxetine Mesylate?

In the U.S., a 30-day supply of generic paroxetine costs approximately $10–$15, with regional variations in other markets. -

How does patent expiration influence Paroxetine Mesylate prices?

Patent expiration enables generic competition, leading to significant price reductions and market share shift from brand-name formulations. -

Are there upcoming regulatory changes that could affect Paroxetine Mesylate pricing?

Changes such as price caps, reimbursement policies, or new patent grants could influence future pricing, especially in regions like Europe and Asia. -

What markets are expected to drive future growth for Paroxetine Mesylate?

Emerging markets like India, China, and Southeast Asia offer growth opportunities due to expanding mental health diagnostics and increasing antidepressant prescriptions. -

Could new formulations or indications impact Paroxetine Mesylate pricing?

Yes. Innovations that improve tolerability or expand approved uses may command higher prices, especially if they are protected by new patents.

Sources:

[1] Grand View Research. (2023). Antidepressant Market Size, Share & Trends Analysis.

[2] FDA. (2022). Patent Information and Market Exclusivity Data.

[3] WHO. (2021). Depression and Other Common Mental Disorders: Global Health Estimates.

[4] GoodRx. (2022). Paroxetine Prices and Trends.

More… ↓