Share This Page

Drug Price Trends for orlistat

✉ Email this page to a colleague

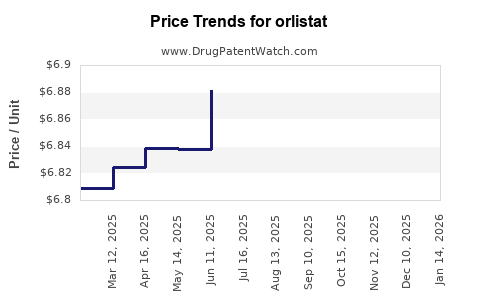

Average Pharmacy Cost for orlistat

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ORLISTAT 120 MG CAPSULE | 61269-0565-90 | 6.93003 | EACH | 2025-11-19 |

| ORLISTAT 120 MG CAPSULE | 61269-0565-90 | 6.92091 | EACH | 2025-10-22 |

| ORLISTAT 120 MG CAPSULE | 61269-0565-90 | 6.92778 | EACH | 2025-09-17 |

| ORLISTAT 120 MG CAPSULE | 61269-0565-90 | 6.94294 | EACH | 2025-08-20 |

| ORLISTAT 120 MG CAPSULE | 61269-0565-90 | 6.91708 | EACH | 2025-07-23 |

| ORLISTAT 120 MG CAPSULE | 61269-0565-90 | 6.88161 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ORLISTAT

Introduction

Orlistat, a lipase inhibitor marketed under brand names such as Xenical and Alli, is a prescription and OTC weight loss medication licensed for weight management in obese and overweight patients. Since its approval by regulatory agencies like the FDA in 1999, Orlistat has carved a significant niche in the global obesity treatment landscape. This report offers a comprehensive market analysis and price projection, vital for stakeholders including pharmaceutical companies, investors, and healthcare providers aiming to navigate or capitalize on the Orlistat market.

Market Overview

Global Market Size and Growth Trends

The global obesity drug market, estimated at USD 4.4 billion in 2022, is projected to grow at a CAGR of approximately 7% through 2030 [1]. Orlistat remains one of the most established pharmacological interventions, with sales driven by obesity prevalence, increasing awareness, and expanding approval for OTC availability in multiple markets.

The rising prevalence of obesity—estimated to affect over 600 million adults worldwide—and associated comorbidities (diabetes, cardiovascular diseases) amplify demand for weight management solutions [2]. The Asia-Pacific region, characterized by rapid urbanization and lifestyle changes, demonstrates lucrative growth potential for Orlistat, with projected market share gains.

Key Market Drivers

- Increasing Obesity Prevalence: The global obesity epidemic primarily propels demand.

- Regulatory Approvals: Expansion of OTC indications and flexible dosing regimes make Orlistat more accessible.

- Lifestyle Management Trends: Growing focus on health-conscious lifestyles supports OTC and prescription markets.

- Healthcare Spending: Rising healthcare budgets foster demand for cost-effective obesity therapies.

Competitive Landscape

Major players include GlaxoSmithKline (GSK), which markets Alli, and Roche, which launched Xenical. Generic manufacturers have increased market penetration, leading to pricing competition. The entry of OTC versions has significantly impacted sales, especially in developed markets.

Innovations such as combination therapies and formulations aiming for better tolerability could reshape competitive dynamics moving forward.

Market Segmentation and Geographical Insights

By Application

- Overweight and Obese Adults

- Pediatric Obesity (less common for Orlistat)

- Adjunct in weight management for comorbid conditions (e.g., type 2 diabetes)

By Distribution Channel

- Prescription-based sales dominate in developed markets.

- Over-the-counter (OTC) sales are expanding, especially in North America and Europe.

- Online pharmacies contribute to increased accessibility.

Geographical Breakdown

- North America: Largest market share (~45%), driven by high obesity prevalence and mature OTC channels.

- Europe: Significant growth; supportive regulations bolster sales.

- Asia-Pacific: Fastest growth rate (~9-10% CAGR), reflecting rising obesity rates and expanding healthcare infrastructure.

- Latin America and Middle East: Moderate growth, with increasing awareness and regulation reforms.

Price Trends and Projections

Historical Pricing Dynamics

Standard prescription Xenical (120 mg) in the US historically ranged between USD 2.50 and USD 5 per capsule, while OTC Alli averaged USD 0.60 to USD 1 per capsule [3]. Generics entered the market post-patent expiry in 2009, leading to a sharp decline in branded prices; currently, generic Orlistat is priced approximately 30-50% lower than branded options.

In Europe, similar trends exist, with OTC prices ranging from EUR 15 to EUR 30 for a month’s supply, depending on the country and pharmacy pricing policies.

Current Price Range (2023)

- Prescription Orlistat: USD 150–USD 250 per month (single patient dose)

- OTC Alli: USD 20–USD 40 for a 30-day supply

- Generics: Approximately 40–60% cheaper than branded formulations in both prescription and OTC formats

Price Projection (2024–2030)

With continued market expansion, increased generic penetration, and potential formulation innovations, prices are expected to:

- Decline modestly by 2–4% annually in mature markets due to competitive pressures

- Remain stable or slightly increase in markets facing regulatory barriers or limited generic supply

- Experience regional variations aligned with economic conditions and healthcare policies

Specifically, the OTC Alli and generics could see prices fall to USD 10–USD 15 per month by 2030 in developed markets, driven by increased competition and patent expirations.

Regulatory Influences on Pricing

Regulatory decisions significantly influence market dynamics and pricing:

- OTC Approval Expansion: Where regulators approve OTC status (e.g., FDA, EMA), prices tend to decline owing to greater accessibility and competition.

- Reimbursement Policies: In markets with insurance reimbursement, prescription Orlistat may retain higher prices, supported by coverage.

- Patent and Patent Challenges: Patent expiry incentivizes generics, reducing prices.

Future Market and Price Outlook

The outlook indicates:

- Continued growth driven by emerging markets

- Price erosion due to generic competition and increased OTC sales

- Potential for premiumization through combination therapies or novel delivery formulations

- Regulatory shifts impacting market access and pricing strategies

In terms of price, a steady decline is anticipated, with branded prescription prices decreasing by approximately 5% annually in mature markets, and OTC and generic prices stabilizing or marginally decreasing due to saturated competition.

Concluding Remarks

Orlistat remains a pivotal weight-loss pharmaceutical with a resilient global footprint. The evolving landscape of OTC availability and the proliferation of generics will further shape pricing strategies. Stakeholders must monitor regional regulatory changes, competitive offerings, and consumer preferences to optimize pricing and market share.

Key Takeaways

- The global Orlistat market is projected to grow at a CAGR of approximately 7% through 2030, driven primarily by rising obesity rates.

- Pricing is declining, especially with increased generic and OTC availability; by 2030, prices may fall by up to 50% in some markets.

- Geographic variability influences pricing dynamics, with North America leading and Asia-Pacific presenting high-growth prospects.

- Regulatory decisions, patent statuses, and reimbursement policies are critical determinants of future market prices.

- Innovation in formulations and combination therapies could create premium segments, offsetting downward price pressures.

FAQs

1. How does patent expiry affect Orlistat pricing?

Patent expiry enables generic manufacturers to enter the market, increasing competition and significantly reducing prices—by approximately 40-60% in many cases—depending on regulatory and market conditions.

2. Are OTC Orlistat products as effective as prescription versions?

Yes, OTC formulations like Alli contain the same active ingredient (Ezetimibe 60 mg or orlistat 120 mg) and have comparable efficacy when combined with diet and lifestyle modifications.

3. What regions offer the highest growth potential for Orlistat?

Asia-Pacific presents the fastest growth due to increasing obesity prevalence, expanding healthcare infrastructure, and regulatory liberalization.

4. Will innovative formulations impact Orlistat’s market share?

Yes, new formulations with improved tolerability or delivery mechanisms could attract consumers and sustain or extend market relevance.

5. How do regulatory changes influence pricing strategies?

Regulations expanding OTC access or granting reimbursement status can either suppress or sustain prices, depending on the market. Conversely, tighter regulations may restrict access and impact revenue.

Sources:

[1]: Market Research Future, "Obesity Drugs Market," 2022.

[2]: World Health Organization, "Obesity and Overweight," 2022.

[3]: GoodRx, "Orlistat Prices," 2023.

More… ↓