Share This Page

Drug Price Trends for nextstellis

✉ Email this page to a colleague

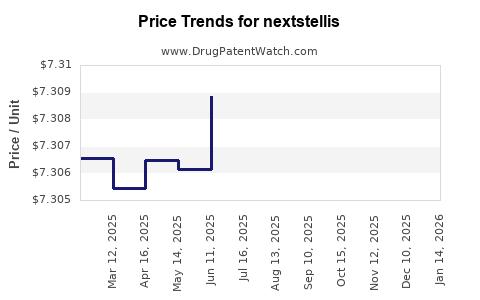

Average Pharmacy Cost for nextstellis

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEXTSTELLIS 3-14.2 MG TABLET | 51862-0258-01 | 7.29641 | EACH | 2025-12-17 |

| NEXTSTELLIS 3-14.2 MG TABLET | 51862-0258-01 | 7.29890 | EACH | 2025-11-19 |

| NEXTSTELLIS 3-14.2 MG TABLET | 51862-0258-01 | 7.29960 | EACH | 2025-10-22 |

| NEXTSTELLIS 3-14.2 MG TABLET | 51862-0258-01 | 7.30589 | EACH | 2025-09-17 |

| NEXTSTELLIS 3-14.2 MG TABLET | 51862-0258-01 | 7.30686 | EACH | 2025-08-20 |

| NEXTSTELLIS 3-14.2 MG TABLET | 51862-0258-01 | 7.30890 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Nextstellis

Introduction

Nextstellis (drospirenone and estetrol) emerges as a novel oral contraceptive combining a well-known progestin, drospirenone, with estetrol, a novel estrogen derived from fetal liver tissue. Approved by the FDA in August 2021, Nextstellis is positioned within the growing global contraceptive market, projected to reach USD 23.87 billion by 2028, growing at a CAGR of approximately 6.4% from 2021 to 2028 [1]. This analysis evaluates the market landscape and forecasts the pricing trajectory for Nextstellis, considering key factors shaping its commercial prospects.

Market Overview

Global Contraceptive Market Dynamics

The contraceptive market has historically been driven by increasing awareness of reproductive health, rising contraceptive use, and technological advances. North America remains the largest regional market, supplemented by expansion in Europe, Asia-Pacific, and emerging markets like Latin America and Africa. The surge in demand for non-invasive, hormone-based contraceptives supports continued growth.

Key players include Bayer (Yaz, Yasmin), Teva, Allergan, and Pfizer. The introduction of innovative drugs such as Nextstellis could capture market share through improved safety profiles, reduced side effects, and improved compliance.

Positioning of Nextstellis

Nextstellis leverages estetrol’s purported minimal thrombotic risk, addressing concerns associated with drospirenone-containing contraceptives. Its unique composition and favorable safety profile position it as a preferred option for women seeking hormonal contraception with potentially fewer adverse effects.

Moreover, the drug’s positioning as a “next-generation” contraceptive aligns with consumer preferences for safer, more natural hormone alternatives. The clinical trial data indicating high efficacy, safety, and tolerability will underpin continued adoption.

Market Penetration and Adoption Drivers

Key Factors Influencing Market Share

- Clinical Efficacy and Safety: Demonstrated reduced thrombotic risk with estetrol-based formulations will foster physician and patient trust.

- Regulatory Approvals: Expansion into additional territories (Europe, Asia) hinges on regulatory processes, impacting launch timelines.

- Brand Recognition and Marketing: Bayer’s established presence in contraceptives offers an advantageous platform for marketing Nextstellis.

- Pricing Strategy: Competitive positioning against existing oral contraceptives influences prescribing patterns.

- Insurance Coverage: Reimbursement policies significantly impact accessibility and sales in developed markets.

Competitive Landscape

Nextstellis faces competition from established combined oral contraceptives (COCs) and emerging options such as non-hormonal devices and implants. In the hormonal segment, Bayer’s Yasmin and Drospirenone-based pills are prominent competitors. However, the safety profile of Nextstellis provides a differentiating factor.

Price Analysis and Projection

Current Pricing Context

In the US, the average retail price for oral contraceptives ranges from USD 20 to USD 50 per month, with variations based on formulation and insurance coverage [2]. Typically, generic brands are priced lower, providing significant competition, especially in cost-sensitive markets.

Bayer initially launched Nextstellis at a premium relative to generics, citing its novel formulation and improved safety profile. Estimated retail pricing for Nextstellis in the US is approximately USD 45–55 per cycle (monthly pack), reflecting a slight premium over traditional generics but aligned with branded contraceptives.

Pricing Strategies and Market Entry

- Premium Pricing: Capitalizes on clinical differentiation and safety benefits, aiming for higher margins in early adoption stages.

- Penetration Pricing: A lower introductory price could accelerate uptake, especially in markets with aggressive competition.

- Reimbursement Negotiation: Partnering with insurers to secure favorable formulary placement diminishes out-of-pocket costs and broadens access.

Future Price Projections

- Short-term (1–2 years post-launch): Expect retention of premium pricing around USD 45–55 per cycle in developed markets, driven by early clinician adoption and safety perceptions.

- Medium-term (3–5 years): Anticipate gradual price reduction to USD 35–45 per cycle as generics enter and market competition intensifies. Economies of scale and increased market penetration will support price adjustments.

- Long-term (beyond 5 years): Potential for further decline to USD 25–35 per cycle, consistent with generic contraceptive pricing, especially in emerging markets, provided patent exclusivity expires or biosimilar competition arises.

Market Entry Considerations and Regional Dynamics

North America

High adoption rates, insurance coverage, and physician familiarity favor premium pricing initially. Bayer’s strong distribution network supports rapid market penetration. Price reductions will likely follow competitive pressures within 3–4 years.

Europe

Regulatory approval processes may extend timelines; however, the European market’s receptiveness to innovative contraceptives with improved safety profiles presents opportunities. Pricing strategies will align with national reimbursement policies.

Asia-Pacific

Emerging markets present significant growth potential due to expanding contraceptive needs. Price sensitivity is higher, prompting Bayer to consider localized pricing models and tiered formulations to increase access.

Regulatory and Market Risks

- Regulatory Delays: Approval challenges in global markets may slow revenue realization.

- Market Adoption: Clinician skepticism or preference for established brands can hinder rapid adoption.

- Pricing Pressures: Increasing competition and generic entry threaten sustained premium pricing.

- Patent and Exclusivity: Patent life influences pricing strategy; generic competition expected after 8–10 years.

Key Takeaways

- Nextstellis holds a differentiated position within the contraceptive market, emphasizing safety due to estetrol’s reduced thrombotic risk.

- Initial pricing will likely reflect a premium over existing generics, targeting early adopters and healthcare providers seeking safer options.

- Over the medium to long term, pricing is projected to decline to align with broader market trends, especially as generics enter and competition intensifies.

- Market expansion hinges on regulatory approvals, clinician acceptance, and reimbursement strategies, with significant upside in emerging markets.

- Continuous monitoring of competitive dynamics and regulatory landscapes is essential for accurate long-term pricing forecasts.

FAQs

1. When did Nextstellis receive FDA approval?

Nextstellis was approved by the U.S. Food and Drug Administration in August 2021, marking its entry into the U.S. contraceptive market [1].

2. How does Nextstellis differ from traditional oral contraceptives?

It combines drospirenone with estetrol, a novel estrogen derived from fetal liver tissue, which offers a potentially lower risk of thrombotic events compared to conventional estrogens used in contraceptives [1].

3. What is the expected market size for Nextstellis in the coming years?

While specific sales projections are proprietary, the global contraceptive market is expected to reach nearly USD 24 billion by 2028, with innovative products like Nextstellis capturing increasing market share due to safety benefits [1].

4. What factors influence the pricing trajectory of Nextstellis?

Factors include clinical efficacy, safety profile, regulatory approvals, competitor pricing, reimbursement policies, and market penetration strategies.

5. How might emerging competition impact Nextstellis’s pricing?

Introduction of generics and biosimilars could lead to significant price erosion over 4–6 years, prompting Bayer to adapt pricing and marketing strategies accordingly.

References

- MarketWatch. (2022). Global Contraceptive Market Forecast to 2028.

- GoodRx. (2022). Average Cost of Oral Contraceptives.

More… ↓