Last updated: July 28, 2025

Introduction

Naproxen, a nonsteroidal anti-inflammatory drug (NSAID), remains a cornerstone in managing musculoskeletal pain, arthritis, and other inflammatory conditions. Its global market size continues to expand, driven by aging populations, increased prevalence of chronic inflammatory disorders, and ongoing healthcare reforms. A comprehensive analysis of current market dynamics and projecting future pricing trends is crucial for pharmaceutical stakeholders, healthcare providers, and investors aiming to optimize portfolio strategies and forecast profitability.

Market Overview

Global Market Size and Growth Trajectory

The global naproxen market was valued at approximately USD 900 million in 2022, with projections indicating a compound annual growth rate (CAGR) of approximately 5-6% through 2028 ([1]). This growth stems from rising incidences of rheumatoid arthritis, osteoarthritis, and various musculoskeletal ailments, particularly in aging demographics across North America, Europe, and Asia-Pacific regions.

Key Market Drivers

- Aging Population: The demographic shift toward older populations increases the prevalence of joint and inflammatory disorders, expanding demand.

- Chronic Disease Burden: Rising incidence of chronic inflammatory conditions elevates the need for long-term NSAID therapy.

- Generics Penetration: As patent exclusivity diminishes, the surge in generic versions of naproxen has made the drug more accessible, further scaling market volume ([2]).

- Overall Healthcare Spending: Growing healthcare expenditure facilitates broader drug accessibility and distribution.

Market Segmentation

-

Product Type:

- Branded formulations (e.g., Aleve, Naprosyn)

- Generic formulations

-

Indication:

- Rheumatoid arthritis

- Osteoarthritis

- Gout

- Tendinitis and bursitis

- Other inflammatory pain conditions

-

Distribution Channel:

- Hospitals

- Retail pharmacies

- Online pharmacies

Regional Market Dynamics

North America remains dominant, accounting for over 45% of revenue, driven by high healthcare spending, well-established OTC markets, and widespread awareness. Europe follows, with robust prescription and OTC sales. The Asia-Pacific region exhibits rapid growth, fueled by expanding healthcare infrastructure and rising disease prevalence ([3]).

Competitive Landscape

The marketplace comprises multiple generic manufacturers alongside branded players:

- Branded Manufacturers: Johnson & Johnson (Aleve), Roche, and Takeda have historically offered patented formulations with premium pricing.

- Generic Manufacturers: Companies like Teva, Mylan, and Sun Pharma dominate volume sales, offering cost-effective alternatives.

Innovations include developing formulations with improved bioavailability, reduced gastrointestinal side effects, and extended-release options to differentiate offerings and capture niche markets.

Price Analysis

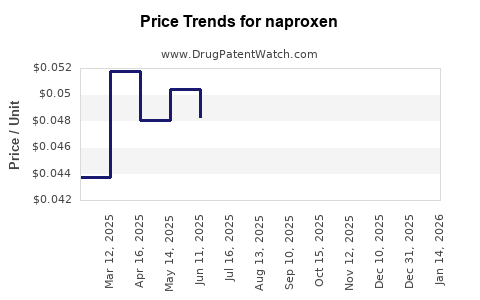

Current Pricing Trends

Over-the-counter (OTC) naproxen formulations, such as Aleve, retail at approximately USD 10–USD 15 for a bottle of 50-100 tablets, translating to USD 0.10–USD 0.30 per tablet. Prescription formulations generally command higher prices due to dosing and formulation differences.

Generic naproxen (250 mg–500 mg) prices vary significantly by region but tend to be priced between USD 0.02–USD 0.08 per tablet in bulk purchases, reflecting high market competition and price erosion.

Factors Affecting Pricing

- Generic Competition: The proliferation of generic options exerts downward pressure on prices.

- Regulatory Environment: Stringent quality and safety regulations can impact manufacturing costs, influencing retail prices.

- Supply Chain Dynamics: Raw material costs, manufacturing capacity, and distribution logistics contribute to regional price variations.

- Market Consolidation and Pricing Strategies: Larger pharmaceutical companies often leverage economies of scale to offer competitive pricing, influencing overall market prices.

Future Price Projections

Short-term Outlook (1–3 Years)

- Pricing Stabilization: Given market saturation and high generic competition, prices are expected to stabilize or decline marginally in mature markets.

- OTC Segment: OTC formulations may see slight price reductions due to increased availability and market penetration.

- Prescription Segment: Slight price fluctuations dependent on regional healthcare policies and reimbursement structures.

Long-term Outlook (4–8 Years)

- Innovative Formulations: Introduction of drugs with improved safety or administration features could command premium prices, temporarily elevating market prices.

- Regulatory Pressures: Stricter safety regulations may increase manufacturing costs, potentially resulting in modest price increases.

- Market Maturity: Saturation in developed markets could limit price growth, with emerging markets offering growth opportunities due to increasing demand.

Impact of Biosimilars and New NSAIDs

While biosimilars are not directly pertinent to naproxen, the development of newer NSAIDs with better safety profiles could influence its market share and pricing, particularly if they offer significant therapeutic benefits.

Regulatory and Economic Considerations

- Patent Expiry and Generic Entry: The expiration of key patents has facilitated generic entry, intensifying price competition.

- Healthcare Policies: Policies advocating for cost-effective, generic-driven care tend to depress prices further.

- Global Economic Conditions: Currency fluctuations and raw material costs impact manufacturing and retail prices.

Conclusion

Naproxen’s market remains resilient, driven by aging demographics and chronic disease prevalence. Price trends forecast moderate declines in mature markets due to high generic competition yet potential stabilization thanks to formulation innovations and regulatory impacts. Stakeholders must monitor regional policy changes, emerging competitors, and technological innovations impacting future valuation and strategic positioning.

Key Takeaways

- The global naproxen market is projected to grow at a CAGR of approximately 5-6% through 2028, driven by demographic and epidemiological trends.

- Generic competition has significantly lowered prices, especially in mature markets, with OTC formulations averaging USD 0.10–USD 0.30 per tablet.

- Innovative formulations with improved safety or convenience could enable premium pricing, influencing future market dynamics.

- The region-specific regulatory landscape and healthcare policies will play a pivotal role in shaping pricing trajectories.

- Emerging markets represent promising growth corridors, potentially supporting higher price points due to increasing healthcare access.

FAQs

1. How does patent expiration influence naproxen pricing?

Patent expiry allows generic manufacturers to enter the market, significantly increasing supply and driving down prices due to increased competition.

2. Are there upcoming formulations of naproxen that could impact its market?

Yes, sustained-release formulations and combinations with gastroprotective agents are under development, offering potential for premium pricing and expanded indications.

3. How does OTC availability affect naproxen pricing?

OTC formulations typically have lower retail prices due to competition and consumer demand for affordable pain relief options.

4. What regional factors most significantly influence naproxen prices?

Healthcare policies, regulatory standards, and local manufacturing capacities are primary regional determinants affecting pricing and availability.

5. What future trends could disrupt the naproxen market?

Development of safer, more effective NSAIDs, biosimilars in related drug classes, and shifts toward alternative therapies could alter market dynamics and pricing strategies.

References

[1] Market Watch. "Global NSAID Market Size & Share Analysis," 2022.

[2] Pharmaceutical Technology. "Generic NSAID Market Trends," 2022.

[3] Grand View Research. "NSAID Market Analysis and Forecast," 2023.