Last updated: July 28, 2025

Introduction

Nabumetone, a non-steroidal anti-inflammatory drug (NSAID), is widely prescribed for managing osteoarthritis, rheumatoid arthritis, and other inflammatory conditions. Despite its long-standing presence in the pharmaceutical landscape, recent shifts in healthcare paradigms, patent status, competitive dynamics, and regulatory policies influence its market trajectory. This analysis evaluates current market conditions, competitive landscape, pricing trends, and future price projections for nabumetone. It aims to provide decision-makers with actionable insights into this therapeutic agent’s commercial potential and pricing strategies.

Pharmaceutical Overview of Nabumetone

Nabumetone was developed by Bristol-Myers Squibb and introduced into the market in the early 1980s. It functions as a prodrug converted in the liver to 6-methoxy-2-naphthalenecarboxylic acid, which selectively inhibits cyclooxygenase-2 (COX-2). Its preferential COX-2 inhibition theoretically offers reduced gastrointestinal side effects compared to traditional NSAIDs, making it a preferred option for long-term management of chronic inflammatory diseases.

Despite this advantage, nabumetone’s market share has declined owing to the emergence of newer NSAIDs and selective COX-2 inhibitors like celecoxib. Additionally, patent expirations have opened avenues for generic manufacturers, influencing pricing and market competition.

Market Dynamics

1. Market Size and Demand

Globally, the NSAID market was valued at approximately USD 18 billion in 2022, with a compound annual growth rate (CAGR) of about 4% projected through 2027 [1]. Nabumetone holds a niche but stable segment within this market, primarily in regions where physicians prefer its gastrointestinal safety profile.

In established markets such as North America and Europe, the demand for nabumetone remains steady, driven by its longstanding reputation, generic availability, and prescribing habits. Emerging markets display growing demand for NSAIDs, but nabumetone’s share is currently limited compared to other agents like ibuprofen and naproxen.

2. Competitive Landscape

The competitive landscape has shifted significantly over the past decade:

-

Generic Entrants: Post-patent expiration, generic nabumetone has flooded the market, reducing prices significantly. Price erosion among generics continues, especially in price-sensitive regions.

-

Alternative NSAIDs: The proliferation of selective COX-2 inhibitors, such as celecoxib, and other non-selective NSAIDs (e.g., diclofenac, ibuprofen), has decreased nabumetone's market share, as physicians opt for newer agents with different efficacy or safety profiles.

-

Emerging Therapies: Biologic agents for inflammatory conditions, especially rheumatoid arthritis, are diminishing reliance on traditional NSAIDs like nabumetone, further constraining its growth.

3. Regulatory and Reimbursement Factors

Regulatory agencies like the FDA and EMA facilitate generic drug approvals, leading to widespread availability and price competition. Reimbursement policies also influence prescribing practices, often favoring cost-effective generic options, hence compressing margins for manufacturers of branded nabumetone.

In certain regions, reimbursement for nabumetone is bundled within broader formulary policies, limiting price flexibility and influencing overall market pricing.

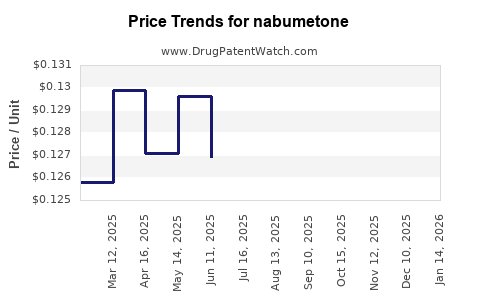

Pricing Trends and Projections

1. Historical Pricing Data

Historical pricing for nabumetone shows a downward trend:

-

Brand-name nabumetone: Original brand prices ranged between USD 10-15 per month supply in the early 2000s.

-

Generics: Price erosion accelerated post-patent expiry (early 2000s), with current generic options priced around USD 2-5 per month supply in the US and comparable costs globally.

In Europe and Asia, pricing varies based on local market dynamics but generally mirrors the US trend toward substantial discounts for generics.

2. Current Market Pricing

As of 2023, the retail price for generic nabumetone varies:

-

United States: Approximately USD 3-5 per month supply retail, with wholesale acquisition costs (WAC) lower; some pharmacies sell below USD 2 per month supply.

-

Europe and Asia: Similar discounts are observed, with prices ranging broadly depending on healthcare reimbursement systems.

3. Future Price Projections

Given current market trends, further decline in unit prices is anticipated:

-

Short-term (1-2 years): Prices for generic nabumetone are expected to stabilize at around USD 2-4 per month supply in developed markets, considering ongoing price competition. No significant brand-name resurgence is projected unless new formulations or indications emerge.

-

Medium-term (3-5 years): Continued market saturation among generics will likely compress prices by an additional 10-20%. Price declines may plateau as competition stabilizes.

-

Long-term (5+ years): Factors like patent cliffs, market consolidation, and new therapeutic options could further depress prices, with estimations suggesting USD 1-3 per month supply in highly competitive regions.

These projections assume no significant regulatory changes or novel therapeutic breakthroughs restoring interest in nabumetone.

Key Factors Influencing Future Pricing

- Patent Status and Generic Competition: Expired patents facilitate commoditization, leading to price declines.

- Market Penetration and Prescribing Trends: Shifts toward selective NSAIDs or biologics could diminish demand, impacting prices.

- Regulatory Cost Structures: Market approval processes and reimbursement policies influence pricing strategies.

- Manufacturing Costs: Economies of scale in generic manufacturing can sustain minimal margins at low prices.

Market Opportunities and Challenges

Opportunities:

- Emerging Markets: Growing short-term demand due to rising prevalence of osteoarthritis and rheumatoid arthritis.

- Formulation Innovations: Developing sustained-release or combination formulations to differentiate product offerings.

- Strategic Partnerships: Collaborations with regional manufacturers can expand access and optimize pricing.

Challenges:

- Price Erosion: The relentless downward pressure on prices limits profitability.

- Market Saturation: High generic penetration restricts revenue growth.

- Competitive Alternatives: Availability of newer and more targeted therapies diminishes relevance.

Conclusion

Nabumetone, as a long-established NSAID, faces a challenging market environment characterized by intense generic competition, evolving prescribing patterns, and regulatory pressures. Pricing remains under downward pressure, with projections indicating stabilization or further decline within the near to medium term. Stakeholders should consider regional market specifics and emerging therapeutic trends when devising pricing and marketing strategies.

Key Takeaways

- Market Stability: Nabumetone maintains a niche role, primarily in regions favoring its gastrointestinal safety profile, but faces declining market shares.

- Price Dynamics: Generic availability has precipitated significant price erosion; prices for nabumetone are expected to remain low in the foreseeable future.

- Competitive Pressure: Alternative NSAIDs and biologics are constraining growth; strategic positioning is vital.

- Regional Variability: Pricing and demand fluctuate significantly based on regional healthcare policies and reimbursement frameworks.

- Innovation Necessity: To sustain profitability, consideration of innovative formulations or targeted indications may be necessary.

FAQs

1. What is the current global market size for nabumetone?

The global NSAID market was valued at approximately USD 18 billion in 2022, with nabumetone occupying a small niche primarily in established markets. The specific market share for nabumetone is limited due to competition but remains relatively stable in select regions.

2. How does patent expiration affect nabumetone prices?

Patent expiration has facilitated the entry of multiple generics, leading to significant price reductions. This commoditization has driven prices downward, with current generic nabumetone retail prices around USD 2-5 per month supply.

3. Are there opportunities to increase nabumetone’s market share?

Opportunities are limited but include targeting emerging markets, developing new formulations, or leveraging clinical data to highlight safety profiles. However, competition from newer NSAIDs and biologics remains a significant barrier.

4. What factors could influence nabumetone’s future pricing?

Factors include patent status, regulatory changes, market penetration, development of new formulations, and shifts in prescribing behaviors toward alternative therapies.

5. Is nabumetone likely to regain market prominence?

Unlikely in the near term unless a novel indication, formulation, or combination therapy offers a significant clinical advantage, or unless regulatory or patent changes create new market opportunities.

Sources:

[1] Grand View Research. Non-steroidal Anti-inflammatory Drugs Market Size, Share & Trends Analysis Report. 2022.