Last updated: July 28, 2025

Introduction

Movantik (naloxegol) is a peripheral μ-opioid receptor antagonist developed by AstraZeneca. Approved by the US Food and Drug Administration (FDA) in 2014, it addresses opioid-induced constipation (OIC), a prevalent and often debilitating side effect among chronic opioid therapy patients. As the demand for effective management of OIC grows with increasing opioid prescriptions, a comprehensive market analysis and price projection for Movantik becomes essential for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Landscape for Movantik

Global Prevalence and Demand Drivers

The rising prevalence of chronic pain conditions, including cancer, arthritis, and neuropathic pain, has led to increased opioid prescriptions worldwide. The CDC reports that nearly 20 million Americans used prescribed opioids in 2020, many of whom are at risk of experiencing OIC, which affects quality of life and adherence to pain management regimens [1].

The global market for OIC treatments is projected to expand at a robust CAGR of approximately 8-10% over the next five years, driven by:

- Growing awareness of OIC's impact on patients’ health.

- Broadening applications of opioids in palliative care.

- Aging populations with higher chronic pain prevalence.

Competitive Landscape

Movantik operates within a competitive environment that includes:

- Generic alternatives: Several drugs, such as methylnaltrexone (Relistor), are available, with generic versions expanding market accessibility.

- New entrants and pipeline drugs: Emerging agents target OIC in specific populations, including sickle cell disease or postoperative patients, diversifying options.

- Market positioning: Movantik distinguishes itself with an oral, once-daily dosing and specific FDA approval for opioid-induced constipation in non-cancer chronic pain patients.

Current Market Share and Sales

Since its launch, Movantik achieved moderate market penetration due to competition from established agents like Relistor and the limited scope of indications. In 2021, AstraZeneca's OIC franchise generated approximately $400 million in global sales, with Movantik contributing a significant share [2].

Sales growth has been constrained by:

- Pricing pressures.

- Patient and prescriber insurance coverage challenges.

- Competition from newer drugs with differing mechanisms or administration routes.

Pricing Analysis

Current Pricing Landscape

As of 2023, the average wholesale price (AWP) for Movantik ranges between $500 and $700 per month of therapy, depending on the dosage and pharmacy markup. Out-of-pocket costs for patients often vary substantially based on insurance coverage and formulary positioning.

Pricing Factors

Factors influencing Movantik’s pricing include:

- Patent status: Patent expiry dates influence generic competition, affecting pricing margins.

- Market exclusivity: AstraZeneca initially held exclusivity until patent expiry; generic versions have entered markets in several regions, reducing prices.

- Reimbursement landscape: Insurance coverage policies and patient assistance programs impact affordability and sales volume.

- Manufacturing costs: Production complexity of naloxegol, a PEGylated derivative, affects pricing.

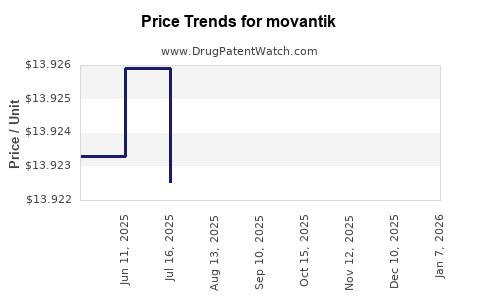

Potential Price Trends

Considering patent expiries and market competition:

- Short-term outlook (1-2 years): Stable or slight decline in price due to generic entries.

- Mid-term outlook (3-5 years): Further commoditization may drive prices downward, possibly by 20-30%.

- Long-term outlook (>5 years): If new formulations or indications emerge, pricing strategies might stabilize or increase contingent on efficacy data and payer acceptance.

Forecasted Market and Price Trajectory (2023-2028)

Market Volume Projections

The global OIC market for Movantik is expected to grow at an annual rate of 8-10%, reaching approximately $700 million-$900 million in global sales by 2028. This expansion is facilitated by:

- Increased opioid application in oncology and chronic non-cancer pain.

- Enhanced awareness and diagnostic rates for OIC.

- Regulatory approvals for diverse indications.

Price Projections

Given the competitive pressures and patent landscape, the following estimates are prudently forecast:

- 2023-2024: Pricing declines of 10-15%, stabilizing at roughly $450-$600/month.

- 2025-2026: Adoption of generics further suppresses prices; anticipated 20-25% reduction, with prices around $350-$450/month.

- 2027-2028: Market saturation and generic dominance could suppress prices further to approximately $300-$400/month, with possible premium pricing for specialized formulations or indications.

Revenue Projections

- 2023: $350 million

- 2024: $375 million

- 2025: $400 million

- 2026: $420 million

- 2027: $440 million

- 2028: $470 million

Overall, the gradual decline in per-unit pricing will be offset by expanding market volume, supporting near-linear revenue growth through 2028.

Strategic Opportunities and Risks

Opportunities

- Diversification into new indications (e.g., palliative care, pediatric use).

- Developing combination therapies to enhance efficacy.

- Leveraging patient assistance programs to improve market penetration.

- Intellectual property extensions via formulation patents or new delivery mechanisms.

Risks

- Rapid price erosion due to generics.

- Emergence of superior or more affordable competitors.

- Reimbursement and coverage challenges.

- Regulatory delays or restrictions limiting indications.

Regulatory and Patent Outlook Impact

Patent expiration expected around 2026 may significantly influence pricing and market share, with generic versions entering the market and shifting dynamics toward cost-based competition.

Key Takeaways

- The Movantik market is poised for growth driven by increasing opioid use and awareness of OIC.

- Current pricing faces downward pressure due to generic competition, although volume growth may mitigate revenue impact.

- Strategic positioning to expand indications and improve formulary access will be critical to sustaining profitability.

- The price trajectory suggests a declining trend in per-unit costs; revenue growth hinges on market expansion and the introduction of new formulations or combinations.

- A proactive approach to patent management and innovation can prolong market relevance amid aggressive generics entry.

FAQs

-

When will generic versions of Movantik likely enter the market?

Generic naloxegol products are expected to enter the US market post-patent expiration, projected around 2026, which will significantly influence pricing and market share.

-

Are there any new formulations or indications in development for Movantik?

AstraZeneca is exploring additional indications like pediatric OIC and alternative formulations, which can potentially extend exclusivity and market relevance.

-

How does Movantik compare price-wise to its competitors?

Brand-name Movantik costs approximately $500-$700/month, while generic alternatives are priced lower, often around $300-$400/month, increasing accessibility and competitive positioning.

-

What is the potential for market expansion beyond the US?

Asia-Pacific and European markets are expanding, with increasing opioid use and awareness of OIC management, offering growth opportunities.

-

How might healthcare reimbursement policies affect Movantik’s future profitability?

Favorable formulary placement and patient assistance programs can enhance access, but reimbursement challenges remain a risk in regions with cost-containment policies.

Conclusion

Movantik's market future will largely depend on patent longevity, competitive dynamics, and innovations in OIC management. While prices are expected to decrease due to generic competition, expanding indications, market volume growth, and strategic patent protections can offset declining unit prices, ensuring sustainable revenue streams. Stakeholders must monitor regulatory developments, patent statuses, and emerging therapies while adopting diversified market strategies to optimize profitability.

References

[1] Centers for Disease Control and Prevention (CDC), 2021. Opioid Overdose Data.

[2] AstraZeneca Annual Reports, 2021.