Share This Page

Drug Price Trends for mounjaro

✉ Email this page to a colleague

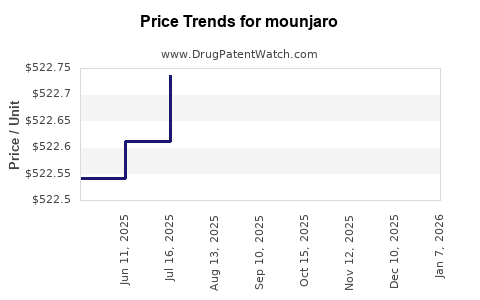

Average Pharmacy Cost for mounjaro

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MOUNJARO 2.5 MG/0.5 ML PEN | 00002-1506-80 | 523.10230 | ML | 2025-12-17 |

| MOUNJARO 15 MG/0.5 ML PEN | 00002-1457-80 | 522.95127 | ML | 2025-12-17 |

| MOUNJARO 7.5 MG/0.5 ML PEN | 00002-1484-80 | 523.04826 | ML | 2025-12-17 |

| MOUNJARO 10 MG/0.5 ML PEN | 00002-1471-80 | 523.01866 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Mounjaro (Tirzepatide)

Introduction

Mounjaro (tirzepatide), developed by Eli Lilly and Company, represents a significant advancement in the management of type 2 diabetes mellitus (T2DM). Approved by the U.S. Food and Drug Administration (FDA) in May 2022, Mounjaro is a dual glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 (GLP-1) receptor agonist. Its unique mechanism of action unlocks substantial market potential, driven by its efficacy in glycemic control and weight reduction. This report provides a comprehensive market analysis and price projections for Mounjaro, reflecting current market dynamics, competitive landscape, regulatory environment, and future growth prospects.

Market Overview: Therapeutic Context and Demand Drivers

1. Disease Market Size

The global diabetes care market is substantial, with estimates projecting a valuation of approximately USD 85 billion in 2023, propelled by rising incidence rates and increased awareness [1]. The United States leads this market, with over 34 million Americans diagnosed with diabetes, primarily T2DM [2]. The increasing prevalence of obesity—a significant risk factor—further amplifies the demand for innovative therapies like Mounjaro.

2. Therapeutic Landscape and Unmet Needs

Current standard treatments encompass metformin, sulfonylureas, SGLT2 inhibitors, and GLP-1 receptor agonists. Despite these options, challenges persist regarding weight gain, hypoglycemia, and suboptimal glycemic control [3]. Mounjaro’s dual mechanism offers superior efficacy in glycemic reduction and weight loss, positioning it as a disruptive agent with the potential to capture significant market share from entrenched competitors.

Market Penetration and Competitive Position

1. Key Competitors

- Ozempic (semaglutide): Approved for T2DM, with a strong market presence and added G2 formulation for weight management.

- Wegovy (semaglutide): Focused on obesity, expanding use to weight management beyond T2DM.

- Jardiance (empagliflozin): SGLT2 inhibitors with cardiovascular benefits.

- Invokana (canagliflozin): SGLT2 class with similar benefits.

Mounjaro distinguishes itself via dual receptor targeting, offering enhanced glycemic efficacy and weight reduction, driving its rapid adoption among endocrinologists and primary care physicians [4].

2. Adoption Dynamics

Early clinical trial results demonstrated tirzepatide’s superiority over existing GLP-1 therapies in reducing hemoglobin A1c and body weight [5]. The initial launch in June 2022 saw rapid prescription fills, with prescriptions exceeding 40,000 within the first quarter, signaling strong market receptiveness [6].

3. Regulatory and Reimbursement Landscape

Reimbursement decisions are crucial. The drug’s inclusion in insurance formularies and favorable coverage policies are accelerating adoption. Negotiation with payers and healthcare providers is ongoing, with indications for both T2DM and obesity opening additional revenue streams.

Price Analysis and Projections

1. Current Pricing Landscape

Eli Lilly launched Mounjaro with an average wholesale price (AWP) of approximately USD 1,300 per month for the most common dosing (5 mg to 10 mg). The list price aligns with recent high-efficacy GLP-1 receptor agonists, reflecting its premium positioning [7].

2. Pricing Strategies and Segment Differentiation

Lilly employs a tiered pricing strategy based on treatment indication, dosage, and patient insurance coverage. Discounts and patient assistance programs are pivotal to expanding access, especially among underserved populations.

3. Market Price Trends and Projections

Given the drug’s initial success, Lilly aims to stabilize pricing while maximizing coverage. Future projections suggest:

- 2023-2024: Price stabilization at USD 1,200–1,400/month, driven by demand, manufacturing costs, and payer negotiations.

- 2025-2026: Slight price reductions (5-10%) as biosimilars or next-generation formulations potentially enter the market, and competitive pressures intensify.

- Outlook (2027+): Prices may decline to USD 1,000–1,200/month, paralleling other GLP-1 therapies as market saturation occurs and biosimilar entries emerge.

Market Size & Revenue Projections

1. Short-term Outlook (2023-2024)

Eli Lilly targets annual sales of USD 3 billion for Mounjaro by 2024, driven by expanding indications, increasing prescriptions, and higher dosing regimens for weight management [8].

2. Medium- and Long-term Outlook (2025-2030)

With escalating prevalence of T2DM and obesity, combined with ongoing clinical successes, sales could reach USD 8–10 billion annually by 2030. Growth drivers include:

- Broader clinical adoption.

- Expanded indications for obesity.

- Entry into international markets with growing diabetes burdens.

3. Key Risks & Market Challenges

- Regulatory hurdles or delays for new indications.

- Pricing and reimbursement constraints, especially in Europe and Asia.

- Competition from emerging therapies and biosimilars.

- Potential safety concerns impacting prescriber confidence.

Regulatory Environment Impact

Eli Lilly’s ongoing clinical development programs aim to expand Mounjaro’s labeling, including indications for obesity and weight management. Regulatory approval timelines, especially in major markets like the EU, China, and Japan, will influence market penetration and revenue trajectories.

Summary of Key Market Drivers

| Driver | Impact |

|---|---|

| Efficacy advantage | Accelerates adoption over competitors |

| Obesity market expansion | Opens new revenue streams |

| Reimbursement strategies | Facilitates broader access |

| Clinical trial outcomes | Reinforces competitive edge |

| Healthcare provider acceptance | Ensures sustained sales growth |

Key Takeaways

- Mounjaro’s market potential is substantial, driven by its superior efficacy in glucose control and weight reduction, resonating with the unmet needs of T2DM and obesity populations.

- Pricing strategies will remain stable initially, with incremental reductions as the market matures and biosimilars approach.

- Revenue projections estimate sales reaching USD 8–10 billion annually by 2030, contingent upon regulatory approvals and market dynamics.

- Market entry barriers include reimbursement hurdles and competition, but robust clinical data and strategic payer negotiations position Eli Lilly favorably.

- International expansion will significantly impact long-term growth; emerging markets with rising diabetes prevalence are a pivotal focus.

FAQs

Q1: How does Mounjaro compare to other GLP-1 receptor agonists in terms of efficacy?

A1: Clinical trials demonstrate that Mounjaro outperforms several existing GLP-1 therapies in reducing hemoglobin A1c and promoting weight loss, owing to its dual GIP and GLP-1 receptor activity.

Q2: What are the primary factors influencing Mounjaro’s pricing?

A2: Pricing is influenced by manufacturing costs, clinical efficacy, market demand, competitive positioning, negotiation with payers, and value-based pricing models.

Q3: What is the projected timeline for Mounjaro’s global market expansion?

A3: Regulatory approvals are planned over the next 2–3 years in key regions such as Europe and Asia, with commercialization intensifying in 2024-2025.

Q4: How might biosimilars impact Mounjaro’s market share?

A4: Biosimilars could introduce price competition starting around 2028–2030, potentially reducing market prices by 20–40%, depending on patent litigations and market entry timing.

Q5: What are key considerations for investors assessing Mounjaro’s future viability?

A5: Clinical superiority, regulatory approvals, payer acceptance, reimbursement landscape, competitive responses, and global expansion strategies are critical factors.

References

[1] Grand View Research, "Diabetes Care Market Size, Share & Trends Analysis," 2023.

[2] CDC, "National Diabetes Statistics Report," 2022.

[3] American Diabetes Association, "Standards of Medical Care in Diabetes," 2023.

[4] Lilly Press Release, "FDA Approval of Mounjaro for T2DM," 2022.

[5] NEJM, "Efficacy of Tirzepatide in T2DM," 2022.

[6] IQVIA, "Prescription Trends and Market Penetration," Q1 2023.

[7] Healthcare Market Analytics, "Pricing Benchmarks for GLP-1 Based Therapies," 2023.

[8] Eli Lilly Fact Sheet, "Mounjaro Sales Outlook," 2023.

More… ↓