Last updated: July 28, 2025

Introduction

Miconazole, an imidazole antifungal agent, is widely used in topical, oral, and vaginal formulations to treat fungal infections such as dermatophytes, candidiasis, and tinea. With rising global fungal infection prevalence and expanding application spectrum, miconazole remains a crucial player in the antifungal market. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and provides price trend forecasts up to 2030.

Market Overview

Global Market Size and Growth Dynamics

The global antifungal market was valued at approximately USD 13.4 billion in 2022, with topical formulations like miconazole accounting for a significant share (about 45%) due to high prevalence of superficial fungal infections and OTC availability (1). The compounded annual growth rate (CAGR) for the antifungal segment is projected at 4.5% from 2023 to 2030, driven by increasing fungal infections, aging populations, and rising immunocompromised patient populations.

Key Market Drivers

- Growing Prevalence of Fungal Infections: An estimated 20-25% of the population worldwide suffer from superficial fungal infections, fostering sustained demand for antifungal agents like miconazole (2).

- Expansion of Indications: Usage beyond topical applications into oral and vaginal formulations widens market prospects.

- OTC Accessibility: Miconazole's OTC status in many regions enhances consumer access, boosting sales volume.

- Increasing Awareness and Diagnoses: Improved healthcare access and diagnostic techniques contribute to increased prescription rates.

Regional Market Breakdown

- North America: Dominates the market (~35%) due to high healthcare expenditure, awareness, and OTC availability. The U.S. prevalence of fungal infections is estimated at 35 million annually (3).

- Europe: Accounts for about 25%, with increased demand driven by aging demographics.

- Asia-Pacific: Exhibits the fastest growth (~6.2% CAGR), influenced by rising fungal infection rates, urbanization, and expanding healthcare infrastructure.

- Latin America and Middle East & Africa: Gradually gaining significance due to increased healthcare access and over-the-counter sales.

Market Competition and Key Players

Major manufacturers include:

- Bayer AG: Offers Canesten, a well-established miconazole-based topical cream.

- GSK: Provides miconazole products including gels and vaginal creams.

- Pfizer: Markets topical agents and combinations.

- Others: Local generic manufacturers and regional brands dominate OTC markets, especially in emerging economies.

Patent landscape is largely generic-friendly; thus, market entry is accessible for regional players, fostering price competition.

Pricing Dynamics and Factors Influencing Price Trends

Current Pricing Benchmarks

- Topical Creams: Average retail prices range from USD 5-15 per tube (15g-30g), with generics priced lower.

- Vaginal Suppositories: USD 10-20 per packet.

- Oral Formulations: Less common but available at approximately USD 20-40 per course.

Pricing varies considerably by region, dictated by regulatory policies, manufacturing costs, and competitive dynamics.

Factors Affecting Price Trends

- Market Saturation: High generic penetration exerts downward pressure on prices.

- Regulatory Environment: Stringent approval processes can temporarily elevate prices due to R&D recovery costs, but broad approvals foster competition.

- Supply Chain Dynamics: Raw material costs, especially for active pharmaceutical ingredients (APIs), impact manufacturing expenses.

- Evolving Formulations: Development of combination drugs or novel delivery mechanisms may elevate unit prices temporarily but could eventually drive market consolidation.

- Patent Expirations: Blanket expiration of key patents facilitates entry of generics, significantly lowering prices over time.

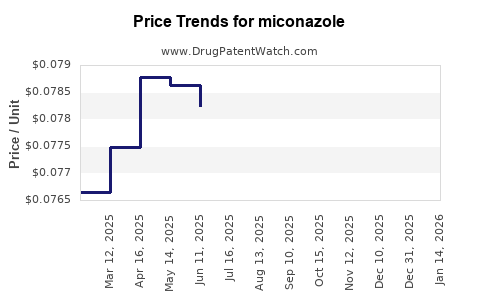

Projected Price Trends (2023-2030)

- Short-term (2023-2025): Slight price declines expected (~2-5%) due to increased generic competition, especially in mature markets.

- Mid-term (2026-2028): Stabilization with potential minor increases (~1-3%) attributed to inflation, raw material costs, and regulatory updates.

- Long-term (2029-2030): Prices may decrease further (~4-8%) as generics dominate, but niche formulations exclusive to branded entities could maintain premium pricing.

Regulatory and Patent Landscape

Patent protections for proprietary formulations or delivery systems have largely expired in most jurisdictions, encouraging broad generic competition. Regulatory agencies such as the FDA, EMA, and regional authorities facilitate rapid approvals for generics, intensifying market competitiveness. Quality standards and bioequivalence requirements influence market entry strategy but generally favor price reduction trends.

Emerging Trends Impacting Pricing

- Digital and Telemedicine Integration: Growing digital platforms increase over-the-counter sales and reduce distribution costs.

- Patient-Centric Formulations: Innovations like once-daily topical applications or sustained-release patches can command premium prices.

- Manufacturing Advancements: Cost-efficient API synthesis and scalable manufacturing lower production costs, exerting downward pressure on prices.

Future Market Opportunities

- Developing Countries: Rising fungal infection instances and limited healthcare infrastructure position emerging markets as lucrative growth areas.

- Product Diversification: Combination therapies addressing multiple pathogens or resistant strains could command higher prices.

- Brand Development: Patenting novel formulations or delivery systems offers leverage for premium pricing.

Key Challenges

- Pricing Pressure: Intense generic competition and regulatory constraints will continue to suppress prices.

- Supply Chain Disruptions: Fluctuations in raw material supply, especially for APIs, may temporarily influence costs.

- Emergence of Resistance: Potential antifungal resistance may necessitate R&D investments, impacting pricing.

Conclusion

The miconazole market is poised for steady growth driven by rising fungal infection prevalence, expanding indications, and accessible formulations. Price trajectories will trend downward, influenced predominantly by increasing generic competition, regulatory easements, and manufacturing efficiencies. Notwithstanding, innovation in delivery systems and combination therapies offer opportunities for premium pricing segments.

Key Takeaways

- Market Growth: Expect a CAGR of around 4-5% from 2023-2030, with emerging markets leading growth.

- Pricing Trends: Generic penetration will drive prices lower, with average topical miconazole prices declining by approximately 4-8% over the next seven years.

- Competitive Landscape: Dominated by generics, with strategic branding and formulation innovations providing differentiation opportunities.

- Regulatory Impact: Rapid approvals and patent expirations facilitate fierce price competition.

- Future Opportunities: Product innovation and market expansion into developing economies remain promising avenues.

FAQs

1. How does patent expiration impact miconazole prices?

Patent expirations enable generic manufacturers to enter the market, leading to increased competition and significant price reductions over a 6-12 month period post-expiry.

2. What regions are expected to see the highest growth in miconazole utilization?

Emerging economies in Asia-Pacific and Latin America are projected to witness the fastest growth, driven by rising infection rates and expanding healthcare infrastructure.

3. Will new formulations or delivery systems influence future pricing?

Yes. Innovative delivery mechanisms like sustained-release patches may command higher prices initially, though widespread adoption could eventually lower costs due to market expansion.

4. How does OTC availability affect miconazole’s market dynamics?

OTC status increases access and sales volume, intensifies price competition, and reduces healthcare provider intervention costs, contributing to overall lower prices.

5. What challenges could disrupt current pricing trends?

Potential supply chain disruptions, rising raw material costs, or the emergence of resistant fungal strains could increase manufacturing costs, temporarily stabilizing or elevating prices.

References

- MarketsandMarkets. "Antifungal Drugs Market by Drug Class, Route of Administration, End User — Global Forecast to 2028." 2023.

- World Health Organization. "Fungal Infections Worldwide," 2022.

- American Academy of Dermatology Association. "Fungal Infections: Overview," 2022.

- IQVIA. "Pharmaceutical Market Trends," 2022.

- FDA. "Guidelines for Generic Drug Approval," 2021.