Last updated: July 28, 2025

Introduction

Methylphenidate, a central nervous system stimulant primarily used to treat Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy, has maintained a significant position in the global pharmaceutical landscape. As one of the most prescribed psychostimulants, its market trajectory is influenced by regulatory policies, demographic trends, technological advances, and evolving treatment paradigms.

This article provides an in-depth market analysis for methylphenidate, including current global market size, competitive dynamics, regulatory considerations, and comprehensive price projections through 2030.

Market Overview and Dynamics

Market Size and Growth Trajectory

The global methylphenidate market was valued at approximately $2.3 billion USD in 2022, with a compound annual growth rate (CAGR) of around 6.2% projected through 2030, reaching an estimated $4.2 billion USD [1]. The increasing prevalence of ADHD, especially among children and adolescents, accounts for a significant share of this growth.

Therapeutic Applications

- ADHD Management: Over 5% of school-aged children globally are diagnosed with ADHD. Methylphenidate remains the front-line pharmacological treatment due to its proven efficacy and safety profile.

- Narcolepsy: Although less prevalent, methylphenidate is also prescribed for narcolepsy, further broadening its application spectrum.

Regional Market Distribution

- North America: Dominates with approximately 45% market share, driven by high diagnosis rates, healthcare infrastructure, and acceptance of stimulant therapies.

- Europe: Accounts for about 25%, with growth fueled by increased awareness and diagnosis.

- Asia-Pacific: Fastest-growing segment, projected CAGR of 8.0%, due to emerging healthcare markets and rising ADHD awareness.

Competitive Landscape

Major pharmaceutical manufacturers include Novartis, Mylan, AstraZeneca, and emerging biotech firms. Generic formulations account for over 70% of prescriptions globally, exerting downward pressure on prices and fostering market accessibility.

Regulatory and Patent Considerations

Patent Expirations

Many branded methylphenidate formulations, such as Ritalin (Novartis), faced patent expiry in the late 2010s or early 2020s, paving the way for generic competitors. This has significantly contributed to a decline in prices and increased market penetration of generics.

Regulatory Environment

Stringent FDA and EMA regulations govern manufacturing, marketing, and scheduling classifications. Recent efforts to control misuse and abuse have led to stricter prescribing protocols and scheduling as a controlled substance in several jurisdictions.

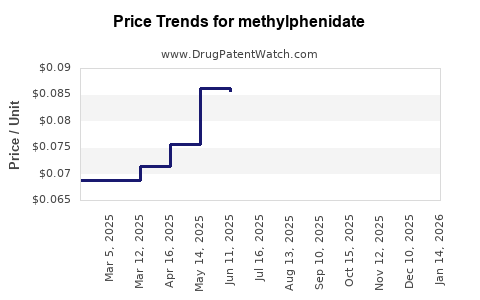

Pricing Trends and Projections

Historical Pricing Dynamics

- Branded Formulations: As of 2022, a monthly supply of branded methylphenidate (e.g., Ritalin) ranged between $150–$200 USD, governed by regional pricing policies.

- Generic Formulations: Reduced to $30–$60 USD per month in the U.S., with similar trends globally, primarily driven by patent expiration and increased competition.

Factors Influencing Future Pricing

- Patent Landscape: Ongoing patent challenges may further commoditize methylphenidate, leading to continued price erosion.

- Formulation Innovations: Extended-release (ER) formulations, transdermal patches, and novel delivery systems typically command premium pricing.

- Regulatory Controls and Abuse Deterrents: Stricter controls may modulate supply and demand, influencing prices.

Price Projections (2023–2030)

| Year |

Estimated Average Monthly Price (USD) — Branded |

Generic (USD) |

Remarks |

| 2023 |

$185 |

$45 |

Stabilization post-patent expiry; emergence of biosimilars possible |

| 2024 |

$180 |

$40 |

Slight decline owing to increased competition |

| 2025 |

$170 |

$35 |

Market saturation with generics; formulation diversification |

| 2026 |

$160 |

$30 |

Further commoditization; demand for cost-effective options |

| 2027 |

$150 |

$25 |

Potential price plateau; regulatory and abuse control factors at play |

| 2028 |

$145 |

$25 |

Slight recovery expected around innovation cycles |

| 2029 |

$140 |

$23 |

Market reaching mature stage |

| 2030 |

$135 |

$20 |

Predicted stabilization at low price points |

Note: These projections are subject to regional regulatory changes, manufacturing costs, and market dynamics.

Emerging Market and Innovation Factors

- Alternate Delivery Systems: The potential market for long-acting formulations is expanding, with projected CAGR of 7.5%. These typically command premium prices, potentially offsetting price declines of traditional forms.

- Biosimilars and Generics: Increased patent challenges and biosimilar development could reduce prices further, especially from 2025 onward.

- Digital and Telehealth Influence: Growing integration of digital tools for monitoring dosing adherence may influence prescribing patterns and subsequent pricing strategies.

Challenges and Opportunities

Challenges

- Regulatory Restrictions: Tight controls over stimulant prescriptions to prevent misuse could limit market growth.

- Market Saturation: High penetration in developed markets limits growth potential.

- Pricing Pressures: The proliferation of generics and biosimilars exerts downward pressure on pricing.

Opportunities

- Expanding Indications: Research into methylphenidate's utility for other neuropsychiatric disorders may open new markets.

- Emerging Markets: Expanding healthcare infrastructure and increasing ADHD diagnosis rates present substantial growth opportunities.

- Formulation Innovation: Extended-release, transdermal patches, and combination formulations can command premium pricing and expand market share.

Conclusion

The methylphenidate market exhibits robust growth driven by rising ADHD prevalence, technological innovations, and increasing acceptance of pharmacotherapy. Patent expiries and generics have precipitated a downward pricing trajectory, which is projected to continue through 2030. Nonetheless, premium formulations and emerging indications could sustain margins for innovative products. Stakeholders must monitor regulatory developments and competitive dynamics meticulously to optimize pricing strategies and market positioning.

Key Takeaways

- The global methylphenidate market is expected to grow at a CAGR of over 6% over the next decade, reaching approximately $4.2 billion by 2030.

- Patent expirations and the rise of generics have reduced prices, which are projected to stabilize or decline further, with average monthly prices in the U.S. dropping to around $20–$25 by 2030.

- Innovation in formulations, especially long-acting and transdermal systems, presents opportunities for premium pricing.

- Regulatory policies aimed at controlling misuse will continue to influence market access and pricing strategies.

- Emerging markets offer significant growth potential due to increasing ADHD awareness and improved healthcare infrastructure.

FAQs

1. How does patent expiration affect methylphenidate pricing?

Patent expirations typically lead to an influx of generic competitors, decreasing brand dominance and driving prices downward due to increased market competition.

2. What are the main factors influencing future methylphenidate prices?

Factors include patent status, formulation innovations, regulatory controls, manufacturing costs, and market demand, particularly in emerging economies.

3. Are there emerging alternatives to methylphenidate with better pricing?

Yes, non-stimulant medications for ADHD, like atomoxetine, and alternative stimulants may influence market dynamics and pricing strategies.

4. How do regulatory policies impact methylphenidate distribution?

Stricter scheduling and prescription monitoring programs aim to curb misuse, potentially limiting supply and influencing pricing, especially in markets with stringent controls.

5. What is the outlook for methylphenidate in emerging markets?

Emerging markets are projected to experience faster growth, driven by rising ADHD awareness, expanding healthcare infrastructure, and increasing acceptance of pharmacological treatments.

References

[1] Market Research Future, "Global Methylphenidate Market Report 2022-2030," 2022.