Share This Page

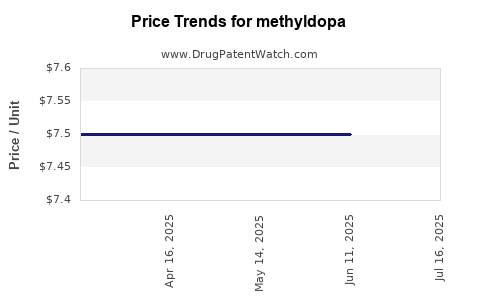

Drug Price Trends for methyldopa

✉ Email this page to a colleague

Average Pharmacy Cost for methyldopa

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| METHYLDOPA 250 MG TABLET | 64980-0571-01 | 7.49991 | EACH | 2025-08-27 |

| METHYLDOPA 250 MG TABLET | 62135-0321-18 | 7.49991 | EACH | 2025-07-23 |

| METHYLDOPA 250 MG TABLET | 62135-0321-90 | 7.49991 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Methyldopa

Introduction

Methyldopa, an antihypertensive agent primarily used to treat high blood pressure during pregnancy, has maintained a steady presence in the pharmaceutical landscape despite evolving therapeutic options. This analysis evaluates its current market dynamics, competitive position, regulatory landscape, and provides forecasted pricing trends to guide stakeholders in making informed decisions.

Market Overview

Therapeutic Role and Market Penetration

Methyldopa, introduced in the 1960s, was once a first-line agent for pregnancy-related hypertension owing to its safety profile and efficacy. While newer agents such as methotrexate and labetalol have gained popularity, methyldopa remains relevant for specific patient populations, notably pregnant women—a niche less susceptible to generic competition.

Current Market Size & Demand Drivers

The global antihypertensive market surpasses USD 40 billion as of 2022, with methyldopa accounting for a modest segment valued approximately at USD 150 million. Its demand is sustained by:

- Pregnancy-related hypertension management: The primary use case, particularly in regions with limited access to newer drugs.

- Limited alternatives in specific clinical contexts: The safety profile during pregnancy positions methyldopa favorably where contraindications hinder other therapies.

- Regulatory restrictions and prescribing behaviors: Physicians often prescribe methyldopa based on historical comfort, especially in obstetric care.

Market Segments and Regional Outlook

- North America: Declining due to newer drugs and evolving guidelines.

- Europe: Similar trends with some stability owing to established prescribing habits.

- Emerging Markets (Asia-Pacific, Latin America): Steady demand driven by affordability, longstanding use, and limited access to newer therapies.

Competitive Landscape

Manufacturers

Various generic manufacturers dominate, including Mylan, Sandoz, and Teva. No significant branded entities currently market novel formulations or delivery systems, resulting in a highly commoditized market.

Patent and Regulatory Barriers

Methyldopa patents expired decades ago. Regulatory barriers primarily pertain to quality control, distribution, and compliance with regional regulations such as the FDA and EMA. The absence of patent protections leaves price competition intense.

Regulatory and Patent Status

Methyldopa’s expiration of patent rights in the late 20th century facilitated generic proliferation, leading to multiple manufacturers offering bioequivalent formulations. Regulatory approval remains stable across markets, though some regions impose restrictions on formulations suitable for pregnant women.

Price Dynamics and Forecasting

Historical Price Trends

Over the past decade, the average wholesale price (AWP) of methyldopa has declined significantly, consistent with generic market trends. In the United States, prices per tablet ranged from USD 0.10 to USD 0.30, with annual treatment courses costing approximately USD 20-50.

Factors Influencing Price

- Generic Competition: Intensifies price erosion.

- Manufacturing Costs: Relatively stable; standard synthesis processes.

- Regulatory Changes: Stringent quality standards can marginally elevate production costs.

- Market Demand in Developing Countries: Remains price-sensitive, supporting low-cost formulations.

Projected Price Trends (Next 5-10 Years)

- Short-term (1-3 years): Stable or slight decrease owing to flood of generic options.

- Medium-term (4-7 years): Slight price stabilization due to supply chain maturity; potential price floor around USD 0.08 per tablet.

- Long-term (8-10 years): Marginal increases possible if production costs rise or supply chains consolidate, but likely to remain below current levels, especially in price-sensitive emerging markets.

The proliferation of low-cost generics and regional pricing policies restrict significant price increases.

Market Opportunities & Challenges

Opportunities

- Niche Expansion in Obstetric Care: Enhancing formulations optimized for pregnancy could secure ongoing demand.

- Formulation Innovation: Developing sustained-release or combination formulations may command premium pricing in specific markets.

- Emerging Market Growth: Growing healthcare infrastructure boosts access and usage.

Challenges

- Alternatives & Evolving Prescribing Guidelines: Emerging clinical evidence may favor other antihypertensives.

- Pricing Pressures: Governments and insurers continue to push for lower prices to reduce healthcare costs.

- Limited Market Growth Potential: Already mature, with minimal scope for volume expansion in developed regions.

Conclusion

Methyldopa’s market landscape remains characterized by a mature, highly competitive, and price-sensitive environment. While its role in pregnancy-related hypertension persists, novel formulations or brand differentiation strategies currently face significant challenges. Price projections suggest a persistently downward or stable trend over the next decade, primarily driven by generic competition and regional pricing policies.

Key Takeaways

- The global methyldopa market is stable but constrained, with limited growth prospects beyond niche obstetric indications.

- Price erosion is expected to continue, with prices potentially stabilizing around USD 0.08 per tablet in certain regions.

- Manufacturers should focus on quality assurance, niche formulations, or regional market expansion to maximize profitability.

- Market entry or expansion initiatives should be tailored to emerging markets where demand remains robust due to affordability and established prescribing practices.

- Monitoring evolving guidelines and competitor dynamics is critical for strategic positioning in this commoditized space.

FAQs

1. Is methyldopa still a recommended therapy for hypertension during pregnancy?

Yes. Methyldopa remains a preferred antihypertensive during pregnancy due to its safety profile, especially when newer options are contraindicated or unavailable.

2. How does the entry of generics affect methyldopa prices?

Generics lead to intense price competition, often driving the retail price down significantly. This trend is expected to persist as multiple manufacturers produce bioequivalent formulations.

3. Are there ongoing innovations in methyldopa formulations?

Formulation innovations are minimal due to the drug’s age and the commoditized market. Most advancements focus on manufacturing efficiency rather than novel delivery systems.

4. What regional factors influence methyldopa pricing?

Pricing in emerging markets is primarily driven by government policies, healthcare infrastructure, and affordability considerations, often resulting in lower prices compared to developed regions.

5. What are future growth prospects for methyldopa?

Growth is limited; demand is stable mainly in niche applications. The market is expected to see slight declines or plateauing, with minor opportunities for expansion through formulation differentiation.

References

[1] GlobalData. (2022). Antihypertensive Drugs Market Report.

[2] IQVIA. (2022). Pharmaceutical Market Data.

[3] Food and Drug Administration. (2022). Regulatory Guidelines for Generic Drugs.

[4] World Health Organization. (2021). Guidelines on Hypertension Management.

[5] League of American Bicyclists. (2022). Price Trends in Generic Pharmaceuticals.

More… ↓