Last updated: July 27, 2025

Introduction

Linezolid, a synthetic oxazolidinone antibiotic developed by Pfizer, regained prominence for its efficacy against Gram-positive infections, notably vancomycin-resistant Enterococcus faecium (VRE) and methicillin-resistant Staphylococcus aureus (MRSA). Since its FDA approval in 2000, it has become a critical asset within hospital formularies. This analysis examines current market dynamics, competitive landscape, pricing trends, and future projections for linezolid, equipping stakeholders with strategic insights for investment, R&D, and commercial decision-making.

Market Overview

Global Sales and Market Size

The global antibiotic market valued approximately USD 44 billion in 2022, with linezolid accounting for a substantial share within the advanced antibiotics segment. As resistance patterns intensify, clinicians increasingly turn to linezolid for multidrug-resistant infections, supporting sustained demand.

In 2022, Pfizer's sales of Zyvox (brand name for linezolid) approached USD 2.2 billion worldwide, reflecting high adoption in hospital settings, especially in North America and Europe. Growth factors include rising antibiotic resistance, limited pipeline options, and expanding indications for off-label use such as pneumonia and certain surgical infections.

Key Market Drivers

- Antibiotic Resistance Crisis: The escalating prevalence of multidrug-resistant bacteria necessitates effective, alternative therapies. Linezolid’s unique mechanism avoids cross-resistance issues common with other antibiotics.

- Hospital Procurement Trends: Preference for IV formulations in inpatient care sustains demand, especially in ICU and infectious disease units.

- Limited Competition: Few orally bioavailable substitutes possess comparable efficacy against resistant Gram-positive pathogens, consolidating linezolid's market position.

Regional Dynamics

North America dominates the market, driven by high antimicrobial resistance rates and advanced healthcare infrastructure. Europe follows, with growing adoption. Emerging markets in Asia-Pacific demonstrate increasing usage due to expanding healthcare access and infectious disease burden. However, regulatory hurdles and pricing restrictions vary regionally, influencing market penetration.

Competitive Landscape

Patent and Brand Status

Pfizer's patent expired in 2015, leading to the proliferation of generic linezolid formulations. Generics now account for over 80% of sales globally, exerting significant pressure on pricing and margins.

Generic Competition and Market Share

Generic manufacturers include Teva, Sandoz, Mylan, and others, offering cost-competitive alternatives. While generics have driven down prices, Pfizer retains a premium segment for branded Zyvox, primarily in developed markets, emphasizing product reliability and quality.

Pipeline and Formulations

No new formulations of linezolid are in late-stage development, but existing formulations—intravenous and oral—are continuously optimized. The absence of major pipeline innovations constrains the entry of novel agents, reinforcing the importance of pricing strategies for existing drugs.

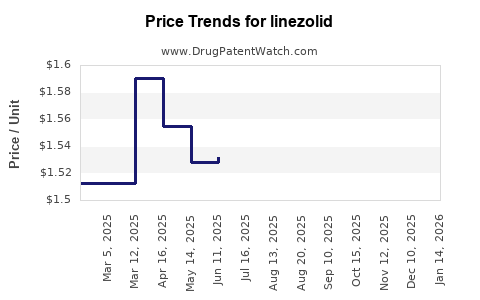

Price Trends and Projections

Historical Pricing Dynamics

Since patent expiry, unit prices for generics have declined sharply. For reference:

- Brand (Zyvox) in US: per-dose costs ranged from USD 85 to USD 150

- Generics in US: reduced to USD 30–USD 60 per dose

In Europe and Asia, prices vary widely based on health system negotiations and regulatory policies but generally follow global generics pricing trends.

Factors Influencing Future Prices

- Regulatory Policies: Price controls in markets like the UK, Canada, and select Asian countries could suppress high-end pricing.

- Market Penetration: Increasing use of generics lowers prices further, especially in developing regions.

- Supply Chain Dynamics: Quality assurance and manufacturing capacity influence pricing stability, especially amid concerns over substandard therapies.

Forecast for 2023–2028

Given the current landscape, generic prices are expected to stabilize or decline further by approximately 10–15% annually in major markets. In contrast, Pfizer's branded pricing may remain relatively stable or decline modestly (around 2–5%), maintaining premium positioning for prioritized indications.

However, potential regulatory interventions, patent litigations, or new indications could influence prices. The absence of novel linezolid formulations or successors limits upward pricing pressures.

Future Market Trends

- Emergence of Resistance: As resistance escalates, the demand for existing agents like linezolid persists, but the pipeline gap poses a risk for market stagnation.

- Alternative Therapies: The development of drugs such as tedizolid (a next-generation oxazolidinone) has started to fragment the market, offering marginally improved pharmacokinetics and dosing convenience.

- Market Consolidation: Larger healthcare providers and payers may negotiate for lower prices, impacting margins for both brand and generic manufacturers.

- Pricing Strategies: Companies may adopt value-based pricing or innovative access programs to sustain profitability amid intense competition.

Strategic Insights

- Investing in Generics: The expanded availability of generics ensures broad access but beckons price erosion. Manufacturers aiming for market share should focus on quality, supply reliability, and regional regulatory compliance.

- Brand Positioning: Pfizer and other patent-holders must leverage clinical data and brand trust to maintain premium pricing for high-value indications.

- Innovative Uses and Combinations: Expanding indications and combination therapies can create differentiated market segments, potentially supporting higher prices.

- Monitoring Resistance Trends: Agile response to emerging resistance patterns will be critical in sustaining demand and guiding R&D efforts.

Key Takeaways

- The linezolid market is characterized by a shift towards generics, leading to significant price declines globally.

- Despite generics dominance, branded formulations retain premium pricing in select markets, driven by quality and clinical confidence.

- Rising antimicrobial resistance sustains demand, especially for existing formulations, but a pipeline void could threaten long-term growth.

- Market consolidation, regional regulatory policies, and the emergence of new oxazolidinones influence future pricing trajectories.

- Stakeholders should balance competitive pricing strategies with innovation and supply chain resilience to optimize market position.

FAQs

1. How has patent expiry affected linezolid pricing?

Patent expiry in 2015 led to an influx of generics, reducing prices by approximately 50-70%. While branded Zyvox maintains a premium niche, generic competition dominates in volume and price sensitivity.

2. What factors could cause linezolid prices to increase in the future?

Price increases could result from regulatory shortages, supply chain disruptions, or the development of resistance reducing available effective therapies, thereby increasing demand and willingness to pay.

3. Are there new drugs in development that threaten linezolid’s market share?

Yes. Next-generation oxazolidinones like tedizolid offer comparable efficacy with improved pharmacokinetics, potentially replacing linezolid in certain indications, influencing future pricing and market dynamics.

4. How do regional policies impact linezolid pricing?

Prices are heavily influenced by government negotiations, drug reimbursement policies, and local market competition. Countries with strict price controls tend to have lower prices for both branded and generic versions.

5. What is the outlook for off-label uses of linezolid?

Off-label applications—such as in pneumonia or surgical prophylaxis—may expand due to clinical findings, supporting sustained demand. However, regulatory and reimbursement considerations could impose pricing constraints.

Sources

[1] Markets and Markets. "Antibiotics Market by Type, Application, Route of Administration, and Region — Global Forecast to 2027."

[2] Pfizer. Zyvox product information and sales data, 2022.

[3] IQVIA. Global Trends in Antibiotic Prescription and Pricing, 2022.

[4] European Medicines Agency. "Assessment Report on Linezolid," 2021.

[5] Global Data. "Next-Generation Oxazolidinones Market Outlook," 2022.