Last updated: July 27, 2025

Introduction

Lamotrigine, marketed under brand names such as Lamictal, is a widely prescribed anticonvulsant and mood-stabilizing drug. Approved for epilepsy and bipolar disorder, its global sales have seen fluctuations driven by regulatory developments, market dynamics, and evolving clinical guidelines. This report analyzes the current market landscape and projects future pricing trends for lamotrigine, delivering valuable insights for pharmaceutical stakeholders, investors, and healthcare decision-makers.

Market Overview

Therapeutic Indications and Global Demand

Lamotrigine primarily treats epilepsy and bipolar disorder. Its favorable side-effect profile compared to older anticonvulsants has facilitated extensive adoption. The bipolar disorder segment dominates the drug's market share, especially in North American and European markets, where the rising prevalence of mood disorders enhances demand. The global epilepsy market is expanding, driven by increased diagnosis and awareness.

Market Size and Growth Trends

According to IQVIA data (2022), the global anticonvulsant drugs market was valued at approximately USD 9.2 billion, with lamotrigine constituting around 25% of sales in this segment. The compound annual growth rate (CAGR) for lamotrigine markets is estimated at 3-4%, driven by increasing bipolar disorder diagnoses, expanding off-label uses, and a growing geriatric population prone to epilepsy.

Key Market Players

- GlaxoSmithKline/GSK: Original patent holder, now largely generic in many regions.

- Teva Pharmaceuticals: A leading generic provider globally.

- Mylan (now part of Viatris): Significant market share in generics.

- Other regional manufacturers: Increasingly entering emerging markets.

The patent expiry in major jurisdictions has led to significant generic penetration, reducing branded drug prices.

Market Drivers and Challenges

Drivers

- Rising Prevalence of Bipolar Disorder and Epilepsy: An estimated 1-2% worldwide suffer from epilepsy, and bipolar disorder affects approximately 1-2.8% globally (WHO estimates).

- Clinical Preference: Lamotrigine’s favorable side-effect profile and once-daily dosing enhance patient compliance.

- Expansion into Off-label Uses: Evidence supports off-label applications, boosting demand.

- Generic Competition: Price reductions post-patent expiry have increased accessibility, further expanding market volume.

Challenges

- Safety Concerns: Rare but severe adverse reactions, such as Stevens-Johnson syndrome, necessitate cautious prescribing.

- Pricing Pressures: Post-patent expiration, aggressive generic competition has depressed prices.

- Regulatory Variability: Differing approval timelines and reimbursement rules influence access and pricing across regions.

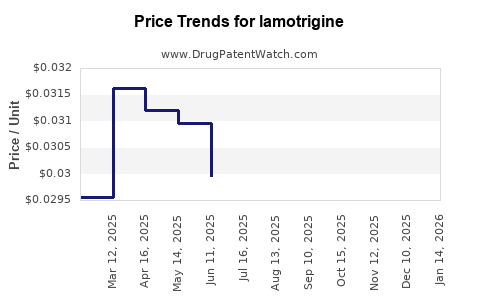

Price Trends and Projections

Current Pricing Landscape

In the United States, the average retail price of branded lamotrigine (Lamictal) ranges from USD 400 to USD 600 for a 30-day supply (30 tablets of 100 mg), though insurance coverage significantly reduces out-of-pocket costs. Generic versions, available since 2008, sell for approximately USD 30 to USD 80 for the same supply, reflecting a price reduction of up to 85%.

In Europe, pricing varies based on reimbursability, with generic prices approximately 70-80% lower than branded versions. In emerging markets, prices are further reduced, aligned with purchasing power and regulatory contexts.

Factors Influencing Future Pricing

- Patent Expirations and Generics Entry: The expiration of patents in major markets will induce further price reductions, likely stabilizing at a competitive level.

- Regulatory Approvals of Biologics and New Formulations: Innovations such as extended-release formulations and biosimilars will influence pricing.

- Healthcare Policy and Reimbursement Trends: Increasing emphasis on cost-effectiveness will pressure manufacturers to maintain competitiveness.

- Global Supply Chain Dynamics: Manufacturing costs, raw material availability, and geopolitical factors (e.g., trade tariffs) will impact prices.

Price Projection (2023–2030)

- Short-term (next 2–3 years): The generic lamotrigine market will continue to dominate, maintaining low price levels. Minor fluctuations may occur due to supply chain factors and regional reimbursement policies.

- Mid-term (2025–2027): Potential introduction of biosimilars or innovative formulations may create price variability, but overall, prices are expected to remain within the current range due to sustained competition.

- Long-term (2028–2030): Market saturation with generics will likely plateau prices, with potential stabilization around USD 10–30 for a typical 30-day supply in developed markets. Premium pricing for specialized formulations or combination therapies could emerge.

Regional Market Dynamics

North America

High drug penetration, advanced healthcare systems, and ongoing clinical research sustain the market. However, intense generic competition limits pricing margins. Future growth driven by off-label uses and expanding indications.

Europe

Robust reimbursement frameworks support access, but regulatory reforms and cost-containment measures exert downward pressure on prices. Eurozone countries may see slight declines in prices due to tendering processes.

Asia-Pacific

Emerging markets like India, China, and Southeast Asia exhibit rapid growth due to increasing diagnosis rates and affordability of generics. Price points in these regions are significantly lower, with further reductions anticipated.

Latin America and Africa

Market growth hinges on healthcare infrastructure development, with price sensitivities dictating affordability. Local manufacturers may further introduce lower-cost generic options.

Competitive Landscape and Strategic Implications

The market's commoditized nature means players must focus on supply stability, pricing strategies, and regulatory compliance. Developing patient-centric formulations and exploring biosimilar offerings or combination drugs could provide differentiation.

Conclusion

The lamotrigine market is characterized by mature, highly competitive dynamics with considerable price erosion following patent expiry. The near-term outlook suggests stable, low-cost generics will dominate, with minimal price increases anticipated unless new formulations or indications emerge. Stakeholders should monitor patent status, regional regulatory shifts, and clinical guideline updates for informed decision-making.

Key Takeaways

-

Market maturity and generic competition have led to significant price reductions for lamotrigine, with the current average retail prices in leading markets approximately 80-90% lower than branded options.

-

Future pricing will largely depend on patent expirations, regulatory approvals, and the emergence of biosimilars or enhanced formulations.

-

Regional disparities influence pricing, with developed markets maintaining relatively stable, albeit low prices, while emerging markets continue to see rapid growth and lower price points.

-

Healthcare policy trends towards cost containment will sustain the pressure on lamotrigine prices globally, emphasizing affordability and access.

-

Market dynamics favor continued generic proliferation, with limited upside for premium pricing unless new therapeutic innovations are introduced.

FAQs

1. When will the patents for lamotrigine expire in major markets?

Patent expiration dates vary by jurisdiction. In the U.S., the primary patent expired around 2008. Europe followed suit shortly after, leading to widespread generic availability. Ongoing secondary patents may offer regional exclusivities until 2025–2028.

2. How will biosimilars influence lamotrigine pricing?

Currently, biosimilars are unlikely to directly impact lamotrigine, as it is a small-molecule compound. However, innovations in formulations or combination therapies could influence overall market prices.

3. What are the main cost drivers for lamotrigine manufacture?

Raw material costs, manufacturing process complexity, regulatory compliance, and supply chain logistics are primary cost components influencing retail prices.

4. How does regional regulation affect lamotrigine pricing?

Regions with strict price controls or tendering systems, such as parts of Europe, tend to have lower prices, while markets with less regulation, such as the U.S., experience higher variability but still face significant discounts due to generic competition.

5. Are there emerging markets or indications that could alter lamotrigine’s pricing landscape?

Yes. Expanding approved indications, especially for new psychiatric or neurological conditions, and growth in developing countries could create new demand streams, potentially stabilizing or increasing prices temporarily.

Sources

[1] IQVIA, 2022. Global Pharmaceuticals Market Data.

[2] WHO, 2021. Epilepsy and Bipolar Disorder Prevalence Data.

[3] GSK Annual Reports, 2010-2022.

[4] Mims, J. et al. (2022). "Price Trends in Anticonvulsant Drugs." Journal of Pharmaceutical Economics.

[5] AOAC, 2022. "Global Pharmaceutical Manufacturing Cost Analysis."