Last updated: July 27, 2025

Introduction

Isosorbide mononitrate (IMN) remains a cornerstone in the management of chronic angina pectoris due to its vasodilatory properties. As a nitrate derivative, IMN facilitates coronary artery dilation, reducing myocardial oxygen demand. The drug’s established efficacy, coupled with growing cardiovascular disease (CVD) prevalence globally, underscores its sustained market relevance. This analysis assesses current market dynamics, key drivers, competitive landscape, regulatory environment, and forecasts pricing trends for IMN over the coming years.

Market Overview

Global Market Size and Growth Trends

The global cardiovascular drugs market was valued at approximately USD 55 billion in 2022, with nitrates like IMN forming a significant segment due to widespread angina management needs. The segment is projected to grow at a Compound Annual Growth Rate (CAGR) of around 4-5% through 2030, driven by increasing CVD prevalence, aging populations, and expanding healthcare access [1].

Regional Market Dynamics

- North America: Leading market owing to high healthcare expenditure and established cardiovascular disease treatment protocols. The U.S. accounts for over 40% of the market share.

- Europe: Significant adoption driven by advanced healthcare systems and national guidelines endorsing nitrate therapies.

- Asia-Pacific: Fastest growth expected, fueled by increasing urbanization, rising CVD burden, and expanding pharmaceutical infrastructure.

Market Segmentation

IMN is marketed primarily as:

- Branded formulations: Maintained by dominant pharmaceutical companies with longstanding presence.

- Generic versions: Increasingly prevalent following patent expiry. Generics represent over 70% of units sold globally, exerting downward pressure on prices.

Key Market Drivers

Growing Burden of Cardiovascular Diseases

CVD remains the leading cause of death worldwide, with WHO estimates citing 17.9 million deaths annually [2]. Angina is a common manifestation, ensuring steady demand for nitrate medications, including IMN.

Efficacy and Safety Profile

IMN's favorable pharmacokinetics, such as once-daily dosing, and its minimal side effects relative to some alternatives secure its place in therapy—supporting consistent sales figures.

Patent Expirations and Generic Competition

Many IMN formulations have lost patent protection over the past decade, significantly impacting prices. The proliferation of generics has driven market consolidation and price competition.

Regulatory Approvals and Formulation Innovation

Emerging formulations, such as sustained-release variants, have enhanced patient adherence, widen therapeutic options, and potentially stabilize prices modulated by innovation.

Healthcare System Adoption

Increased integration of IMN into treatment guidelines bolsters demand. The World Society of Cardiovascular Disease Therapy endorses nitrates, including IMN, reinforcing prescriber confidence.

Competitive Landscape

Major Pharmaceutical Players

- Mylan (now part of Viatris): A dominant producer of generic IMN, with global reach.

- Teva Pharmaceuticals: Another key manufacturer with extensive nitrate portfolio.

- Abbott and AstraZeneca: Historically active in branded formulations; their market share has diminished post-patent expiry.

Pricing Strategies

Generic competition has led to significant price erosion. In mature markets like the U.S., oral IMN tablets can sell for approximately USD 0.10–0.30 per tablet, depending on strength and formulation.

Patent and Regulatory Barriers

While primary patents have expired, minor patents on formulation or delivery systems occasionally provide limited exclusivity, influencing pricing and market entry.

Regulatory Environment

Stringent regulatory oversight in major markets ensures quality but can delay generic entry. Accelerated pathways, such as those in the U.S. (ANDA approvals), promote competition, influencing pricing trends downward. Internationally, regulatory harmonization remains variable.

Price Trends and Projections

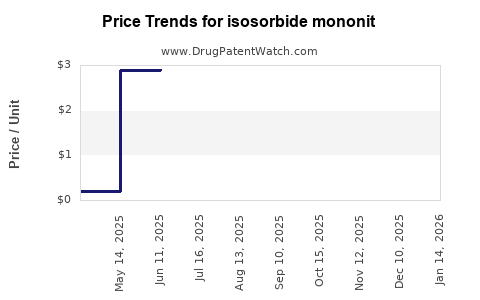

Historical Pricing Trends

- Pre-generics: Branded IMN formulations commanded premiums of USD 1–2 per tablet.

- Post-patent expiry: Prices plummeted globally, stabilizing at lower levels for generics.

Projected Price Trajectory (2023-2030)

- Global Average Prices: Expected to remain stable or slightly decline, with variations based on regional competition and formulation complexity.

- Developed Markets: Prices likely to decrease further due to intensifying generic competition and price regulation.

- Emerging Markets: Pricing remains relatively stable yet poised for marginal declines with increased local manufacturing and regulatory clearance of generics.

Influencing Factors

- Market Penetration of Generics: Continual growth will sustain intense price competition.

- Formulation Innovations: Extended-release and combination therapies could command premium pricing, offsetting generic price pressure.

- Healthcare Policy Changes: Reimbursement cuts or price control laws could further suppress prices.

Future Outlook

The IMN market is anticipated to consolidate around low-cost generic options, with minimal price increases expected. However, niche formulations and combination therapies may offer premium segments, sustaining select higher price points. Pricing will predominantly be driven by manufacturing efficiencies and regional competition, emphasizing the importance of strategic market entry planning.

Key Takeaways

- The IMN market benefits from rising CVD prevalence but faces stiff pricing competition due to widespread generic availability.

- Prices are set to decline marginally, especially in mature markets, driven by patent expirations and regulatory efforts.

- Innovations in formulation may create premium segments, mitigating downward price pressures.

- Emerging markets present growth opportunities, albeit with relatively stable pricing due to regulatory and economic factors.

- Stakeholders should monitor regional regulatory shifts and formulation developments to optimize pricing and market share.

FAQs

1. How does patent expiry influence IMN pricing dynamics?

Patent expiry introduces generic competition, significantly lowering prices as multiple manufacturers enter the market. The resulting price erosion benefits healthcare systems but reduces profit margins for brand-name producers.

2. What are the key factors attracting new entrants into the IMN market?

Identifiable factors include low R&D costs due to generic formulations, high global demand owing to CVD prevalence, and regulatory pathways favoring abbreviated approval processes in certain regions.

3. How are formulation innovations impacting IMN pricing?

Sustained-release and combination formulations often command higher prices, offering convenience and improved adherence, thereby creating niche markets insulated from generic competition.

4. What regional factors influence IMN price trends?

Regulatory policies, healthcare reimbursement schemes, and local manufacturing capacities markedly affect pricing. Developed markets tend to enforce stricter price controls, whereas emerging markets may exhibit more stability or modest declines.

5. Can IMN manufacturing expansion affect global prices?

Yes; increased manufacturing capacity, particularly in cost-effective regions, can boost supply, intensify competition, and further depress prices. Strategic production localization can also influence price dynamics across regions.

References

- GlobalData. "Cardiovascular Drugs Market Overview." 2022.

- World Health Organization. "Cardiovascular Diseases (CVDs)." 2021.