Share This Page

Drug Price Trends for zubsolv

✉ Email this page to a colleague

Average Pharmacy Cost for zubsolv

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZUBSOLV 2.9-0.71 MG TABLET SL | 54123-0929-30 | 10.13418 | EACH | 2025-12-17 |

| ZUBSOLV 11.4-2.9 MG TABLET SL | 54123-0114-30 | 20.32222 | EACH | 2025-12-17 |

| ZUBSOLV 8.6-2.1 MG TABLET SL | 54123-0986-30 | 15.22930 | EACH | 2025-12-17 |

| ZUBSOLV 0.7-0.18 MG TABLET SL | 54123-0907-30 | 5.05772 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Zubsolv

Introduction

Zubsolv, a combination medication containing buprenorphine and naloxone, is a prominent treatment option for opioid use disorder (OUD). It offers an alternative to Suboxone, with distinctive formulations aimed at improving patient adherence. As the demand for effective OUD therapies escalates amid the ongoing opioid epidemic, understanding the market dynamics and pricing outlook for Zubsolv is essential for stakeholders including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global and U.S. Market Demand

The global opioid dependence treatment market was valued at approximately USD 1.6 billion in 2021, with projections indicating a compound annual growth rate (CAGR) of around 7% through 2028 [1]. The U.S. accounts for the majority share due to its high prevalence of opioid addiction, with over 2 million individuals affected by OUD as of recent estimates.

Therapeutic Landscape

Zubsolv competes primarily with sublingual buprenorphine formulations, notably Suboxone (marketed by AbbVie) and generic equivalents. It differentiates itself through a lower tablet size (sublingual film) and enhanced bioavailability, which potentially improves patient compliance and reduces misuse risk.

Regulatory and Reimbursement Environment

FDA approval of Zubsolv in 2013 positioned it as an innovative treatment in the OUD space. Reimbursement policies, driven by Medicaid, Medicare, and private insurers, significantly influence market penetration. Recent legislative initiatives aim to expand access to medication-assisted treatment (MAT), further catalyzing market growth.

Market Penetration and Commercial Strategies

Evolving strategies by Xeris Pharmaceuticals (the manufacturer of Zubsolv) involve expanding access through provider education, formulary inclusion, and patient assistance programs. Conversely, the rise of generic formulations has intensified price competition, impacting the brand’s market share and revenue.

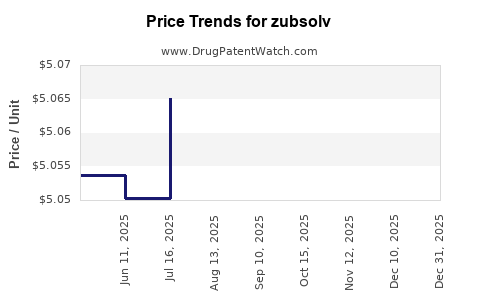

Price Dynamics and Trends

Historical Pricing Data

In 2014, the average wholesale acquisition cost (AWAC) for a 30-day supply of Zubsolv hovered around USD 250–300, positioning it higher than some generics. Over subsequent years, pricing experienced slight fluctuations influenced by competition and reimbursement adjustments.

Current Pricing Environment

As of 2023, the average retail price of Zubsolv varies regionally, ranging from USD 275–350 per month of treatment. Reimbursement structures and negotiated discounts often reduce the actual out-of-pocket expense for patients.

Factors Influencing Price Trends

- Generic Competition: The entry of generic buprenorphine/naloxone films has compressed prices, with some generics priced approximately 20–30% lower than branded Zubsolv [2].

- Manufacturing Costs and Supply Chain: Supply chain disruptions, especially amid global stresses post-pandemic, influence pricing and availability.

- Regulatory Changes: Policies promoting lower-cost access and increased provider prescribing options may exert downward pressure on prices.

- Market Penetration: High adoption rates enable premium pricing; however, saturation and market share decline can drive price reductions or promotional incentives.

Price Projection for the Next Five Years

Analysts project a modest annual decline of 2–4% in Zubsolv’s average price, driven mainly by increasing generic competition and strategic price cuts to retain market share. As the focus shifts toward expanding access and reducing healthcare costs, manufacturers may adopt tiered pricing and patient assistance programs to maintain revenue. Nevertheless, demand for branded formulations may sustain higher-end pricing in specialty markets.

Future Market Drivers

- Rising Opioid Addiction Rates: Continued epidemic growth sustains demand for effective MAT options.

- Policy and Legislation: Initiatives favoring wider medication access, including telemedicine provisions for OUD treatment, could influence pricing strategies.

- Technological Advances: Development of long-acting formulations like buprenorphine implants may impact the short-term market for Zubsolv but also open avenues for novel combination therapies.

Strategic Considerations for Stakeholders

- Pharmaceutical RoI: Given the expected price pressures, maximizing market share through clinical differentiation and patient access programs becomes crucial.

- Pricing Strategies: Manufacturers should anticipate gradual price compression; employing value-based pricing may preserve margins.

- Market Expansion: Targeting underserved populations and expanding geographic reach can mitigate adverse pricing trends.

Conclusion

Zubsolv’s market outlook is characterized by steady growth driven by the opioid epidemic’s persistence and evolving treatment paradigms. However, future pricing will increasingly reflect competitive dynamics, regulatory pressures, and market saturation. Stakeholders must navigate this landscape by balancing innovation, access, and strategic pricing to sustain profitability.

Key Takeaways

- The opioid use disorder treatment market, including Zubsolv, is expected to grow at a CAGR of approximately 7%, with demand driven by ongoing opioid addiction issues and expanded treatment initiatives.

- Pricing for Zubsolv has historically hovered around USD 275–350/month, with recent downward pressures stemming from generic competition.

- The next five years are likely to see a gradual price decline (2–4% annually), influenced heavily by market saturation and increased generic options.

- Strategic focus on expanding access, optimizing reimbursement, and differentiating product offerings remains essential for maintaining profitability.

- Advances in alternative long-acting therapies may influence the future demand and pricing strategies for short-term formulations like Zubsolv.

FAQs

1. How does Zubsolv compare to other buprenorphine/naloxone treatments in terms of price?

Zubsolv’s branded price typically surpasses generics but offers potential benefits in bioavailability and patient adherence. With generics entering the market, prices are converging, making cost a significant differentiator.

2. What factors could significantly impact Zubsolv’s pricing in the near future?

Increased generic competition, regulatory price controls, changes in healthcare reimbursement policies, and shifts toward long-acting formulations are primary factors influencing future prices.

3. Is Zubsolv favored over other treatments in specific patient populations?

Yes. Its smaller dosage form and bioavailability advantages make it suitable for patients with adherence challenges or specific anatomical considerations. However, clinical decisions depend on individual patient needs and provider preference.

4. How does policy legislation affect Zubsolv’s market and pricing strategies?

Legislation promoting expanded access to MAT and reducing barriers to treatment can enhance market penetration but may also pressure manufacturers to lower prices or offer assistance programs to remain competitive.

5. What are the main challenges facing Zubsolv’s market sustainability?

Key challenges include rising generic competition, pricing pressures, evolving treatment guidelines favoring long-acting therapies, and potential policy shifts that could affect reimbursement and access.

Sources

[1] Grand View Research, "Opioid Dependence Treatment Market," 2022.

[2] IQVIA, "Pharmaceutical Price Trends," 2023.

More… ↓