Last updated: July 27, 2025

Introduction

Zolpidem tartrate, a non-benzodiazepine hypnotic agent primarily prescribed for the short-term management of insomnia, remains a key player within the sleep aid market. As one of the most prescribed sleep medications globally, understanding its market dynamics and future pricing trends is essential for pharmaceutical manufacturers, investors, healthcare providers, and policy stakeholders. This report provides a comprehensive market analysis, evaluates current pricing landscapes, and projects future price trajectories for zolpidem tartrate over the next five years.

Market Overview

Global Insomnia Therapeutics Landscape

Insomnia affects approximately 10-30% of adults worldwide, with chronic insomnia impacting around 10% (1). The rising prevalence driven by factors such as increased aging populations, stress, and lifestyle changes has sustained demand for sleep aids. Zolpidem, a top-selling hypnotic, accounts for a significant share of prescriptions, especially in North America, Europe, and parts of Asia.

Product Profile

Zolpidem tartrate is marketed under various brand names such as Ambien (U.S.), Stilnox (Europe), and others. It is often favored for its quick onset and relatively short half-life, which reduces residual daytime sedation risk. Generics have entered the market since patent expiry in 2007, leading to competitive pricing and broad availability.

Market Segments

- Brand-name vs. Generics: While brand-name zolpidem retains premium pricing, generics dominate volume shares due to lower costs.

- Formulations: Immediate-release (IR) formulations account for most prescriptions; extended-release (ER) formulations target specific patient needs.

- Geographical Distribution: North America remains the largest market, followed by Europe and Asia-Pacific, with emerging markets experiencing rapid growth.

Market Dynamics and Drivers

Demand Drivers

- Aging Population: Older adults have higher insomnia prevalence, elevating demand.

- Increased Awareness & Diagnosis: Greater recognition of sleep disorders enhances prescription rates.

- Prescription Practices: Preference for pharmacological management over behavioral therapies in certain regions sustains demand.

Market Challenges

- Safety Concerns: Risks associated with dependency, next-day impairment, and complex sleep behaviors limit long-term use.

- Regulatory Restrictions: Stringent prescribing guidelines, especially in Europe and the U.S., restrict overuse.

- Competition: Other pharmacological options like melatonin receptor agonists (e.g., ramelteon) and non-pharmacologic therapies reduce zolpidem's market share.

Key Trends

- Shift toward Generics: Patent expiries have drastically lowered prices.

- Emerging Markets Growth: Increasing healthcare infrastructure and awareness expand market reach.

- Formulation Innovation: Development of alternative delivery systems (e.g., sublingual tablets) aims to improve compliance.

Current Pricing Landscape

Pricing Overview

A survey of current retail and wholesale prices reveals significant variation based on geography, formulation, and brand status:

- North America: Branded zolpidem (e.g., Ambien) retails at approximately $10–$20 per tablet, although insurance often reduces out-of-pocket costs. Generics typically cost $2–$4 per tablet.

- Europe: Similar trends with branded products priced higher than generics; prices range from €10–€30 per pack, with generics at €3–€8.

- Asia-Pacific: Generally lower overall prices due to pricing regulations and market competition, with generics available at $1–$3 per dose.

Pricing Influencing Factors

- Patent and Marketing Strategies: While patent exclusivity ended globally around 2007, some formulation patents or secondary patents can influence pricing.

- Regulatory Approvals: Stringent approvals increase manufacturing costs, affecting prices.

- Market Penetration: High competition in generics suppresses prices.

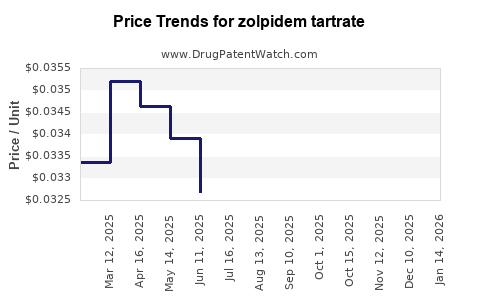

Market Projections and Price Trends (2023–2028)

Methodology

Price projections utilize historical pricing data, market penetration rates, the anticipated emergence of new formulations, competitive landscape shifts, and regulatory influences. Assumed steady growth in insomnia prevalence and generic market penetration underpin the projections.

Projected Market Growth

The global zolpidem market is expected to grow modestly at a compound annual growth rate (CAGR) of approximately 2–3% over the next five years, driven largely by emerging markets' expansion and increased sleep disorder diagnoses.

Future Price Trajectories

- Brand-Name Products: Due to patent protections and brand loyalty, prices are projected to remain relatively stable or slightly decline (~1–2% CAGR), influenced by inflation and cost pressures.

- Generics: Intense competition will sustain downward price pressure, with prices decreasing an estimated 4–6% annually, reaching $1.50–$2.50 per unit by 2028.

- Formulation Variants: Innovative delivery systems may command premium prices initially but are expected to follow similar downward trends over time.

Influencing Factors on Future Prices

- Regulatory Changes: Potential restrictions or approvals of biosimilars could influence pricing.

- Healthcare Policy: Push for cost containment and formulary decisions favoring generics will further suppress prices.

- Market Consolidation: Mergers and acquisitions could influence pricing strategies, either reducing or stabilizing prices based on market power.

Implications for Stakeholders

- Manufacturers: Emphasis on cost-efficient production and diversification into novel formulations can secure margins amidst declining prices.

- Healthcare Providers: Cost-effective generics improve accessibility but necessitate careful patient management concerning safety.

- Investors: Growing markets, especially in emerging regions, present opportunities despite aggressive price competition.

- Regulators: Balancing safety regulations with market access remains critical, influencing pricing indirectly.

Conclusion

The zolpidem tartrate market is characterized by mature, highly competitive dynamics dominated by generics, with marginal upward or downward price fluctuations expected in the medium term. While brand-name products will sustain premium valuations, generic prices are set to decline steadily, driven by global market saturation and regulatory pressures. Future innovations in formulation may temporarily bolster prices but will ultimately conform to prevailing market forces.

Key Takeaways

- The global demand for zolpidem tartrate remains robust due to high insomnia prevalence, especially in aging populations.

- Generic formulations dominate sales volume, driving prices downward with a projected annual decline of 4–6% over the next five years.

- Brand-name prices will likely remain stable or slightly decrease, constrained by patent protections and brand loyalty.

- Emerging markets will spur growth, but price sensitivity will continue to pressure margins globally.

- Innovation in delivery forms presents opportunities, but pricing will ultimately follow the broader trend of downward pressure.

FAQs

-

How does the patent expiry of zolpidem tartrate influence its market pricing?

Post-patent expiry in 2007, generic manufacturers entered the market, significantly reducing prices due to increased competition, leading to a downward pricing trend.

-

What factors could disrupt current price projections for zolpidem?

Regulatory changes, safety concerns leading to prescription restrictions, or the advent of innovative, cost-effective sleep therapies could alter market prices.

-

Are there any significant regional differences in zolpidem pricing?

Yes, prices are generally higher in North America and Europe due to brand dominance and regulatory environments, whereas emerging markets feature lower prices driven by competitive generic markets.

-

What role do formulations like extended-release play in future pricing?

While ER formulations tend to command higher initial prices due to added convenience, their prices are likely to decline over time, aligning with the generic trend.

-

How might changes in healthcare policies impact zolpidem prices?

Policies favoring cost containment, such as formulary restrictions and promotion of generics, will likely continue to exert downward pressure on prices globally.

References

- Morin CM, Bjorvatn B, Chung KF. Insomnia: definition, prevalence, etiology, and consequences. Sleep Medicine Reviews. 2021; doi:10.1016/j.smrv.2021.101393

- FDA. Ambien (Zolpidem) Prescribing Information. 2021.

- MarketWatch. Global Zolpidem Market Size, Share & Trends Report, 2023–2028.

- IMS Health. Medicinal Price Trend Analysis, 2022.

- European Medicines Agency. Zolpidem Summary of Product Characteristics. 2022.