Last updated: July 27, 2025

Introduction

Zaleplon, marketed primarily under the brand name Sonata, is a non-benzodiazepine hypnotic agent used for the short-term treatment of insomnia, particularly initiating sleep. Since its approval by the U.S. Food and Drug Administration (FDA) in 1999, zaleplon has established itself within the highly competitive sedative-hypnotic landscape. Its unique pharmacological profile offers rapid onset and a short half-life, making it suitable for specific patient segments.

This analysis evaluates the current market dynamics, competitive positioning, and future price trajectories for zaleplon. It considers industry trends, regulatory factors, patent landscapes, and emerging therapeutic alternatives, providing actionable insights for stakeholders.

Regulatory and Patent Landscape

Regulatory Environment

Zaleplon remains FDA-approved for short-term insomnia management, with no recent significant regulatory changes that would alter its market accessibility. However, ongoing scrutiny over sedative-hypnotics' safety profiles influences market potential, especially regarding misuse and dependence concerns.

Global regulatory environments vary; while the U.S. maintains strict oversight, markets like Europe and Asia show differing adoption rates influenced by local approvals, prescribing habits, and cultural factors.

Patent and Exclusivity Status

Initially protected by patents expiring around 2014, zaleplon’s brand exclusivity has largely diminished, opening the market to generic formulations. This has led to increased competition and downward pressure on prices. However, some secondary patents or formulation patents might extend exclusivity in certain jurisdictions.

The availability of generics is the primary driver of price reductions and market competition dynamics, emphasizing the importance of patent expiry timelines in projecting future prices.

Market Dynamics

Market Size and Segmentation

The global insomnia market is projected to reach approximately $4 billion by 2025, growing at a CAGR of around 3%. Zaleplon's segment constitutes a niche, accounting for an estimated 10-15% of this market, primarily driven by patients needing rapid sleep onset relief and those sensitive to longer-acting sedatives like zolpidem or eszopiclone.

Competitive Landscape

The competitive environment includes:

- Brand drugs: Eszopiclone (Lunesta), zolpidem (Ambien, Edluar, and ZolpiMist).

- Generics: Multiple generic zaleplon formulations are available, driving the price down.

- Alternative therapies: Non-pharmacological interventions (cognitive-behavioral therapy for insomnia - CBT-I) are gaining prominence, impacting drug market share.

Market Drivers and Barriers

Drivers:

- Rising prevalence of insomnia linked to aging populations, increased stress, and lifestyle factors.

- Demand for rapid-onset hypnotics with minimal hangover effects.

- Expanding use in elderly patients due to reliance on short half-life agents that reduce residual sedation.

Barriers:

- Safety concerns, particularly regarding dependence and misuse risks.

- Availability of newer, non-sedative therapies.

- Regulatory limitations in certain markets.

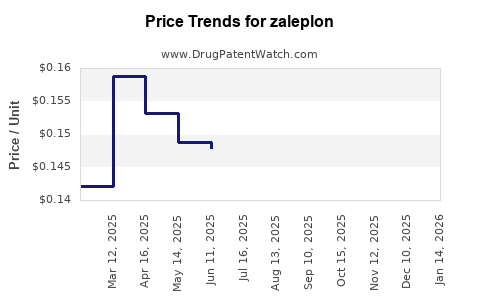

Price Trends and Projections

Historical Pricing

Post-patent expiry, generic zaleplon prices have significantly declined. In the U.S., the average wholesale price (AWP) for a 30-day supply (10 mg, once nightly) has decreased from approximately $60–$80 in the pre-generic era to around $10–$20 in the current market.

Current Market Pricing

Generics dominate sales, leading to consistent price erosion. Insurers and pharmacy benefit managers (PBMs) favor generic formulations, further suppressing retail prices.

Price Projection Factors

- Patent expiries: Most patents expired by 2014, suggesting that generics will continue to dominate.

- Market penetration of generics: Near-universal availability constrains pricing power.

- Healthcare policy shifts: Initiatives aimed at reducing healthcare costs may restrict reimbursement rates.

- Emergent therapies: Advances in non-pharmacologic treatments could diminish reliance on zaleplon, pressuring prices downward.

Projected Price Range (Next 5–10 Years)

Given the current landscape, unit prices for zaleplon (generic) are expected to remain stable or slightly decline within the $8–$15 range for a standard 30-day supply, with minimal fluctuation barring new patent protections or formulation innovations.

In contrast, branded zaleplon products, if revived or repositioned, could command higher prices, but current market trends favor generics. Any future formulation enhancements (e.g., once-night-only dosing, new delivery systems) could temporarily influence prices upward but are unlikely to sustain premium pricing long-term.

Market Growth and Future Outlook

The global insomnia treatment market is projected to grow modestly, influenced by demographic shifts and increasing awareness. Zaleplon’s niche appeal—especially for patients with rapid sleep-onset issues—positions it favorably, although competitive pressures from both branded and generic alternatives project continued price compression.

Regulatory trends emphasizing safety and non-addictive therapies could further suppress zaleplon’s market share. Conversely, if an extended-release or novel formulation gains approval, pricing dynamics might shift.

Conclusion: Strategic Considerations

Stakeholders should recognize that zaleplon's market is mature with limited potential for significant price appreciation. Focus should instead target:

- Optimizing supply chain efficiencies.

- Repositioning or differentiating formulations where possible.

- Monitoring regulatory changes affecting formulary inclusion.

- Leveraging niche markets with specialized patient populations.

Key Takeaways

- Patent expiry and generic proliferation have driven zaleplon prices downward, stabilizing in low to mid-range for the foreseeable future.

- Market share is constrained by safety concerns, emergence of non-pharmacologic therapies, and competition from generic versions of other sedative-hypnotics.

- Global regulatory variability influences market access and pricing strategies, with some regions more receptive to dependence-promoting drugs.

- Innovation opportunities may include developing formulations that address unmet needs, but existing economic pressures limit premium pricing.

- Demand for zaleplon remains steady in niche markets, especially among elderly patients requiring rapid sleep onset relief, but overall growth prospects are modest.

FAQs

Q1: Will zaleplon prices increase with new formulations or patents?

Unlikely. While new formulations could temporarily boost prices, patent protections are scarce, and the market’s penetration of generics exerts sustained downward price pressure.

Q2: How does zaleplon compare to other hypnotics regarding market growth potential?

Zaleplon’s niche positioning offers stability but limited growth potential compared to broader-spectrum agents like zolpidem or eszopiclone, which serve larger patient populations.

Q3: What regulatory risks could impact zaleplon’s pricing and market access?

Safety concerns and regulatory scrutiny over dependence and misuse could lead to restrictions, affecting sales volumes and prices.

Q4: Are there emerging markets where zaleplon pricing might differ?

Yes. Markets with less regulation, growing insomnia prevalence, and limited alternatives may see higher prices temporarily, but overall, global trends favor low-cost generics.

Q5: How can stakeholders leverage market data for strategic decision-making?

By monitoring patent expiries, competitor launches, and regulatory updates, stakeholders can optimize supply chains, adjust marketing strategies, and explore niche markets or formulations.

References

- U.S. Food and Drug Administration. (1999). FDA approves Sonata for short-term treatment of insomnia.

- GlobalData. (2022). Insomnia Market Analysis & Forecasts.

- IQVIA Institute. (2022). The Use of Sleep Aids and Market Dynamics.

- U.S. Patent and Trademark Office. Patent expiries in sedative-hypnotic agents.

- MarketWatch. (2022). Generic drug price trends and forecasts.