Last updated: July 29, 2025

Introduction

Zafirlukast, marketed primarily under the brand name Accolade, is a leukotriene receptor antagonist (LTRA) primarily used for the management and prevention of chronic asthma and allergic rhinitis. Released in the late 1990s, Zafirlukast belongs to a class of drugs designed to inhibit leukotriene pathways, thereby reducing airway inflammation and bronchoconstriction. Its significance in the respiratory therapeutics market persists despite the competitive landscape, with newer agents like montelukast gaining prominence.

This analysis examines the current market position of Zafirlukast, evaluates key factors shaping its demand, reviews competitive dynamics, and offers price projections over the next five years, focusing on industry trends, pricing strategies, and regulatory changes.

Market Overview and Current Position

Product Profile

Zafirlukast works by selectively blocking cysteinyl leukotriene receptor 1 (CysLT1), ultimately reducing airway inflammation and hyperresponsiveness. Its approval by the U.S. Food and Drug Administration (FDA) in 1996 catalyzed its entry into the asthma treatment market. While initially a preferred LTRA, Zafirlukast has diminished in market share over recent years in favor of montelukast (Singulair) and other inhaled corticosteroids (ICS).

Market Size and Demand Dynamics

The global asthma therapeutics market is projected to reach USD 31.3 billion by 2027, growing at a CAGR of approximately 4.8% (Research and Markets, 2022). Zafirlukast’s share within this market is declining, estimated at less than 2% of the total asthma meds segment. Its primary consumers are established patients with specific contraindications to montelukast or those seeking alternative LTRA options.

While prescription volume for Zafirlukast has decreased globally, it maintains niche demand in certain regions and among specific patient populations, including those with unique side effect profiles or allergies contraindicating other medications. Its utilization is primarily driven by formulary protocols, clinician preference, and patient-specific factors.

Regulatory and Reimbursement Environment

Zafirlukast’s patent expiration in various markets has led to increased generic availability, intensifying price competition. Reimbursement policies vary by country, with some health systems favoring generics to reduce costs. Regulatory agencies continue to monitor the safety profile, especially regarding neuropsychiatric side effects associated with similar agents, affecting market confidence.

Competitive Landscape

Key Competitors

- Montelukast (Singulair): Market leader, with robust global penetration due to once-daily dosing, efficacy, and broad pediatric approval.

- Inhaled Corticosteroids (ICS): Such as fluticasone, increasingly replacing older LTRAs as first-line therapy.

- Other Leukotriene Modifiers: Including zileuton (a 5-lipoxygenase inhibitor), offering alternative pathways.

Market Penetration and Positioning

Despite competition, Zafirlukast retains a niche, often favored in specific cases such as patients experiencing adverse neuropsychiatric effects with montelukast or those with specific pharmacokinetic needs. Its positioning as an alternative rather than a first-line therapy limits its overall market potential.

Pricing Strategy and Trends

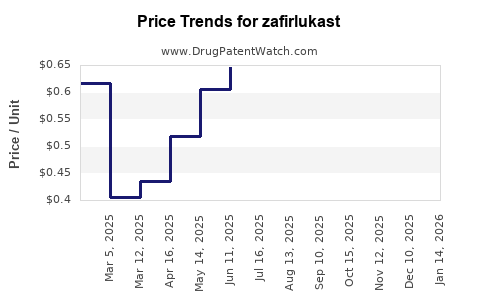

Historical Pricing Trends

Initially, Zafirlukast’s price point aligned with other branded asthma medications, with retail prices ranging from USD 150–200 per month of therapy. The advent of generics in the late 2000s resulted in significative price erosion, with average prices dropping by 40-60% in many markets.

Generic Competition and Impact

Generic Zafirlukast's entry in multiple markets has led to substantial downward pressure. Retail prices for generics now vary between USD 50–80 per month, depending on regional factors, pharmacy margins, and reimbursement policies.

Current Pricing Landscape

The price disparity across regions reflects differing healthcare policies:

- United States: Approximately USD 70–90 per month for generics, with insurance coverage influencing patient out-of-pocket costs.

- Europe: Prices decline further, often subsidized or reimbursed, roughly USD 50–70 per month.

- Emerging Markets: Prices are substantially lower, between USD 30–50, aligned with lower manufacturing costs and negotiating power of healthcare systems.

Factors Influencing Price Projections

- Patent Expiry and Generic Availability: Continued expansion of generics is expected to sustain downward price pressure.

- Regulatory Changes: Ongoing safety monitoring and potential label changes may influence market confidence and demand.

- Market Demand: Niche demand in select populations could stabilize prices, but overall, Zafirlukast's market share is likely to shrink.

- Supply Chain Dynamics: Manufacturing costs, supply chain resilience, and regional distribution can impact final prices.

- Healthcare Policies: Emphasis on cost containment and biosimilar entry may further heighten price competition.

Five-Year Price Projection

Based on current trends, historical data, and industry forecasts, the following projections are made:

| Year |

Estimated Price Range (USD/month) |

Commentary |

| 2023 |

USD 50–80 |

Continued generic penetration; slight reduction from 2022 prices. |

| 2024 |

USD 45–75 |

Increased generic competition and possible consolidation in supply. |

| 2025 |

USD 40–70 |

Marginal continuous decline; niche demand sustains residual pricing. |

| 2026 |

USD 40–65 |

Possible stabilization as demand narrows; potential new formulations unlikely. |

| 2027 |

USD 35–60 |

Market remains dominated by generics; prices stabilize at lower end. |

Assumptions:

- Absence of new patent grants or market exclusivity extensions.

- No significant regulatory barriers impacting production or approval.

- Continued emphasis on cost-effective healthcare, favoring generic dispensing.

Key Market Drivers and Challenges

Drivers

- Patent Expiry and Generics: Open avenues for price erosion but expand market access.

- Specialist Niche Demand: Limited but steady demand in certain patient subsets.

- Cost Governments Favor: Preference for affordable generics in publicly funded healthcare systems.

Challenges

- Market Shrinkage: Competition from montelukast and ICS reduces overall demand.

- Safety and Side Effects: Neuropsychiatric concerns with related drugs may influence the prescribing landscape.

- Emerging Therapies: Novel biologics and personalized medicine approaches threaten traditional oral therapies.

Conclusion

Zafirlukast’s future in the respiratory therapeutics market appears constrained by evolving competitive dynamics and patent expiries. Its niche utility sustains modest demand, yet widespread adoption diminishes steadily. Price-wise, generics dominate, reinforcing a downward trajectory over the coming five years, with prices stabilizing in the USD 35–60 monthly range.

For stakeholders, strategic positioning—particularly emphasizing niche markets, safety profile advantages, and cost competitiveness—will be critical. Market entrants or existing manufacturers should consider these factors alongside regional healthcare policies when devising pricing and distribution strategies.

Key Takeaways

- Zafirlukast’s global market share is declining due to competition from montelukast and other asthma therapies.

- Generic entry has significantly lowered its price, with projections indicating further declines over the next five years.

- Its niche positioning ensures residual demand, mainly in specific patient populations with contraindications to other agents.

- Market drivers include cost containment policies and reformulations, but challenges persist from newer therapies and safety concerns.

- Strategic opportunities lie in targeted marketing within niche markets and leveraging cost advantages of generics.

FAQs

1. How does Zafirlukast compare to montelukast in efficacy?

Both are leukotriene receptor antagonists, with comparable efficacy in controlling asthma symptoms. However, montelukast generally offers more convenient dosing (once daily) and has broader pediatric approval, contributing to its market dominance.

2. Will Zafirlukast regain market share in the future?

Unlikely, unless significant advances in safety profile, formulation improvements, or targeted indications emerge. Market trends favor newer agents with better compliance and safety data.

3. How does patent expiration affect Zafirlukast pricing?

Patent expiration enables generic manufacturers to enter the market, increasing supply and reducing prices substantially; this trend is expected to continue.

4. Are there regional variations in Zafirlukast pricing?

Yes, pricing varies widely based on local approvals, healthcare policies, and the presence of generics, with emerging markets typically offering the lowest prices.

5. What innovative developments could influence Zafirlukast’s market?

Development of biosimilars, new delivery systems, or combination therapies could alter demand dynamics, but none are currently imminent.

References

[1] Research and Markets. “Global Asthma Drugs Market Forecast.” 2022.

[2] U.S. FDA Drug Database. “Zafirlukast (Accolade) Approval History.” 1996.

[3] IQVIA. “Pharmaceutical Market Data and Trends 2022.”

[4] European Medicines Agency. “Safety Updates on Leukotriene Receptor Antagonists.” 2020.