Share This Page

Drug Price Trends for victoza

✉ Email this page to a colleague

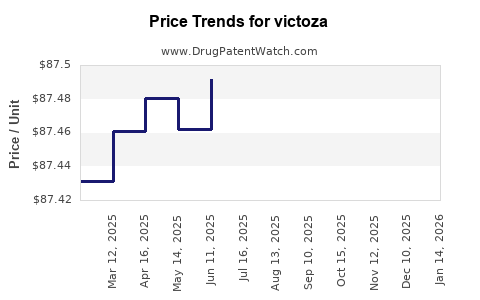

Average Pharmacy Cost for victoza

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VICTOZA 2-PAK 18 MG/3 ML PEN | 00169-4060-12 | 87.80433 | ML | 2025-12-17 |

| VICTOZA 3-PAK 18 MG/3 ML PEN | 00169-4060-13 | 87.75763 | ML | 2025-12-17 |

| VICTOZA 2-PAK 18 MG/3 ML PEN | 00169-4060-12 | 87.71537 | ML | 2025-11-19 |

| VICTOZA 3-PAK 18 MG/3 ML PEN | 00169-4060-13 | 87.59412 | ML | 2025-11-19 |

| VICTOZA 3-PAK 18 MG/3 ML PEN | 00169-4060-13 | 87.54773 | ML | 2025-10-22 |

| VICTOZA 2-PAK 18 MG/3 ML PEN | 00169-4060-12 | 87.64069 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Victoza

Introduction

Victoza (liraglutide) is a glucagon-like peptide-1 (GLP-1) receptor agonist developed by Novo Nordisk for the treatment of type 2 diabetes mellitus (T2DM) and obesity. Since its approval by the FDA in 2010, Victoza has established itself as a key player in the metabolic disorder therapeutics space, driven by its dual benefits of glucose regulation and weight management. As the global burden of T2DM escalates — with the International Diabetes Federation estimating 537 million adults affected worldwide as of 2021 — the market potential for Vulfranza remains substantial. This analysis explores current market dynamics, competitive landscape, regulatory considerations, and future price trajectories for Victoza.

Market Overview and Dynamics

Global Diabetes Market and Victoza's Position

The worldwide diabetes market is projected to reach approximately USD 114 billion by 2030, expanding at a CAGR of 7.1% (2021–2030) [1]. As a first-line injectable therapy for T2DM, Victoza commands a significant share within the GLP-1 receptor agonist segment, which is estimated to grow at a CAGR of around 10% over the same period.

Victoza’s therapeutic profile, featuring proven efficacy in glycemic control and weight reduction, positions it favorably among clinicians. Its once-daily administration caters to patient adherence, further consolidating its market penetration. The drug’s expanding indication portfolio—such as approval for obesity treatment under the brand name Saxenda—broadens its revenue streams, although with distinct pricing strategies.

Competitive Landscape

The GLP-1 market is increasingly competitive, with key rivals including Eli Lilly's Trulicity (dulaglutide), AstraZeneca's Bydureon (exenatide extended-release), and newer entrants like Eli Lilly's Mounjaro (tirzepatide). Mounjaro, recently approved for T2DM and obesity, exhibits superior glycemic-lowering effects and weight management benefits, potentially encroaching on Victoza’s domain.

Moreover, oral GLP-1 options and SGLT2 inhibitors continue to challenge injectable therapies, emphasizing the importance of brand loyalty and pricing strategies for Victoza.

Regulatory and Market Penetration Factors

Regulatory approvals across emerging markets (e.g., China, India) are pivotal for growth. Despite high prevalence, affordability remains a hurdle, necessitating strategic pricing to improve accessibility. The recent push for value-based care models globally could influence reimbursement and formulary inclusion, impacting Victoza’s sales.

Pricing Strategies and Trends

Current Pricing Landscape

Victoza's list price in the United States is approximately USD 1,000-$1,200 per month for a typical treatment course, translating to roughly USD 12,000-$14,000 annually [2]. Actual out-of-pocket costs vary widely depending on insurance coverage, discounts, and rebates.

In Europe and other developed regions, prices are comparable or slightly lower due to negotiated payer agreements. Notably, in the US, the high list price contrasts with manufacturer rebates and patient assistance programs.

Factors Influencing Price Trends

-

Market Competition: The advent of biosimilars and entrenched brands like Trulicity exert downward pressure on Victoza’s pricing, compelling pharmaceutical firms to adopt value-based pricing strategies.

-

Indication Expansion: The approval of Victoza’s biosimilar or its successor products could prompt significant price adjustments, aligned with generic or biosimilar markets.

-

Pricing in Emerging Markets: Lower income nations necessitate differential pricing models. Novo Nordisk has committed to tiered pricing and patient assistance programs, which could influence global average prices.

-

Reimbursement Policies: Payers’ willingness to reimburse high-cost therapies, especially under value-based arrangements, directly affects net achievable prices.

Projected Price Trends (2023–2030)

-

Short-term (2023–2025): Prices are expected to plateau, with minor adjustments driven by inflation and competitive pressures. Payer negotiations and rebates may reduce net prices by 15–25%.

-

Mid-term (2025–2027): Introduction of biosimilars, if approved, could lead to a 20–30% reduction in list prices; however, brand loyalty and clinical benefits may limit steep discounts.

-

Long-term (2028–2030): Ongoing innovation, including oral formulations or combination therapies, could reshape pricing paradigms. Prices may decrease further, particularly in emerging markets, possibly reaching USD 7,000–USD 9,000 annually in certain regions.

Future Market and Price Projection Models

Forecasting Victoza’s sustainable revenue and price trajectory involves integrating multiple factors:

-

Market Penetration: Assuming a conservative annual growth of 5-8% influenced by increasing global prevalence and expanded indications.

-

Competitive Dynamics: Inclusion of integrative therapies like Mounjaro may catalyze price erosion, but brand loyalty and clinical differentiation could sustain premium pricing for Victoza.

-

Regulatory and Reimbursement Trends: Moving toward value-based pricing models could promote price reductions but also foster premium pricing for superior efficacy and safety profiles.

Based on these parameters, a realistic projection for Victoza's average annual net price in established markets by 2030 could range from USD 8,000 to USD 12,000, in line with evolving competitive and regulatory conditions.

Key Market Opportunities and Challenges

-

Opportunities:

- Expansion into emerging markets via tiered pricing.

- Leveraging its dual role in glycemic control and weight management.

- Future combination therapies with SGLT2 inhibitors or newer agents.

-

Challenges:

- Intense competition, especially from biosimilars and oral GLP-1 formulations.

- Price sensitivity amid rising healthcare costs.

- Patent expirations, pending biosimilar approvals.

Key Takeaways

- Victoza remains a prominent player in the global T2DM and obesity markets, with growth driven by rising disease prevalence and expanding indications.

- Current pricing approaches are influenced by competitive pressures, reimbursement policies, and patient affordability, with a trend toward stabilization or gradual reduction.

- Innovative therapies, biosimilar entries, and policy shifts will significantly impact future pricing, with projections indicating notable price declines in the coming years.

- Strategic positioning, including market expansion and lifecycle management, remains critical for maintaining revenue streams.

- Stakeholders should monitor regulatory changes, emerging competitors, and payer dynamics to optimize pricing and market share.

FAQs

1. How does Victoza compare to other GLP-1 receptor agonists in terms of pricing?

Victoza’s list price remains higher than some competitors, but actual net prices are influenced by rebates and negotiations. Drugs like Trulicity often have similar or slightly lower net costs, but differences in dosing schedules, efficacy, and safety profiles can justify price premiums for Victoza.

2. What factors could lead to Victoza’s price decline in the near future?

Introduction of biosimilars, increased competition from newer agents like Mounjaro, patent expirations, and shifts toward value-based reimbursement models can accelerate price reductions.

3. Are there geographical differences in Victoza’s pricing?

Yes. Developed markets generally have higher list prices, while emerging markets employ tiered, subsidized, or negotiated prices tailored to affordability and reimbursement frameworks.

4. How might new clinical data influence Victoza’s market share and pricing?

Positive data demonstrating superior efficacy or safety could reinforce its premium positioning, supporting stable or increased pricing. Conversely, data favoring competitors may trigger price competition.

5. What is the outlook for Victoza’s revenue in the next decade?

While expected to decline modestly due to biosimilar competition and market saturation, expansion into new markets and indications could offset some declines, sustaining overall revenues through 2030.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition. 2021.

[2] GoodRx. Victoza Price and Cost: How Much Does It Cost? 2022.

More… ↓