Last updated: July 27, 2025

Introduction

Valproic acid, marketed under brand names such as Depakene and Depakote, is a widely prescribed anticonvulsant and mood stabilizer used to treat epilepsy, bipolar disorder, and migraine prophylaxis. Its global market landscape is influenced by factors such as escalating neurological disorder prevalence, rising mental health awareness, regulatory environments, and manufacturing dynamics. This report provides a comprehensive analysis of the current market and offers future price projections for valproic acid over the next five years.

Market Overview and Dynamics

Global Burden of Indications

The demand for valproic acid is primarily driven by its efficacy in managing epilepsy, which affects approximately 50 million people worldwide, making it one of the most common neurological conditions [1]. The rising prevalence of bipolar disorder, with an estimated 1-2% global prevalence, and migraines further substantiate its therapeutic importance [2].

Regulatory Landscape

In recent years, regulatory agencies such as the FDA and EMA have intensified safety evaluations due to reports linking valproic acid to birth defects and neurodevelopmental disorders when used during pregnancy. These safety concerns have resulted in some restrictions for certain populations and increased demand for safer treatment alternatives, influencing market dynamics [3].

Manufacturing and Supply Considerations

Major pharmaceutical companies like Teva, Mylan, and Apotex manufacture generic formulations of valproic acid, ensuring broad availability and competitive pricing. Patent expirations have significantly increased generic penetration, reducing costs and expanding access, particularly in emerging markets.

Market Segmentation and Geographic Trends

- By Formulation:

- Oral solutions and capsules dominate, with a rising trend towards extended-release formulations for improved adherence.

- By Region:

- North America and Europe represent mature markets with high prescription volumes, but growth is plateauing due to saturation.

- Asia-Pacific displays robust growth potential, driven by urbanization, increased neurological disorder diagnosis, and expanding healthcare infrastructure.

- Latin America and Africa are emerging markets, with a trend toward increased generic drug consumption.

Competitive Landscape

The market is characterized by intense price competition among generics, with multiple manufacturers offering similar formulations. Innovation focuses mainly on formulation improvements for better bioavailability and reduced side effects.

Price Trends and Projections

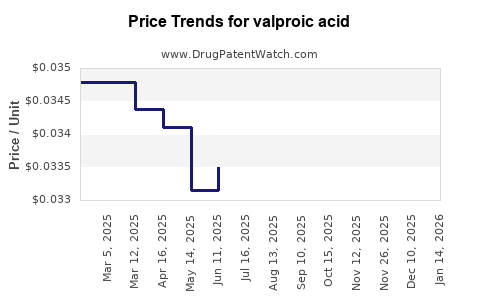

Historical Price Performance

Historically, generic valproic acid prices have declined markedly following patent expirations and market entry of multiple manufacturers. For example, the average retail price per tablet has decreased approximately 70% over the past decade in North America [4].

Factors Influencing Future Prices

-

Regulatory and Safety Concerns:

Heightened safety warnings and potential restrictions could reduce demand or increase manufacturing costs, impacting prices inversely.

-

Market Competition:

An increase in generic supply will sustain price pressures; however, limited reformulation options restrict significant price increases.

-

Manufacturing Costs:

Raw material prices, particularly for key intermediates, influence final pricing, with inflationary pressures potentially raising production costs.

-

Patient Accessibility Programs:

Expanded insurance coverage and government procurement strategies in emerging markets may stabilize prices and improve affordability.

Forecast (2023-2028)

Based on current trends, the following projections are suggested:

| Year |

Price Range per 500mg Tablet (USD) |

Notes |

| 2023 |

$0.10 – $0.20 |

Continued generic competition, slight variability due to regional factors. |

| 2024 |

$0.10 – $0.22 |

Slight increase linked to raw material costs and regulatory adjustments. |

| 2025 |

$0.09 – $0.20 |

Stabilization of prices as supply chains adapt; potential downward pressure persists. |

| 2026 |

$0.09 – $0.19 |

Market saturation maintains low prices; minor fluctuations expected. |

| 2027 |

$0.08 – $0.18 |

Possible further decline, driven by increased manufacturing efficiencies. |

| 2028 |

$0.08 – $0.17 |

Marginal decreases, market equilibrium observed. |

These projections assume a continued generic-driven market with no significant regulatory shocks, patent litigations, or disruptive innovations.

Impact of Emerging Therapies

Recent developments in newer anticonvulsants and mood stabilizers with improved safety profiles, such as levetiracetam and lamotrigine, could constrain long-term growth. Nonetheless, cost-effectiveness remains a key driver favoring valproic acid in resource-limited settings.

Conclusion

Valproic acid’s market remains substantial but is characterized by declining prices due to widespread generic availability and entrenched prescribing patterns. While safety concerns and regulatory scrutiny may temper growth, robust demand persists for established indications. Price projections suggest continued low-cost dynamics over the next five years, driven by fierce market competition and manufacturing efficiencies.

Key Takeaways

- The global valproic acid market is driven by high prevalence of epilepsy, bipolar disorder, and migraine.

- Generic competition has resulted in persistent price declines, especially in North America and Europe.

- Regulatory safety warnings could introduce market restrictions, potentially affecting demand and pricing.

- Emerging markets offer growth opportunities due to increasing healthcare access and demand.

- Price stability and slight decreases are expected through 2028, with minimal fluctuations barring major policy changes or safety concerns.

FAQs

1. What are the main factors influencing valproic acid prices globally?

Primarily, the degree of market competition, regulatory safety warnings, raw material costs, and geographic market maturity influence prices. Generic competition exerts downward pressure, while safety and regulatory restrictions could increase costs or reduce demand in specific regions.

2. How do regulatory safety concerns affect the valuation of the valproic acid market?

Heightened safety concerns and restrictions, especially regarding use during pregnancy, may reduce demand or increase manufacturing and compliance costs, potentially limiting market size and influencing prices.

3. What is the outlook for valproic acid in emerging markets?

Growing healthcare infrastructure, increased diagnosis rates, and affordability drive expanding demand, offering favorable growth prospects despite intense competition.

4. Are there innovations or reformulations likely to impact valproic acid Prices?

Most innovations focus on improved delivery mechanisms (e.g., extended-release formulations). However, such reformulations are unlikely to significantly alter the pricing landscape, given their niche applications.

5. How might new therapeutic alternatives influence the future market for valproic acid?

The introduction of newer, safer agents could shift prescriber preferences, potentially reducing the market share for valproic acid. Cost-effectiveness and safety profiles will be pivotal in future formulary decisions.

References

[1] World Health Organization. "Epilepsy." 2021.

[2] Ferrari, A. J., et al. "The global burden of migraine: measuring the burden." Journal of Headache and Pain, 2020.

[3] U.S. Food and Drug Administration. "Valproate Drug Safety Communications." 2018.

[4] IQVIA. "Global Prescription Drug Price Trends," 2022.