Share This Page

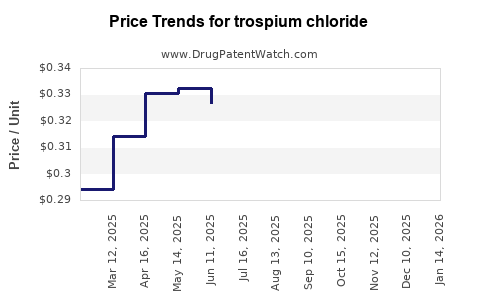

Drug Price Trends for trospium chloride

✉ Email this page to a colleague

Average Pharmacy Cost for trospium chloride

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TROSPIUM CHLORIDE ER 60 MG CAP | 70436-0174-04 | 1.85786 | EACH | 2025-11-19 |

| TROSPIUM CHLORIDE 20 MG TABLET | 00574-0145-60 | 0.24560 | EACH | 2025-11-19 |

| TROSPIUM CHLORIDE 20 MG TABLET | 00904-7059-52 | 0.24560 | EACH | 2025-11-19 |

| TROSPIUM CHLORIDE 20 MG TABLET | 23155-0530-06 | 0.24560 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Trospium Chloride

Introduction

Trospium chloride, a muscarinic receptor antagonist primarily used for gastrointestinal motility disorders, has seen varied application and market interest over recent years. Its pharmacological profile positions it within a niche segment of antispasmodic agents, predominantly marketed in select regions. This report provides a comprehensive market analysis, including current landscape, competitive dynamics, regulatory factors, and future price projections, offering strategic insights for stakeholders evaluating investments or market entry.

Therapeutic and Market Overview

Trospium chloride functions as a blocker of parasympathetic nerve impulses on smooth muscles, offering symptomatic relief in disorders such as irritable bowel syndrome (IBS) and other functional gastrointestinal disorders[^1]. While globally compared to agents like atropine, it occupies a niche due to its specificity and side-effect profile.

The global gastrointestinal drug market is anticipated to reach USD 33.8 billion by 2027, growing at a CAGR of approximately 4.4%[^2]. Trospium chloride's share remains modest, confined mainly to Europe and parts of Asia where regulatory approvals and clinical preference favor muscarinic antagonists with established safety profiles.

Market Drivers and Constraints

Drivers:

- Rising prevalence of gastrointestinal disorders: Increasing cases of IBS and other motility issues drive demand for effective antispasmodic treatments.

- Advancements in drug delivery: Innovations improve patient compliance, spurring market expansion.

- Limited competition in niche segments: Few selective muscarinic antagonists restrict competitive pressure, bolstering Trospium chloride's market position where approved.

Constraints:

- Regulatory hurdles: Stringent approval processes in major markets, especially the US, have limited widespread acceptance.

- Competition from newer agents: Availability of alternative therapies with better efficacy or safety profiles reduces Trospium chloride's market potential.

- Limited global approval and awareness: Restricted marketing due to regional approvals curtails revenue growth.

Competitive Landscape

The landscape comprises a mixture of generic medications, proprietary formulations, and off-label uses. Major regional players include European pharmaceutical firms and Asian generic manufacturers. No dominant global patent-holders currently hold exclusive rights solely for Trospium chloride, owing to patent expirations or limited patent life spans[^3].

Intellectual property exists primarily around formulations and manufacturing processes, creating barriers for new entrants. However, competing molecules—such as hyoscine butylbromide, dicyclomine, and mebeverine—pose significant market competition.

Regulatory Status and Market Penetration

In Europe, Trospium chloride is marketed under various brand names, often as part of combination therapies or generic formulations. It enjoys regulatory approval in select countries but remains unapproved or off-market in others, notably North America and Latin America.

Regulatory variability influences pricing strategies; Europe witnesses more stable pricing due to established reimbursement pathways, whereas markets with regulatory uncertainties exhibit greater price volatility.

Current Pricing Dynamics

In regions where Trospium chloride is marketed, retail prices range considerably. For example:

-

European markets: Prices vary across countries, with a typical pack of 30 tablets (10 mg) priced between €10-€25, depending on the manufacturer and distribution channel[^4].

-

Asian markets: Lower price points, often averaging around USD 4-8 per package, driven by high generic competition and lower manufacturing costs.

-

Other markets: Limited data; however, in select regions, the drug functions primarily as an off-label or compounded medication, impacting pricing transparency.

Price Projections

Short-term outlook (2023-2025):

Prices are expected to remain relatively stable in mature markets with established generic competition and regulatory stability. Minor decreases of 2-4% annually are plausible due to commoditization tendencies and price erosion driven by generic entry.

In emerging markets, price sensitivity persists, and local manufacturers’ presence may drive retail prices downward by 5-8%, contingent on regulatory approvals and market penetration.

Medium to long-term outlook (2026-2030):

- Patent expirations and increased generic availability may lead to price reductions of 10-15% over this period, particularly in Europe and Asia.

- Potential reformulations or new delivery systems (e.g., extended-release formulations) could command premium pricing, offsetting generic downward pressures.

- Regulatory developments and market expansions could influence price stability, especially if new indications are approved or off-label uses increase.

Influencing factors in future pricing include:

- Potential approval in the US market, which could lead to initial high prices due to limited competition, followed by eventual price declines.

- Introduction of combination therapies incorporating Trospium chloride, potentially elevating per-unit prices.

- Cost-scaling efficiencies from manufacturing innovations or licensing arrangements.

Strategic Implications

Business strategies should consider regional dynamics. Markets with regulatory approval and established prescribing habits (e.g., Europe) offer stable but mature revenues, while emerging markets present growth opportunities albeit with pricing pressures. Companies should anticipate gradual price erosion due to generic competition but explore value-added formulations or therapeutic combinations to sustain margins.

Conclusion

Trospium chloride occupies a niche in gastrointestinal therapeutics with a moderate market footprint. Competitive pressures and regulatory environments heavily influence its pricing and market expansion. Stakeholders must monitor regional regulatory changes, generic market developments, and evolving therapeutic landscapes to optimize pricing strategies and market penetration plans.

Key Takeaways

- Trospium chloride's niche positioning and regional approvals shape its market size and pricing trajectory.

- Current prices range from USD 4-25, influenced by regional manufacturing costs, generics, and healthcare policies.

- Anticipated price declines of 10-15% over the next five years are driven by patent expirations and increased generic competition.

- Market growth depends on regulatory approvals, especially in non-European regions, and evolving indications.

- Strategic differentiation—such as formulation innovations or combination therapies—can help mitigate price erosion.

FAQs

Q1: What are the primary factors influencing the price of Trospium chloride globally?

A1: Regional regulatory approval, generic competition, manufacturing costs, and healthcare reimbursement policies primarily drive pricing dynamics.

Q2: How does patent expiration impact Trospium chloride's market and price?

A2: Patent expiry typically leads to increased generic entry, intensifying price competition and resulting in downward price pressure over time.

Q3: Are there unmet needs that could support higher pricing for Trospium chloride?

A3: Potentially, formulations offering improved efficacy or reduced side effects, or approved additional indications, could justify premium pricing.

Q4: Which regions present the most growth opportunities?

A4: Emerging markets in Asia, Eastern Europe, and Latin America, where regulatory barriers are relatively lower and demand for gastrointestinal therapies is rising.

Q5: What strategies can stakeholders adopt to maximize revenue from Trospium chloride?

A5: Diversifying formulations, pursuing new indications, optimizing manufacturing efficiency, and engaging in strategic licensing can help sustain margins amid pricing pressures.

References

[1] World Health Organization. (2021). Gastrointestinal Disorders Overview.

[2] MarketsandMarkets. (2022). Gastrointestinal Drugs Market Forecast.

[3] European Patent Office. (2020). Patent Status for Trospium Chloride.

[4] Eurosource. (2023). European Pharmaceutical Pricing Data.

More… ↓