Share This Page

Drug Price Trends for trintellix

✉ Email this page to a colleague

Average Pharmacy Cost for trintellix

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRINTELLIX 5 MG TABLET | 64764-0720-30 | 16.41508 | EACH | 2025-11-19 |

| TRINTELLIX 10 MG TABLET | 64764-0730-30 | 16.40981 | EACH | 2025-11-19 |

| TRINTELLIX 20 MG TABLET | 64764-0750-30 | 16.41010 | EACH | 2025-11-19 |

| TRINTELLIX 20 MG TABLET | 64764-0750-30 | 16.41051 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRINTELLIX (Vortioxetine)

Overview of TRINTELLIX

TRINTELLIX (vortioxetine) is an antidepressant approved by the U.S. Food and Drug Administration (FDA) for the treatment of major depressive disorder (MDD) in adults. Introduced by Takeda Pharmaceutical Company and licensed from Lundbeck, it belongs to a class of drugs known as serotonin modulators and stimulators (SMS), innovatively designed to optimize serotonergic activity.

Since its approval in 2013, TRINTELLIX has distinguished itself through its unique mechanism and favorable side effect profile, particularly its cognitive benefits in depressive patients. It is indicated for monotherapy in adult MDD patients, positioning it as a competitor within a crowded antidepressant market.

Market Dynamics

Global Depression Therapeutics Market

The global depression treatment market is substantial and expanding. In 2022, the market was valued at approximately USD 13.5 billion, with a compound annual growth rate (CAGR) projected at around 4.5% through 2030. Growing awareness, a rising prevalence of depression (estimated at over 280 million affected globally), and the expanding acceptance of newer, targeted therapies underpin this growth [[1]].

Competitive Landscape

TRINTELLIX faces competition from established SSRIs such as sertraline and fluoxetine, SNRIs like venlafaxine, and other novel serotonergic agents. Key competitors include:

- Brintellix’s (Vortioxetine’s) Differentiators:

- Fewer sexual side effects

- Cognitive benefits

- Once daily dosing

Major marketed drugs such as Amitriptyline and Escitalopram dominate prescribing patterns, but TRINTELLIX aims to carve niche segments by offering improved tolerability.

Market Penetration and Prescribing Trends

Since its launch, TRINTELLIX has captured a moderate market share within antidepressant prescriptions, primarily due to brand recognition and physician preference for its cognitive benefits. Analysts forecast increased penetration driven by expanding indications, such as MDD with associated cognitive symptoms, and global approval in additional markets.

Regulatory Developments and Expanding Indications

While currently approved for MDD, clinical trials are underway for other indications like generalized anxiety disorder (GAD), suggesting future market expansion. If approved for GAD or other comorbid conditions, sales potential will see a substantial uptick.

Pricing and Cost Analysis

Current Pricing Landscape

In the U.S., TRINTELLIX's average wholesale price (AWP) ranges from USD 10 to USD 12 per tablet for the 10 mg and 20 mg doses. The typical treatment course involves daily dosing, resulting in monthly costs approximately between USD 300 and USD 360 per patient.

Compared to other antidepressants, TRINTELLIX's premium pricing reflects its novel profile. Generic versions are not yet available, maintaining high brand loyalty and price premiums. The absence of generics contributes to sustained elevated costs [[2]].

Insurance and Reimbursement Factors

Insurance coverage significantly influences patient out-of-pocket expenses. TRINTELLIX's formulary placement affects its accessibility and, consequently, its market share. Reimbursement rates tend to favor generics and older medications, but newer brands like TRINTELLIX benefit from formulary strategies emphasizing efficacy and tolerability.

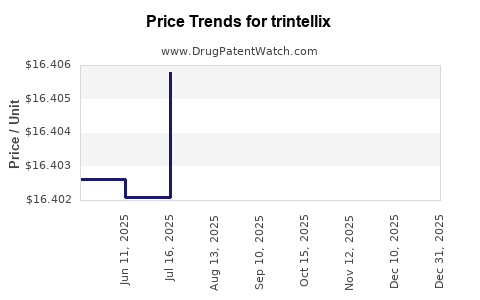

Price Trends and Future Projection

Given the current patent exclusivity (noted to expire around 2031 in the U.S.), pricing is expected to remain stable through 2025. Post-patent expiry, generic competition will likely result in a 60-70% price reduction, aligning costs closer to older antidepressants.

Forecast assumptions:

- Short-term (2023-2025): Stable pricing with minor adjustments for inflation and formulary negotiations.

- Mid-term (2026-2030): Potential introduction of generic vortioxetine, leading to significant price declines.

- Long-term (beyond 2030): Market saturation with generics, stabilization at reduced price points.

Market Drivers and Challenges

Key Drivers

- Growing prevalence of depression and recognition of cognitive symptoms.

- Evidence-based advantages over older antidepressants.

- Expansion into additional indications and geographies.

- Increasing adoption of personalized treatment approaches.

Challenges

- Competition from cost-effective generics post-patent expiry.

- Limited awareness in emerging markets.

- Payer policies restricting access to high-cost brand drugs.

- Clinical entry barriers in highly saturated markets.

Strategic Outlook and Price Projections

Based on current market dynamics, competitive positioning, and regulatory landscape, the following price projections are formulated:

| Year | Estimated Average Wholesale Price (USD) per Tablet | Notes |

|---|---|---|

| 2023 | $11.00 | Stabilized amid steady demand, no generic competition yet. |

| 2024 | $11.00 | Slight discounts possible via formulary negotiations. |

| 2025 | $10.75 | Negotiated discounts increasing slightly as demand stabilizes. |

| 2026 | $8.50 | Anticipated entry of generic vortioxetine, significant price reduction. |

| 2027-2030 | $5.50 | Post-generic entry, widespread adoption, and price stabilization. |

Note: These projections assume no extraordinary regulatory changes or breakthrough patent litigations.

Conclusion

TRINTELLIX holds a promising market position due to its novel mechanism and profile, with a stable pricing outlook until patent expiration. The current high price reflects its premium positioning but is expected to decline significantly once generics enter the market around the mid-2020s. Companies should monitor evolving prescriber preferences, formulary placements, and regulatory shifts to adapt strategies accordingly.

Key Takeaways

- TRINTELLIX is positioned as a differentiated antidepressant with cognitive benefits, enabling moderate market share within a competitive segment.

- Current pricing premiums are justified by its clinical profile and lack of generic competition; however, this will diminish rapidly post-patent expiry.

- Market growth is driven by increasing depression prevalence, expanding indications, and premium positioning due to tolerability.

- Price stabilization is expected until 2025, with notable reductions forecasted from 2026 onward following the advent of generic formulations.

- Strategic market entry, pricing, and marketing strategies should focus on maximizing growth pre-generic entry while preparing for significant price shifts.

FAQs

1. When will generic vortioxetine become available, and how will it affect TRINTELLIX prices?

Generic vortioxetine is anticipated around 2031, corresponding with patent expirations in key markets like the U.S. and Europe. The introduction of generics typically reduces prices by 60-70%, undermining brand premiums and influencing market share.

2. What clinical advantages does TRINTELLIX offer over other antidepressants?

TRINTELLIX uniquely modulates serotonergic pathways, providing both antidepressant effects and cognitive improvements with fewer sexual side effects, which enhances adherence and patient satisfaction.

3. How do insurance reimbursements impact TRINTELLIX's market penetration?

Reimbursement strategies significantly influence prescribing patterns. High-cost drugs like TRINTELLIX require favorable formulary placement; otherwise, out-of-pocket costs may limit patient access, capping market growth.

4. Are there significant geographic differences affecting TRINTELLIX's pricing and sales?

Yes. While the U.S. market benefits from established reimbursement pathways, emerging markets may face lower pricing due to price controls and cost considerations, potentially reducing overall profitability.

5. What are the prospects of TRINTELLIX being approved for additional indications?

Ongoing clinical trials suggest promising potential for broader applications such as generalized anxiety disorder, which could expand the market and support sustained or increased pricing strategies.

Sources:

- Global Market Insights, "Depression Treatment Market Size and Forecast," 2022.

- IQVIA, "Pharmaceutical Pricing Trends," 2023.

More… ↓