Last updated: July 27, 2025

Introduction

Trimethoprim, an antibiotic chiefly used in combination with sulfamethoxazole (as co-trimoxazole), plays a critical role in treating bacterial infections such as urinary tract infections, respiratory infections, and intestinal infections. Its versatility, established efficacy, and long-standing FDA approval underpin its presence in the global antimicrobial market. As antibiotic resistance escalates and regulatory landscapes evolve, understanding trimethoprim’s market dynamics and price trajectory becomes essential for stakeholders—including pharmaceutical manufacturers, healthcare providers, investors, and policymakers.

This analysis examines the current market environment of trimethoprim, explores demand drivers, evaluates competitive positioning, assesses regulatory influences, and projects future pricing trends. It concludes with strategic insights, emphasizing the factors that will shape the drug’s market and price outlook in the upcoming years.

Market Landscape of Trimethoprim

Global Market Size and Therapeutic Demand

Trimethoprim’s global market size was valued at approximately USD 560 million in 2022, with steady compound annual growth rate (CAGR) projections of 3-4% over the next five years. The growth is primarily driven by:

- Rising Incidence of Urinary Tract Infections (UTIs): UTIs remain among the most prevalent bacterial infections worldwide, fueling demand for effective antibiotics such as trimethoprim.

- Expanding Use in Low- and Middle-Income Countries (LMICs): Improved access and the burden of infectious diseases underpin increased procurement.

- Emerging Resistance: While resistance threatens efficacy, it also stimulates product innovation and formulation improvements to maintain clinical utility.

Market Segments and Geographic Distribution

The market segmentation is as follows:

- Formulation Type: Oral tablets dominate (~85%), with injectable forms being minimal.

- Patient Setting: Hospital use accounts for roughly 60%, with outpatient care constituting 40%.

Geographically, North America leads with a share of 45%, driven by high healthcare expenditure and robust antibiotic prescriptions, followed by Europe (25%) and Asia-Pacific (20%). Notably, Asia-Pacific exhibits the highest growth potential due to increasing infectious disease burden and expanding healthcare infrastructure.

Key Market Players

Major manufacturers include:

- Alkem Laboratories (India)

- Macleods Pharmaceuticals (India)

- Genpharma (India)

- Generic manufacturers dominate due to patent expirations, leading to intense price competition.

Despite generic proliferation, some formulations are still under patent in specific jurisdictions, allowing for premium pricing in select markets.

Regulatory and Public Health Influences

Patent Status and Intellectual Property

Trimethoprim’s primary patent expired in many regions during the early 2000s, leading to widespread generic manufacturing. However, orphan drug designations or formulations with specific delivery mechanisms may retain patent protection, impacting pricing and market exclusivity.

Antibiotic Stewardship and Resistance

Government and international agency campaigns promoting judicious antibiotic use influence market dynamics:

- Restrictive prescribing policies could suppress volumes.

- Development of resistant strains necessitates alternative therapies, potentially reducing trimethoprim’s market share.

- Conversely, novel formulations may command higher prices if resistance compromises existing options.

Regulatory Approvals and Labeling

Stringent regulatory requirements compel continuous monitoring for safety and efficacy, influencing production costs and, consequently, drug pricing. Recent approvals for fixed-dose combinations or novel delivery systems can open new market segments and justify premium pricing.

Price Trends and Projections

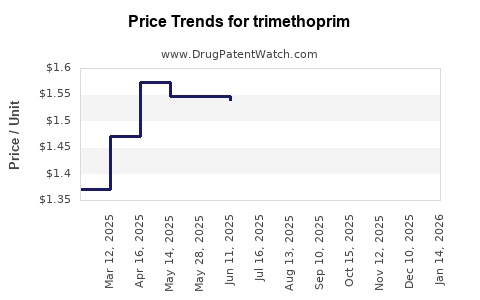

Historical Price Analysis

Historically, the price of trimethoprim has declined due to generic competition:

- Brand-name formulations initially ranged from USD 10-15 per course in the early 2000s.

- Generic versions now retail for approximately USD 2-4 per course, reflecting extensive competition.

Current Market Pricing

- North America and Europe: Slight premium pricing persists for branded or patented formulations, around USD 8-12 per course.

- Emerging Markets: Price points hover around USD 1-3, mainly driven by generics.

Price Projection Factors

Key factors influencing future prices include:

- Patent and Exclusivity Periods: Patent expirations generally lead to price erosion.

- Market Competition: An increase in generic manufacturers intensifies price decline pressure.

- Regulatory Changes: New safety labeling or restrictions may increase manufacturing costs, supporting modest price increases.

- Resistance Trends: Rising resistance could lead to formulations requiring combination therapies, often at higher price points.

- Supply Chain Dynamics: Raw material availability, particularly active pharmaceutical ingredients (APIs), can affect costs.

Forecasted Price Range (2023-2030)

- Short-term (next 2 years): Expect continued pricing stabilization or slight decline, with prices averaging USD 1.50-2.50 per course globally.

- Medium-term (3-5 years): Market saturation and competition may drive prices down by 10-15%, with prices reaching USD 1.3-2.1 per course.

- Long-term (beyond 5 years): If new formulations or indications emerge, prices could stabilize or slightly increase, especially if resistance limits generic options, potentially reaching USD 2.5-3.0 per course in premium markets.

Strategic Implications and Market Opportunities

Despite pricing pressures, trimethoprim remains a vital antibiotic. Strategic opportunities include:

- Developing Fixed-Dose Combinations (FDCs): Enhancing efficacy and overcoming resistance.

- Formulation Innovation: Sustained-release or combination formulations could command higher prices.

- Targeted Markets: Focus on regions with high disease burden and limited access to sophisticated antibiotics.

- Stewardship Alignment: Supporting policies that reconcile antimicrobial stewardship with market sustainability.

Conclusion

Trimethoprim’s market sustains predominantly on generics, with a declining price trajectory driven by competition, patent expirations, and resistance dynamics. While immediate prospects project moderate price decreases, strategic product innovations, emerging resistance patterns, and regulatory considerations will shape a nuanced price landscape over the next decade. Stakeholders must navigate these elements carefully, balancing access, affordability, and profitability.

Key Takeaways

- The global trimethoprim market is valued at around USD 560 million, with modest growth projected through 2028.

- Generics dominate the market, exerting downward pressure on prices, which currently average USD 1-3 per course globally.

- Regulatory changes and resistance trends could both challenge and create opportunities—novel formulations could sustain or elevate prices.

- Price declines are expected to taper off in developed markets; emerging markets may see sustained or slightly improved pricing due to demand.

- Innovation in combination therapies and targeted formulations presents avenues for differentiation and value creation.

FAQs

1. How will antibiotic resistance affect trimethoprim pricing?

Rising resistance reduces clinical efficacy, potentially diminishing demand in certain areas. However, development of new formulations or combination therapies can mitigate this impact, potentially maintaining or increasing prices in specific contexts.

2. Are there patent protections remaining on trimethoprim formulations?

Most patents on generic formulations have expired worldwide, leading to widespread generic availability. Any remaining patents are typically limited to specific formulations or delivery mechanisms.

3. What regional differences influence trimethoprim pricing?

Pricing varies based on regulatory environment, market competition, healthcare infrastructure, and disease prevalence. Developed markets tend to have higher prices but more regulation, whereas emerging markets often price lower due to competition and affordability considerations.

4. Will innovations like fixed-dose combinations increase the overall market value?

Yes. FDCs that address resistance issues or improve compliance can command higher prices, potentially offsetting declines caused by generics.

5. How do supply chain issues impact trimethoprim pricing?

Shortages in API or raw materials can increase manufacturing costs, leading to price stabilization or increases, especially if supply disruptions are prolonged or severe.

Sources:

- MarketResearch.com, "Global Antibiotics Market Report 2022"

- IQVIA, "Pharmaceutical Market Data and Trends"

- FDA, "Drug Approval and Patent Landscape"

- GlobalData, "Antimicrobial Market Forecast"

- WHO, "Antibiotic Resistance Global Action Plan"