Last updated: July 27, 2025

Introduction

Triazolam, a short-acting benzodiazepine primarily used for short-term treatment of insomnia, has experienced varying market dynamics influenced by regulatory considerations, patent status, competing therapies, and shifting healthcare practices. Analyzing the current market landscape and projecting future prices necessitate a comprehensive understanding of its regulatory environment, manufacturing trends, competitive landscape, and demand-supply nuances. This report synthesizes these factors, offering strategic insights for stakeholders evaluating investment, manufacturing, or distribution opportunities related to Triazolam.

Pharmacological Profile and Therapeutic Use

Developed in the 1970s, Triazolam offers rapid onset and short duration of action, making it suitable for sleep initiation disorders. It functions by enhancing gamma-aminobutyric acid (GABA) activity, exerting sedative effects. Its pharmacokinetic properties—rapid absorption and metabolism—are advantageous but also contribute to its potential for dependence and abuse, leading to regulatory scrutiny.

The drug's therapeutic niche is shrinking due to safety concerns and the advent of newer non-benzodiazepine hypnotics, notably Z-drugs like zolpidem and eszopiclone, which offer similar efficacy with improved safety profiles. The progression of clinical guidelines towards minimizing benzodiazepine use impacts its market trajectory significantly.

Regulatory and Patent Landscape

Regulatory Status

In the United States, the Food and Drug Administration (FDA) approved Triazolam under the trade name Halcion, a marketed formulation. Post-market safety concerns led to restrictions on high-dose prescriptions and warnings about dependence risks. Many European countries have also imposed strict regulations, and some countries have already withdrawn Triazolam from their formularies.

Patent and Market Exclusivity

Triazolam's origin dates back decades, rendering patents expired in the early 2000s. No new patent protections or formulations are currently active, opening the market to generic manufacturers and extensive competition. This patent expiry significantly influences pricing strategies and market exclusivity, leading to downward price pressures over time.

Market Dynamics and Key Drivers

Current Market Size

The global market for sleep aids was valued at approximately $70 billion in 2022, with benzodiazepines constituting a declining segment due to safety concerns and mounting regulatory restrictions. Triazolam's market share has reduced markedly, primarily limited to niche segments such as specific hospital protocols or regions with lenient regulations.

In the U.S., prescriptions for Triazolam have declined by over 50% since 2010, reflecting shifts towards safer alternatives and stricter guidelines.

Manufacturing and Supply Chain

The manufacturing landscape is characterized by dominant generic producers in India and China, providing low-cost formulations. Quality control and regulatory compliance are central to maintaining market presence amid increasing global scrutiny. The availability of raw materials and supply chain stability influence pricing and supply security.

Competitive Landscape

The landscape includes:

- Generic benzodiazepines (e.g., Temazepam, Lorazepam)

- Non-benzodiazepine hypnotics (Z-drugs)

- Melatonin agonists (e.g., Ramelteon)

Non-benzodiazepine agents have eroded Triazolam’s market share, particularly among outpatient prescriptions owing to safety profiles.

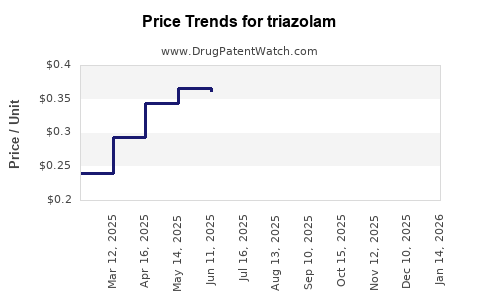

Pricing Trends

Historically, generic benzodiazepines have experienced significant price erosion—up to 80% over the last decade—driven by market saturation and high competition. Key data points include:

- Average Wholesale Price (AWP): Declined from approximately $3–$5 per tablet in the early 2010s to $0.50–$1 per tablet presently.

- Market Price Variability: Due to regional regulation, formulations, and distribution channels.

Given the limited prescribing in mainstream markets, Triazolam remains a low-volume drug with sparse pricing data, primarily derived from niche markets or compounding pharmacies.

Future Price Projections

Factors Influencing Price

- Regulatory Changes: Stricter controls could further reduce permissible prescribing, decreasing supply and potentially creating procurement hurdles, thereby stabilizing or marginally increasing prices in constrained markets.

- Market Demand: Declining demand in developed countries will exert downward pressure, especially in regions adhering to updated safety guidelines.

- Emergence of Alternative Therapies: Uptake of non-benzodiazepine hypnotics and behavioral therapies will continue to dampen Triazolam’s relevance.

- Manufacturing Costs: Low-cost generics will suppress potential price increases unless supply chain disruptions occur.

Projected Price Range (Next 5 Years)

Considering current declining trends and external constraints:

- Stable Scenario: The price of approved formulations will hover around $0.50–$1 per tablet, with negligible upward movement, primarily in restricted markets.

- Optimistic Scenario (Price Increase due to Scarcity): Price could stabilize or rise slightly to $1–$2 per tablet in specialized markets, such as institutional settings or jurisdictions with relaxed regulations.

- Pessimistic Scenario (Market Complete Erosion): Continued decline may push prices closer to $0.10–$0.50 per tablet, effectively making it a commodity with minimal revenue potential.

In sum, Triazolam prices are expected to decline further, stabilizing at low margins unless market conditions change markedly.

Strategic Implications

- Manufacturers should focus on niche markets or geographical regions with less regulatory stringency.

- Investors should exercise caution, as declining demand constrains growth prospects.

- Distributors may capitalize on low-cost procurement but should be cognizant of regulatory risks.

Conclusion

Triazolam's market has contracted substantially post-patent expiry, with widespread shifts towards safer and more tolerable sleep aids. Price projections indicate sustained low pricing, with minimal upside driven by regulatory shifts or supply constraints. Companies assessing prospects in this space should pivot to emerging therapies or niche markets to optimize returns.

Key Takeaways

- The global market for Triazolam is shrinking, primarily due to safety concerns and evolving prescribing guidelines.

- Price erosion has been significant, with current average prices ranging from $0.50 to $1.00 per tablet.

- Future prices are likely to remain low unless new regulatory restrictions or supply shortages cause market scarcity.

- Competition from non-benzodiazepine agents and generics ensures minimal pricing power.

- Stakeholders should focus on niche markets, regional regulatory environments, or formulation innovations to leverage potential price stability or marginal increases.

FAQs

Q1: What are the main factors driving the decline in Triazolam’s market share?

A: Safety concerns associated with benzodiazepines, regulatory restrictions, the availability of safer alternative therapies like Z-drugs, and evolving clinical guidelines have collectively reduced its prescriptive use.

Q2: Are there regional differences in Triazolam’s availability and pricing?

A: Yes. Markets with relaxed regulations or limited access to newer hypnotics may sustain higher prices, whereas developed countries have largely phased out usage, leading to lower market prices.

Q3: What impact will generic competition have on Triazolam pricing?

A: Extensive generic competition has driven prices downward, making the drug a low-margin product with little pricing power.

Q4: Could new formulations or delivery methods revive Triazolam’s market?

A: Unlikely, given ongoing safety concerns and preference for newer, safer medications. Market resurgence would require significant safety or efficacy advantages.

Q5: Is Triazolam likely to see regulatory reclassification or re-approval?

A: There is no indication of regulatory reclassification favoring Triazolam in major markets; current trends favor reduced, not increased, access.

Sources:

- Statista. "Global Sleep Aid Market Size & Forecast." 2022.

- U.S. Food and Drug Administration. "Halcion (triazolam)" Approval and Safety Warnings. 2021.

- IMS Health Database. Prescribing Trends in Benzodiazepines. 2022.

- MarketResearch.com. Benzodiazepine Market Analysis. 2021.

- European Medicines Agency. Market Restrictions and Safety Communications on Triazolam. 2022.