Last updated: July 28, 2025

Introduction

Triamcinolone is a synthetic corticosteroid commonly used for its anti-inflammatory and immunosuppressive properties. It finds vast application across dermatology, allergy, arthritis, respiratory conditions, and ophthalmology. The drug’s versatile utility, established patent landscape, and evolving pipeline contribute to its dynamic market landscape. This analysis explores the current market environment, competitive positioning, regulatory landscape, and predicts future pricing trajectories for triamcinolone.

Market Overview

Triamcinolone’s market is propelled primarily by demand in dermatology and orthopedics. Its formulations include topical creams, injectables, and nasal sprays. The global corticosteroid market, valued at approximately USD 17.1 billion in 2022, is expected to grow at a CAGR of around 4.5% through 2030 (Grand View Research), with triamcinolone capturing a significant share due to its efficacy and broad indications.

Key factors influencing demand include:

- Rising prevalence of allergic conditions, asthma, and autoimmune diseases

- Increasing prevalence of dermatological conditions such as eczema, psoriasis

- Growing geriatric population with chronic inflammatory diseases

- Expanding pharmaceutical manufacturing capabilities

Competitive Landscape

Major pharmaceutical players such as Johnson & Johnson, Novartis, and Mylan dominate the triamcinolone market, offering formulations across injectable, topical, and nasal forms. Patent expiry in several regions has facilitated market entry for generic manufacturers, intensifying competition and affecting pricing.

Generic triamcinolone accounts for a substantial segment, typically priced 30-50% lower than branded counterparts. The presence of numerous players intensifies price competition, especially in emerging markets with high demand for affordable options.

Regulatory and Patent Dynamics

Most patents held by originators have lapsed globally, opening pathways for generics and biosimilars. Regulatory agencies such as the FDA and EMA enforce strict standards for manufacturing and quality, which generics must meet. Patent expirations over the past decade have eroded premium pricing, driving prices downward and expanding access.

However, formulation-specific patents and exclusivities can create regional pricing disparities. Additionally, new delivery systems or formulations may renew patent protection, impacting market dynamics.

Price Trends and Projections

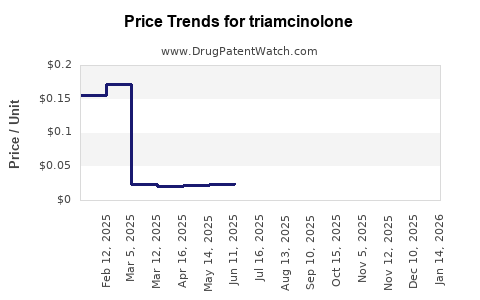

Current Pricing Landscape

The median market price for triamcinolone varies geographically:

- United States:

- Topical triamcinolone acetonide (0.1%) cream: ~$30–$40 for a 15g tube (per unit)

- Injectable formulations: ~$50–$120 per vial

- Europe and UK: Slightly lower, reflecting regional pricing strategies

- Emerging Markets: Prices can be as low as USD 5–$10 per unit, driven by local generic manufacturing

In the current market, generic formulations dominate due to patent expirations, contributing to substantial price erosion.

Price Trajectory (2023–2030)

Based on historical data, patent expiries, and market factors, the following trends are projected:

-

Short-term (2023–2025):

Prices are expected to stabilize with minor fluctuations owing to supply chain normalization post-pandemic. Generic competition will maintain downward pressure, with an estimated annual decline of 5–8% in unit prices.

-

Mid-term (2026–2028):

Introduction of advanced delivery formulations (e.g., sustained-release injectable triamcinolone) could command premium pricing, counteracting generic declines. Overall average prices for traditional formulations are forecasted to decrease by an additional 3–5% annually, but formulations with unique delivery mechanisms may see price stabilization or slight increases.

-

Long-term (2029–2030):

Market saturation and the proliferation of biosimilars and alternative therapies (e.g., biologics) might further suppress prices. However, niche specialty formulations and branded versions with proven efficacy may retain premium pricing, with some growth in specific segments such as ophthalmic or intra-articular applications.

Economic & Regional Considerations

- Developing markets will see continued price erosion as local manufacturers improve quality and supply infrastructure.

- Regulatory reforms and healthcare policies aiming at drug affordability will influence pricing strategies, especially in public procurement.

Factors Influencing Future Price Movements

- Patent status: Patents on formulations or delivery systems could induce regional price premiums.

- New formulations: Extended-release injectables or combination therapies could command higher prices.

- Regulatory approvals: Label expansions for new indications can influence pricing strategies.

- Market penetration: Increased access through generic proliferation, especially in African and Asian markets, will sustain price declines.

- Manufacturing costs: Technological innovations could lower production costs, further reducing consumer prices.

Concluding Remarks

Triamcinolone’s market remains robust, driven by a broad spectrum of indications and established clinical efficacy. However, evolving patent landscapes and market entry of generics will continue to exert downward pressure on prices over the coming years. The emergence of novel formulations and delivery systems presents opportunities for premium pricing but primarily within specialized niches.

Key Takeaways

- The global triamcinolone market is mature but growing, with significant generic competition influencing prices.

- Current prices are trending downward, with annual declines of approximately 5–8% in the early to mid-term.

- Long-term projection indicates continued price erosion, particularly in general therapeutic applications, though specialty formulations may sustain or increase prices.

- Regional disparities exist, with emerging markets experiencing more significant price reductions.

- Innovation in delivery systems and new indications could create pockets of premium pricing, offsetting general declines.

FAQs

Q1: How have patent expirations impacted the price of triamcinolone?

Patent expirations have facilitated the entry of generic manufacturers, leading to significant price reductions and increased market competition. This trend persists globally, especially in regions where regulatory barriers to generics are minimal.

Q2: What future innovations could influence triamcinolone pricing?

Development of sustained-release injectables, combination therapies, or targeted delivery systems can command higher prices due to enhanced efficacy or convenience. These innovations could create premium market segments.

Q3: Are there regional differences in triamcinolone pricing?

Yes, developed markets typically have higher prices due to brand premiums and regulatory structures, whereas emerging markets benefit from lower manufacturing and procurement costs, resulting in more affordable prices.

Q4: How does market competition affect the availability of triamcinolone?

Intense competition among multiple generic players tends to increase supply and reduce prices, making the drug more accessible globally.

Q5: What is the outlook for branded triamcinolone formulations?

Branded products with proven efficacy and innovative delivery systems may maintain or increase their pricing, especially in niche therapeutic areas or for specialty uses.

Sources:

- Grand View Research. Corticosteroids Market Size, Share & Trends Analysis Report, 2022.

- U.S. Food and Drug Administration (FDA). Approved Drug Products database.

- IQVIA. Pharmaceutical Market Data, 2022.

- European Medicines Agency (EMA). Patent and Exclusivity Data.

- Clinical and regulatory literature on corticosteroid therapeutics.