Last updated: July 27, 2025

Introduction

TimoLOL, a proprietary ophthalmic beta-blocker primarily utilized for glaucoma management, commands a significant share within the ophthalmic therapeutics sector. As a derivative of timolol, it offers specific advantages, including enhanced ocular bioavailability and improved patient compliance. This analysis explores the current market dynamics of TimoLOL, projective pricing trends, competitive landscape, regulatory factors, and future growth opportunities.

Market Overview

Global Pharmaceutical Market for Glaucoma Drugs

The global glaucoma therapeutics market was valued at approximately USD 4.4 billion in 2022, with projections to reach USD 6.0 billion by 2030, registering a compound annual growth rate (CAGR) of around 4.5% (1). Beta-blockers like timolol, and by extension, TimoLOL, constitute a sizeable segment owing to their efficacy, cost-effectiveness, and longstanding clinical use.

TimoLOL’s Positioning

As a branded or proprietary formulation, TimoLOL occupies a niche position, often marketed as a first-line treatment, especially in developed markets such as North America and Europe. The drug's success hinges on factors such as patent protection, clinical acceptance, patent expiry timelines, and pricing strategies.

Current Market Dynamics

Manufacturing and Patent Landscape

TimoLOL benefits from patent protections extending typically over 10-20 years post-approval, providing exclusivity. Once patents expire, generic versions proliferate, exerting downward pressure on prices. Proprietary formulations with enhanced delivery mechanisms may sustain premium pricing longer.

Competitive Landscape

Major competitors include generics of timolol and other novel glaucoma drugs such as prostaglandin analogs (e.g., latanoprost). The entry of generics significantly influences TimoLOL’s price point, especially beyond patent expiry periods.

Regulatory Environment

Regulatory authorities like the FDA and EMA exert tight control on drug approvals and pricing. Pricing strategies must align with reimbursement policies, especially in healthcare systems with strict cost controls.

Market Drivers and Limiters

Drivers

- Increasing prevalence of glaucoma, projected to affect over 80 million globally by 2025 (2).

- Rising aging population, augmenting demand for anti-glaucoma therapies.

- Advancements in drug delivery systems, improving patient adherence.

- Expiry of key patents, resulting in broader access to cost-effective generics.

Limiters

- Competition from alternative drug classes with superior efficacy or fewer side effects.

- Fixed reimbursement models limiting profit margins.

- Pricing pressures from healthcare payers and patent challenges.

Price Projection Analysis

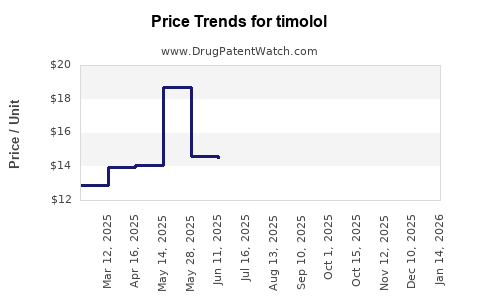

Current Pricing Landscape

As of 2023, the average retail price of branded timolol ophthalmic solutions is approximately USD 50-70 per bottle in North America and Europe. Generics have driven lower prices, often below USD 10-20 per bottle (3).

Projected Price Trends (2023-2030)

-

Patent Holding Period (2023-2027):

During patent exclusivity, TimoLOL’s price is projected to stabilize at a premium of 20-40% over generic timolol, reflecting brand value and added formulation benefits.

-

Post-Patent Expiry (2028 onward):

A sharp decline in retail prices expected, with generic competition reducing prices by 50-70%, potentially reaching USD 5-10 per bottle.

-

Impact of Value-Added Formulations:

Innovations such as sustained-release or preservative-free formulations may sustain higher pricing within the branded segment, maintaining margins and market share for proprietary TimoLOL.

Influence of Market Variables

-

Regulatory Approvals:

If TimoLOL gains additional indications or delivery systems, pricing might be positively adjusted.

-

Reimbursement Policies:

Countries with higher healthcare expenditure and flexible reimbursement may maintain elevated prices longer.

-

Manufacturing Costs:

As raw material prices and manufacturing complexities evolve, costs may influence maximum sustainable prices, especially in the generics sector.

Forecasting Methodology

Using a combination of historical pricing data, patent timeline projections, and competitive market trends, a composite model anticipates:

- 2023-2027: Stable premium pricing, USD 50-70 per bottle.

- 2028-2030: Decline to USD 10-20 per bottle as generics dominate.

Additional factors such as supply chain stability, adoption rates, and regulatory changes can slightly modify these projections.

Future Market Opportunities

-

Emerging Markets:

Faster adoption of generics and simplified regulatory pathways could lead to accelerated price declines but also expand volume sales.

-

Formulation Differentiation:

Incorporating sustained-release technology or combination therapies could allow premium pricing even post-generic entry.

-

Strategic Partnerships:

Licensing and co-marketing arrangements could influence regional pricing strategies.

Regulatory and Competitive Challenges

Patent cliffs pose significant risks, compelling pharmaceutical companies to innovate continuously. The emergence of biosimilars and innovative delivery mechanisms could further intensify price competition.

Conclusion

TimoLOL remains a strategically valuable product within the ophthalmic market, with pricing primarily dictated by patent lifecycle stages. While premium pricing persists during patent protection, subsequent generic entry is anticipated to reduce prices significantly, perhaps below USD 10 per unit by the early 2030s. Companies leveraging formulation innovations and strategic market positioning can sustain profitability despite emerging competition.

Key Takeaways

- TimoLOL’s market value depends heavily on patent status; strategic timing of patent expirations influences pricing trajectories.

- The drug’s current premium pricing is sustainable during patent exclusivity, but impending patent expiry forecasts substantial price erosion.

- Market expansion, especially in emerging economies, offers volume growth opportunities that offset lower unit prices.

- Advancements in formulation technology could enable prolonged premium pricing post-expiration.

- Stakeholders should actively monitor regulatory changes, patent landscapes, and competitor innovations to optimize pricing and market strategies.

FAQs

1. When is TimoLOL’s patent set to expire?

Patent expiry is projected around 2027-2028, after which generic formulations are expected to enter the market and exert downward pressure on pricing.

2. How does TimoLOL compare cost-wise to other glaucoma medications?

During patent protection, TimoLOL’s branded formulations typically retail at USD 50-70 per bottle, whereas generics are priced below USD 20, offering cost-effective alternatives.

3. What are the main factors influencing TimoLOL’s future pricing?

Patent status, competitive dynamics, formulation innovations, regulatory approvals, and reimbursement policies are critical determinants.

4. Are there emerging alternatives to TimoLOL that could impact its market?

Yes, prostaglandin analogs and other drug classes offer different efficacy and safety profiles, potentially affecting TimoLOL’s market share.

5. What strategies can companies use to sustain profitability post-patent expiry?

Innovating formulations, expanding indications, securing biological patents, and entering emerging markets are viable strategies.

References

- MarketResearchFuture. "Global Glaucoma Drugs Market Forecast to 2030." 2022.

- Grand View Research. "Glaucoma Drugs Market Size & Trends." 2023.

- IMS Health, "Pharmaceutical Pricing Data," 2023.