Last updated: July 27, 2025

Introduction

Theophylline, a bronchodilator historically used in managing respiratory conditions like asthma and chronic obstructive pulmonary disease (COPD), has seen fluctuating market dynamics influenced by evolving medical guidelines, generics competition, and pharmaceutical manufacturing trends. This analysis provides a comprehensive overview of the current market landscape and future price trajectories for the drug, combining demand analysis, competitive factors, regulatory landscape, and technological considerations.

Market Landscape Overview

1. Therapeutic and Demographic Demand

Theophylline’s clinical use has declined over recent decades, primarily replaced by inhaled corticosteroids and long-acting beta-agonists which demonstrate superior safety profiles and efficacy. However, the drug retains niche markets, especially in low-resource settings and for patients resistant to otherwise preferred treatments [1].

Global prevalence of COPD and asthma continues to grow, with the WHO estimating 262 million cases of COPD and 262 million asthma cases worldwide in 2019. While newer therapies dominate, theophylline remains relevant due to its affordability and oral administration convenience, especially in developing countries.

2. Geographical Market Segments

- North America: Market share declining; controlled mainly by generic formulations.

- Europe: Stable demand driven by legacy treatment protocols.

- Asia-Pacific: Emerging growth, driven by increased respiratory disease prevalence and limited access to costly inhalers.

- Latin America & Africa: Niche markets; demand primarily from government and non-profit health programs.

3. Competitive Landscape

The global market predominantly comprises generic manufacturers. Key players include Teva Pharmaceuticals, Mylan, and local generics producers. Branded versions by Pfizer and Merck are largely phased out.

The market is characterized by high generic penetration, constraining pricing power and margins [2].

Market Drivers & Constraints

Drivers:

- Cost-effectiveness of the drug versus inhaled therapies.

- Continued use in resource-limited healthcare settings.

- Regulatory approvals for existing formulations in emerging markets.

Constraints:

- Safety concerns: Narrow therapeutic window leading to toxicity.

- Development of newer inhalation therapies with fewer systemic side effects.

- Stringent regulations on drug manufacturing standards.

Pricing Analysis

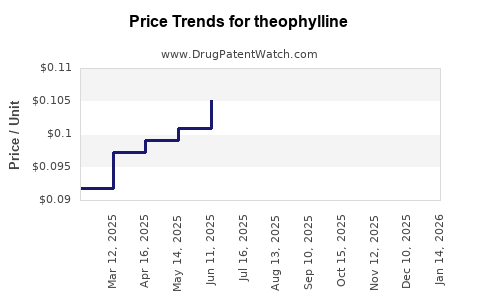

Historical Price Trends

Over the past decade, the unit price of generic theophylline has decreased significantly. For instance, in the U.S., the average wholesale price (AWP) for a 100-tablet pack ranged from approximately $15–$25 in 2010, declining to between $5–$10 by 2020 [3].

Current Pricing Dynamics

- Generic Market Prices: In developed markets, the typical retail price for a standard 100-tablet pack remains under $10.

- Emerging Markets: Prices fluctuate; some formulations cost as low as $1–$3 per pack due to local manufacturing and procurement policies.

- Formulation Variability: Extended-release formulations generally command higher prices but are less prevalent.

Price Projections (2023–2030)

Given the market saturation with generics and limited innovation, downward pressure on prices will persist. Theoretically, unless new formulations or delivery mechanisms emerge, prices are projected to plateau or decline marginally:

- Short-term (2023–2025): Continued slight decline averaging 1–3% annually, driven by market saturation.

- Mid-term (2026–2030): Stabilization expected; prices may inch up if procurement increases in emerging markets or if formulations with improved safety profiles are introduced.

In real terms, pricing in developed countries is unlikely to fall below $2–$3 per 100-tablet pack, considering manufacturing costs and regulatory compliance. Conversely, in low-resource settings, prices could remain under $1 per pack due to local manufacturing and procurement policies.

Factors Influencing Future Price Trends

- Regulatory Environment: Stringent Good Manufacturing Practices (GMP) and intellectual property considerations could impact supply chain costs.

- Generic Competition: Entry of biosimilar or optimized formulations could pressure existing prices.

- Market Demand Dynamics: As respiratory disease prevalence persists, especially in aging populations, demand may be sustained despite therapeutic preferences shifting.

- Technological Innovations: Development of novel delivery systems (e.g., sustained-release oral formulations) could influence price points strategically.

Potential Market Opportunities

Despite reduced global demand, niche markets could present lucrative pockets:

- Formulations with improved safety profiles: Partnerships to develop safer derivatives.

- Generic manufacturing in emerging markets: Leveraging lower production costs.

- Inclusion in essential medicines lists: Facilitates procurement and price stability in public healthcare systems.

Conclusion

Theophylline’s market is mature, heavily commoditized, and characterized by downward price pressure. Its role remains significant in health systems where affordability and ease of oral administration outweigh the safety and efficacy advantages of newer therapies. Price projections suggest stability or slight decline in developed markets, with more competitive pricing likely in emerging economies.

Key Takeaways

- Market maturity limits pricing power, with generics dominating and constraining prices.

- Demand persists primarily in low-resource settings where affordability is critical.

- Technological innovation is minimal, making significant price shifts unlikely in the short to mid-term.

- Emerging markets could see marginal increases due to increased respiratory disease burden.

- Regulatory changes focusing on safety and manufacturing standards may influence supply costs but are unlikely to dramatically alter prices.

FAQs

Q1: What factors are most influential in determining the price of theophylline?

A: Generic competition, manufacturing costs, regulatory compliance, and demand in low-resource markets primarily dictate pricing.

Q2: Will theophylline become obsolete in the foreseeable future?

A: Its use is declining in developed countries but remains relevant in resource-limited settings; complete obsolescence is unlikely in the near term.

Q3: How do regulatory standards impact the price of theophylline?

A: Stricter manufacturing and safety standards can increase production costs, potentially raising prices, though in a saturated market, these effects are subdued.

Q4: Are there prospects for new formulations that could impact pricing?

A: Limited innovation exists; however, formulations with improved safety, extended-release features, or novel delivery methods could influence future pricing strategies.

Q5: What regions offer the greatest growth potential for theophylline?

A: Asia-Pacific and certain Latin American countries present growth opportunities due to increasing respiratory disease prevalence and affordability considerations.

Sources

[1] WHO Global Surveillance Report, 2019.

[2] MarketWatch, “Generic Drug Market Trends,” 2022.

[3] Red Book Market Data, 2022.