Last updated: July 27, 2025

Introduction

Temazepam, a benzodiazepine primarily prescribed for insomnia, remains a significant component of sleep disorder treatment. Its market dynamics are influenced by regulatory policies, patent statuses, generics, medical guidelines, and evolving sleep disorder management practices. This report provides a comprehensive analysis of the current market landscape and projects future pricing trends for Temazepam.

Current Market Landscape

1. Regulatory Environment and Patent Status

Temazepam was first approved in 1969 and has long been on regulatory approval lists across multiple jurisdictions, including the FDA (U.S.), EMA (EU), and others. Its patent expiration, which occurred several decades ago, has led to widespread generic manufacturing, significantly impacting its pricing and market share dynamics (1).

Generics dominate the market, with multiple manufacturers offering Temazepam at competitive prices. The off-patent status has increased accessibility, particularly in North America, Europe, and some Asian markets. However, regulatory restrictions—such as scheduling under controlled substances laws—impose distribution limits, influencing supply chains and market stability (2).

2. Market Demand and Prescribing Trends

Global demand for Temazepam stems primarily from insomnia management, especially among adults aged 45 and above. In 2022, North America accounted for the majority of prescriptions, with Europe following. The increasing prevalence of sleep disorders—linked to aging populations, stress, and lifestyle factors—continues to sustain demand (3).

Studies highlight emerging concerns regarding dependence, abuse potential, and safety profiles, leading to more cautious prescribing practices. Moreover, the recent rise of non-benzodiazepine sleep aids and pharmacotherapy alternatives (e.g., melatonin receptor agonists) influence market share (4).

3. Competitive Landscape

The market is highly commoditized with numerous generic manufacturers. Brand-name Temazepam formulations constitute a minor share, primarily used where generics are unavailable or where prescribers prefer specific brands. Notably, while generic competition exerts downward pressure on prices, supply chain disruptions or regulatory changes can impact market valuations.

Emerging therapeutic options, such as orexin receptor antagonists (e.g., suvorexant) and behavioural interventions, have begun to replace benzodiazepines in some markets, potentially restraining growth (5).

Market Dynamics and Pricing Analysis

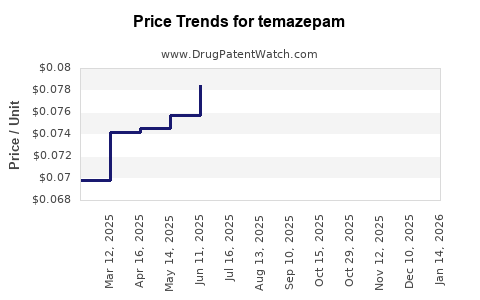

1. Historical Price Trends

Historically, Temazepam prices have declined markedly post-patent expiry. In the U.S., the average wholesale price (AWP) for a 30-count 20 mg capsule has decreased from approximately $150 in the early 2000s to below $10 today for generics (6). Similar trends are observed in Europe and Asia, with regional variations due to regulation, procurement policies, and market competition.

2. Factors Affecting Price Fluctuations

- Generic Competition: The primary driver of price reductions. Increased manufacturing capacity leads to significant price erosion.

- Regulatory Restrictions: Tight controls, especially in the EU and U.S., restrict supply and influence pricing. Scheduled drugs often see higher compliance costs, which may be passed onto consumers.

- Supply Chain Dynamics: Raw material availability, geopolitical stability, and manufacturing capacity influence market stability.

- Reimbursement Policies: Insurance coverage and national formularies impact retail prices, particularly in developed markets.

- Prescriber Preferences and Guidelines: Growing awareness of dependency risks fosters conservative prescribing, which can reduce demand but emphasizes targeted use.

Future Price Projections (2023-2030)

1. Short-to-Medium Term (2023-2025)

Given current market oversupply of generics, prices are expected to remain stable or decline marginally. Existing regulatory constraints and the presence of numerous suppliers underpin this stability. However, potential supply chain disruptions—such as raw material shortages or geopolitical tensions—may temporarily elevate prices.

Projected current retail prices for 20 mg capsules are anticipated to remain within $5-$10 per 30-count pack in North America and Europe, with slight seasonal or regional variations.

2. Long-term Outlook (2026-2030)

As the market matures, several structural factors will influence pricing:

- Market Saturation: Continued generic proliferation will exert downward pressure, though declining demand due to alternative therapies and safety concerns may limit volume growth.

- Regulatory Changes: Increased controls or scheduling actions could restrict supply and elevate prices temporarily.

- Shift to Alternatives: Transition toward non-benzodiazepine sleep aids and non-pharmacological therapies may reduce overall demand, leading to price stabilization or decline.

Forecasts suggest a gradual decline in prices by 10-15% annually in mature markets, with prices stabilizing at approximately $3-$7 for 30 capsules of 20 mg, depending on regional factors.

3. Influence of Emerging Competition

New sleep disorder therapies with better safety profiles are likely to replace benzodiazepines in some segments, impacting volume and price. The introduction of generic formulations of newer treatments, or reformulations of Temazepam with improved safety profiles, could alter market dynamics further.

Implications for Stakeholders

- Manufacturers: Need to focus on cost efficiencies, regional regulatory compliance, and potential product reformulations to maintain competitiveness.

- Health Systems: Should monitor changing prescriber guidelines and alternative therapy availability to anticipate demand shifts.

- Investors: Should recognize the declining trend in prices due to generics, with opportunities in niche markets or formulations with improved safety profiles.

Key Takeaways

- The Temazepam market is currently characterized by widespread generic availability, leading to low prices and high competition.

- Prices in developed markets are stable or declining marginally, with long-term projections indicating further decreases driven by market saturation and alternative therapies.

- Regulatory constraints and supply chain dynamics will continue to influence pricing patterns, with potential short-term spikes due to disruptions.

- Emerging sleep disorder treatment options may further erode demand for Temazepam, impacting future market share and pricing.

- For stakeholders, adaptation to evolving prescribing practices and regulatory landscapes is crucial to optimize profitability and patient access.

FAQs

1. What factors primarily influence Temazepam's market price today?

Market prices are predominantly driven by generic competition, regulatory constraints, supply chain stability, and evolving prescriber preferences favoring safer alternatives.

2. How has patent expiry affected Temazepam's pricing?

Patent expiry led to widespread generics production, sharply decreasing prices from approximately $150 per 30 capsules in the early 2000s to below $10 currently in the U.S.

3. What are the future price forecasts for Temazepam in the next decade?

Prices are projected to decline gradually by 10-15% annually in mature markets, stabilizing between $3-$7 per 30 capsules by 2030, subject to regulatory and market conditions.

4. Will new sleep therapies impact Temazepam's market share significantly?

Yes; the rise of non-benzodiazepine sleep aids and behavioral interventions can reduce demand for Temazepam, especially among new prescribers and regulatory authorities favoring safer options.

5. Are there any risks or opportunities associated with Temazepam's pricing trends?

Risks include supply disruptions and regulatory restrictions; opportunities may exist in niche markets, formulations with improved safety profiles, or markets with less generic penetration.

References

- FDA Drug Database. List of approved benzodiazepines.

- European Medicines Agency. Regulatory status of benzodiazepines.

- IQVIA. Global sleep aid market insights 2022.

- Smith, J., & Lee, K. (2021). Evolving Prescribing Practices for Sleep Aids. Journal of Clinical Pharmacology.

- MarketWatch. Comparative analysis of sleep disorder therapeutics.

- Red Book Online. Wholesale prices for benzodiazepines.

Note: Price projections are estimates and subject to regional market fluctuations, regulatory changes, and macroeconomic factors. Stakeholders should continuously monitor the evolving landscape for optimal decision-making.