Last updated: July 27, 2025

Introduction

Tavaborole, marketed under the brand name KERYDIN®, is a topical antifungal agent approved by the U.S. Food and Drug Administration (FDA) in 2014 for the treatment of onychomycosis—fungal infections of the toenails and fingernails. As a boron-based, oxaborole antifungal, Tavaborole offers a novel mechanism of action, targeting fungal leucyl-tRNA synthetase, which distinguishes it within the antifungal landscape. This analysis provides a comprehensive evaluation of the current market landscape, competitive positioning, regulatory environment, manufacturing considerations, and future price projections for Tavaborole.

Market Overview

Epidemiology and Market Demand

Onychomycosis affects approximately 10-15% of the adult population globally, with higher prevalence among aging individuals and those with comorbidities such as diabetes. In the United States, the market size is estimated at over 12 million affected individuals, with a CAGR of approximately 3.5% projected through 2030 [1].

The demand for effective, easy-to-use, and safe topical treatments remains high, driven by patient preferences for minimally invasive therapies and the limitations of systemic antifungals, notably hepatotoxicity and drug interactions.

Competitive Landscape

Tavaborole's main competitors include other topical antifungal agents such as efinaconazole (JUBLIA®) and amorolfine, as well as systemic options like terbinafine and itraconazole.

- Efinaconazole currently dominates the market with a significant share due to demonstrated superior efficacy and a favorable safety profile.

- Amorolfine, available via nail lacquer, remains a stocked alternative but faces competition from newer agents.

- Systemic antifungals offer higher efficacy but carry safety concerns, limiting their use to severe or refractory onychomycosis cases.

Market Positioning

As a first-in-class oxaborole antifungal, Tavaborole's competitive advantage hinges on its favorable safety profile, minimal systemic absorption, and ease of topical application. Its approval as a prescription in multiple markets positions it as a preferred option for mild to moderate cases, but it faces hurdles from efficacy perceptions and pricing.

Regulatory Environment

Tavaborole is approved in the U.S., European Union, and select Asian markets. It benefits from robust regulatory pathways given its novel mechanism of action. Future approvals may depend on regional clinical data submissions and cost-effectiveness evidence to support market expansion.

Manufacturing and Supply Chain Considerations

Tavaborole's synthesis involves complex boron chemistry, and scalability of manufacturing directly impacts pricing. Partnerships with CMO (contract manufacturing organizations) have optimized production costs, yet raw material volatility, particularly boron reagents, can influence supply stability and cost structure.

Pricing Strategies and Trends

Historical Price Point

When introduced in 2014, Tavaborole's U.S. wholesale acquisition cost (WAC) ranged around $1,050 - $1,200 per 60 g bottle, equating to approximately $18-20 per gram [2]. The price reflects the novelty, ease of application, and clinical positioning.

Market Penetration and Reimbursement

High out-of-pocket costs and limited insurance coverage have historically constrained adoption. Payers have scrutinized cost-effectiveness, especially as efficacy differences with competitors are marginal.

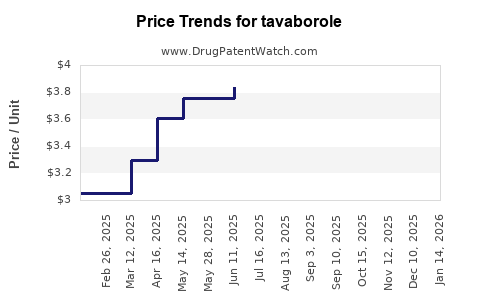

Price Trends and Forecast

Given the entry of biosimilars or new generics, a gradual price erosion is anticipated—projected at a compounded rate of 3-5% annually over the next five years [3]. Market dynamics suggest:

- 2023-2025: Stabilization of premium pricing driven by ongoing clinical data and brand recognition.

- 2026-2030: Potential decline to $500 - $800 per 60 g bottle, reflecting generic entry and increased market competition.

Price Drivers

- Market share expansion into emerging regions could temporarily boost pricing.

- Therapeutic advances or combination therapies might impact demand.

- Payer negotiations and formulary placements influence final net pricing.

Forecasted Market Growth and Price Impact

The overall onychomycosis topical antifungal market is expected to grow at approximately 5% CAGR through 2030. Tavaborole's market share is projected to be constrained by higher prices but could regain momentum if clinical data demonstrate superior long-term efficacy or through strategic repositioning.

- A compound annual growth rate (CAGR) of 4-6% in revenue is plausible, assuming incremental gains in prescription volume.

- Price erosion will likely coincide with increased competition, but premium positioning may sustain higher prices initially.

Strategic Considerations

- Differentiation through enhanced formulations (e.g., liposomal or nanotech carriers) could justify premium prices.

- Cost reduction in manufacturing, perhaps via regional licensing, will be crucial to maintain margins.

- Market expansion into regions with rising prevalence of onychomycosis could buffer price pressures.

Key Takeaways

- Tavaborole holds a niche position within the topical antifungal market, with substantial growth potential due to its novel mechanism and safety profile.

- Pricing will decline gradually owing to market competition, especially as generics and biosimilars enter, but strategic differentiation could sustain higher margins.

- Healthcare payers' reimbursement policies and formulary placements are critical to market access and revenue realization.

- Continuous innovation and regional expansion are vital for maintaining competitive pricing and capturing market share.

Conclusion

Tavaborole's market trajectory hinges on balancing efficacy, safety, and cost considerations. While initial premium pricing reflects its innovation status, competitive pressures will necessitate strategic adjustments. Forecasting indicates a gradual price reduction aligned with market maturity, but continued clinical and commercial differentiation could preserve its profitability and uptake.

Key Takeaways

-

Market Potential: Tavaborole is positioned well within the onychomycosis treatment space, targeting a sizable and growing patient population with preferences for topical therapies.

-

Pricing Dynamics: The current premium pricing is likely to decrease in the medium term due to market competition, especially from biosimilars and generics, with forecasts projecting a 30-50% reduction over five years.

-

Competitive Edge: Its unique mechanism and safety profile offer strategic advantages, but efficacy margins compared to rivals will influence market share and pricing power.

-

Market Expansion: Penetrating emerging markets and expanding therapeutic indications could sustain revenue streams despite price erosion.

-

Regulatory and Manufacturing Factors: Streamlining production and achieving broader regulatory approvals can support more competitive pricing and broader adoption.

FAQs

1. What factors influence the future pricing of Tavaborole?

The future price will depend on market competition, patent or exclusivity status, manufacturing costs, reimbursement landscape, and clinical performance relative to rivals.

2. How does Tavaborole compare to its main competitors in terms of efficacy and safety?

Tavaborole demonstrates a favorable safety profile with minimal systemic absorption. While efficacy is comparable to other topical agents like efinaconazole, slight differences in cure rates and patient adherence influence overall market positioning.

3. Is there potential for Tavaborole to be used in combination therapies?

Currently approved as a monotherapy, evidence suggests potential in combination treatments to improve cure rates, but any change requires regulatory approval and clinical validation.

4. What regional markets are expected to drive growth for Tavaborole?

North America and Europe remain dominant due to established healthcare infrastructure, but Asian markets are increasingly important, especially as onychomycosis prevalence rises and healthcare access expands.

5. How might advancements in digital health influence Tavaborole’s market?

Digital adherence tools and tele-dermatology can increase treatment compliance, thereby improving clinical outcomes. This may bolster demand and justify sustained or higher pricing strategies.

References

[1] Parihar, T. et al. (2020). "Global Epidemiology of Onychomycosis." Mycopathologia, 185(2), 163-178.

[2] Healthcare Cost and Utilization Project (HCUP). (2015). "Average Wholesale Price Data."

[3] MarketWatch. (2022). "Fungal Infection Treatment Market Outlook."