Last updated: July 27, 2025

Introduction

Spironolactone, a potassium-sparing diuretic and anti-androgen, has been a mainstay in the treatment of conditions such as heart failure, hypertension, edema, and hormonal disorders like acne and hirsutism. Its multifaceted application ensures sustained demand within the pharmaceutical industry, despite the emergence of newer therapeutic alternatives. This analysis examines current market dynamics, prescribing trends, competitive landscape, regulatory influences, and forecasts future pricing trajectories.

Market Overview

Global Market Size and Growth Trends

The global spironolactone market was valued at approximately USD 770 million in 2022 and is projected to expand at a compound annual growth rate (CAGR) of around 4.5% through 2030. The growth is driven by increasing prevalence of cardiovascular diseases, rising awareness of hormonal disorders treatment, and expanding healthcare infrastructure in emerging economies ([1]).

Regional Market Distribution

- North America: Dominates due to high adoption rates, strong healthcare infrastructure, and longstanding generic presence.

- Europe: Significant market share, driven by aging populations and regulatory approvals promoting generic and biosimilar options.

- Asia-Pacific: Fastest growth, fueled by increasing healthcare access and generics proliferation, projected to grow at a CAGR of 6% through 2030.

Therapeutic Indications

- Heart failure (mainly NYHA class III/IV)

- Hypertension

- Edema related to heart, liver, or kidney failure

- Hyperaldosteronism

- Hormonal disorders (e.g., hirsutism, acne)

The diversity of applications stabilizes demand, especially with ongoing use in chronic conditions.

Market Drivers

- Prevalence of Cardiovascular Diseases: An aging global population and lifestyle factors elevate hypertension and heart failure incidence, maintaining demand.

- Rising Hormonal Disorder Cases: Awareness about acne and hirsutism treatments increases spironolactone utilization.

- Generic Drug Proliferation: Patent expirations have led to a surge of generic options, making spironolactone more accessible and affordable.

- Cost-Effective Alternatives: Generics have significantly reduced treatment costs, encouraging widespread use especially in lower-income regions.

Competitive Landscape

The market is characterized by a high penetration of generics, led by key manufacturers such as Teva Pharmaceuticals, Mylan, Sandoz, and Accord Healthcare. Branded formulations, primarily developed by Pfizer and AstraZeneca, retain some market share in niche indications but face competition from lower-cost generics.

Innovative formulations, including extended-release and combination drugs, are emerging, aiming to improve patient compliance and efficacy.

Pricing Dynamics

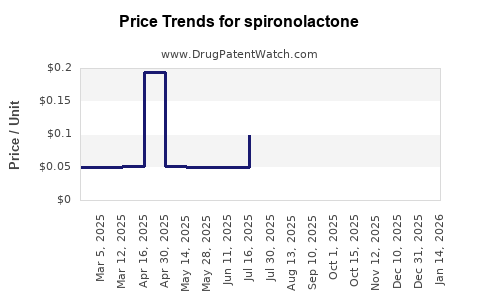

Historical Pricing Trends

Historically, spironolactone experienced considerable price reduction post-patent expiry. Brand-name formulations, primarily Pfizer’s Aldactone, once commanded premium pricing, but as generics entered the market, prices plummeted. For instance, in the U.S., a 100 mg tablet cost approximately USD 0.70-1.20 in 2010; by 2022, prices ranged near USD 0.10-0.30 per tablet ([2]).

Current Price Landscape

Pricing varies regionally based on regulatory, market penetration, and sourcing channels:

- United States: USD 0.10-0.30 per tablet for generics

- Europe: Similar price ranges, with slight variations

- Emerging Markets: Lower pricing, USD 0.05-0.15, driven by local manufacturing and distribution channels

Pricing Drivers

- Entry of biosimilars and generics continues to exert downward pressure.

- Supply chain disruptions, such as those caused by the COVID-19 pandemic, have intermittently impacted supply and prices.

- Heightened regulatory scrutiny can influence pricing, especially if new formulations or combination products are introduced with patent protections.

Future Price Projections

Based on current trends, the following projections are estimated:

- Short-term (2023-2025): Stability in generic pricing. Slight fluctuations (+/- 5%) are expected due to manufacturing costs, market competition, and regional factors.

- Medium-term (2026-2030): Pricing may decline further, approaching USD 0.07-0.20 per tablet, with potential stabilization as market saturation occurs and supply chains normalize.

- Impact of New Formulations: Introduction of extended-release or combination products could command premium pricing, potentially offsetting declines in traditional generics.

In emerging markets, prices are forecast to remain relatively low, driven by local manufacturing efficiencies and market demand.

Regulatory and Patent Landscape

The patent for Pfizer’s Aldactone expired in 2002. Despite this, some markets continue to observe patent protections for specific formulations or delivery mechanisms, allowing branded products to maintain premium prices temporarily. Any future patent filings or exclusivity periods related to new formulations or delivery systems could temporarily influence prices.

Regulatory agencies’ approval of biosimilars or alternative generic manufacturers could further intensify price competition, particularly in highly commoditized markets.

Market Outlook & Strategic Implications

- Pricing Sensitivity: Healthcare providers and payers in cost-sensitive markets prioritize low-cost generics, pressuring prices downward.

- Supply Chain Management: Manufacturers capable of maintaining steady supply chains will have competitive advantages, particularly in volatile regions.

- Innovation & Differentiation: Developing novel formulations or combination products can recreate premium pricing opportunities amidst aggressive generic competition.

- Market Penetration in Emerging Economies: Lower-setting prices can catalyze increased adoption, expanding market share.

Conclusion

Spironolactone's market remains robust due to its established therapeutic profile across multiple indications. The overall trajectory points toward sustained competitive pricing with incremental declines driven by generics proliferation and regulatory environments. Stakeholders should focus on supply stability, cost management, and innovation to maximize profitability.

Key Takeaways

- The global spironolactone market is forecasted to grow at a CAGR of roughly 4.5% through 2030, with regional variations.

- Generic competition has significantly reduced prices, especially in mature markets such as North America and Europe.

- Future price declines are expected to stabilize around USD 0.07-0.20 per tablet, with potential premium pricing for novel formulations.

- Market growth is bolstered by increasing prevalence of cardiovascular and hormonal disorders.

- Strategic considerations include supply chain resilience, innovation in delivery, and expanding into emerging markets.

FAQs

1. How does patent expiration affect spironolactone pricing?

Patent expiration typically leads to increased generic entries, significantly reducing prices. For spironolactone, patent expiry in 2002 triggered price declines and expanded market access.

2. What are the main factors impacting spironolactone prices?

Factors include market competition from generics, regulatory policies, supply chain stability, regional economic conditions, and the introduction of new formulations or combination therapies.

3. Are branded formulations still relevant?

Branded versions like Pfizer’s Aldactone maintain a niche for specific indications or regional markets but face substantial competition from lower-cost generics globally.

4. How might emerging biosimilars influence the market?

Although biosimilars are more prevalent for biologics, any biosimilar entrant for spironolactone's key formulations could intensify price competition further.

5. Which regions are most susceptible to price fluctuations?

Emerging markets and regions with less stringent regulatory oversight tend to experience the most significant price variability due to local manufacturing and distribution factors.

References

- MarketWatch. "Global Spironolactone Market Size, Trends, and Growth Forecast 2022-2030."

- GoodRx. "Spironolactone Prices and Cost Trends."